Understanding Qatar’s Cryptocurrency Regulatory Landscape 🌍

In Qatar, the evolving landscape of cryptocurrency regulations presents a unique terrain for enthusiasts and businesses alike to navigate. From the initial curiosity surrounding digital currencies to the swift regulatory changes, understanding Qatar’s stance on cryptocurrency is crucial. As the nation delves deeper into the realm of blockchain technology and decentralized finance, the regulatory landscape continues to shift, offering both challenges and opportunities for those looking to participate in this dynamic ecosystem. By exploring the nuances of Qatar’s approach to cryptocurrencies, individuals can gain insight into the legal framework shaping the future of digital assets in the region.

Navigating the Requirements for Cryptocurrency Exchange Licensing 📝

When embarking on the journey to secure a cryptocurrency exchange license, one must tread carefully through a maze of regulatory requirements. Understanding the intricate web of rules and guidelines set forth by Qatar’s regulatory landscape is crucial. Navigating these requirements involves meticulous attention to detail and adherence to specific criteria to ensure compliance with the law 📝. Each step in the licensing process is vital, from initial applications to ongoing reporting obligations. Meeting these requirements not only demonstrates a commitment to legality but also sets the foundation for a secure and reputable cryptocurrency exchange operation 💼.

Operating a licensed cryptocurrency exchange in Qatar comes with its unique set of challenges. Compliance issues lurk around every corner, necessitating constant vigilance and adaptability 🛡️. However, the benefits of obtaining a license are substantial. Apart from legal legitimacy, a licensed exchange can gain trust from customers and attract more investors, propelling the business towards success 🚀. Looking ahead, the regulatory landscape in Qatar is expected to evolve, presenting both opportunities and challenges for cryptocurrency exchanges 🔮.

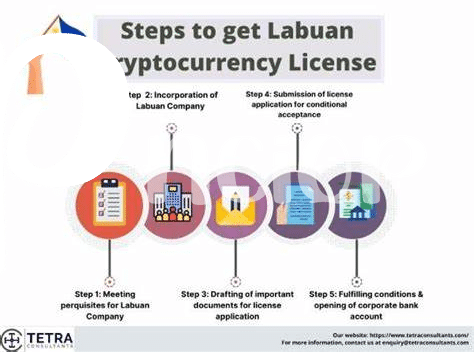

Key Steps to Obtain Approval for Operating a Cryptocurrency Exchange 💼

Securing approval to operate a cryptocurrency exchange in Qatar involves a series of strategic maneuvers and thorough documentation. From preparing a comprehensive business plan to engaging with regulatory authorities, each step plays a vital role in the approval process. Building strong partnerships with local financial institutions, ensuring compliance with AML/CFT regulations, and demonstrating robust cybersecurity measures are key ingredients for success. Additionally, obtaining the necessary licenses and approvals, conducting regular audits, and adhering to reporting requirements are essential tasks that pave the way towards establishing a reputable and trusted cryptocurrency exchange platform in Qatar.

Compliance Challenges Faced by Cryptocurrency Exchanges 🛡️

When it comes to operating a cryptocurrency exchange, compliance challenges can be a significant hurdle to navigate. From staying updated with evolving regulations to ensuring robust security measures are in place, cryptocurrency exchanges face a myriad of complexities in meeting regulatory standards. A key aspect lies in implementing stringent Anti-Money Laundering (AML) and Know Your Customer (KYC) protocols to prevent illicit activities and safeguard user information. Additionally, maintaining transparency in operations while balancing privacy concerns adds another layer of challenge. Overcoming these compliance hurdles requires diligent monitoring and proactive measures to uphold regulatory integrity in the cryptocurrency space. For more insights on meeting licensing demands, check out best practices for cryptocurrency exchange licensing requirements in Poland.

Benefits of Operating a Licensed Cryptocurrency Exchange 🚀

Operating a licensed cryptocurrency exchange opens up a world of opportunities for businesses in Qatar. With a government-approved license, exchanges can operate with legitimacy and trust, attracting more users and investors. Additionally, being compliant with regulations helps in building a reputable brand and fostering long-term relationships with customers. Moreover, licensed exchanges have access to better banking services and partnerships, ensuring smoother operations and growth potential. The benefits of operating within the legal framework not only enhance credibility but also pave the way for sustainable growth and innovation in the dynamic cryptocurrency sector.

Future Trends in Qatar’s Cryptocurrency Regulatory Environment 🔮

When looking ahead to the future trends in Qatar’s cryptocurrency regulatory environment, it’s crucial to consider the evolving landscape shaped by technological advancements and changing global regulations. The adoption of blockchain technology and cryptocurrencies is expected to continue growing in Qatar, prompting authorities to refine existing regulations and potentially introduce new guidelines to ensure the security and stability of the market. As the country strives to balance innovation with investor protection, we anticipate a shift towards more transparent and clear regulatory frameworks that aim to attract both local and international cryptocurrency exchanges looking to operate within Qatar’s boundaries.

Cryptocurrency Exchange Licensing Requirements in Philippines