Understanding Panama’s Regulatory Landscape 🌎

Panama’s regulatory landscape surrounding cryptocurrency is a dynamic ecosystem shaped by evolving global trends and local considerations. This includes a mix of regulatory bodies and frameworks aimed at balancing innovation with consumer protection. Understanding the nuances of Panama’s regulatory landscape is crucial for navigating the compliance requirements and opportunities within the cryptocurrency space. By delving into the regulatory intricacies, stakeholders can better position themselves to operate efficiently and legally in this emerging sector.

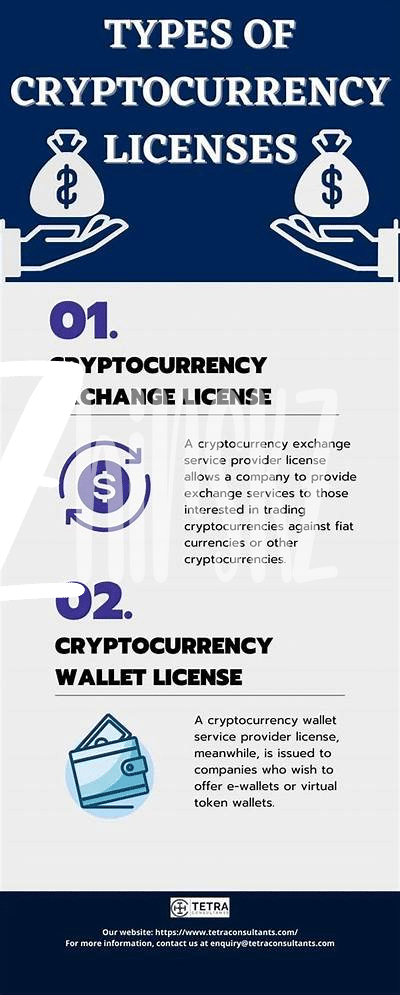

Licensing Requirements for Cryptocurrency Exchanges 💼

Panama has established clear guidelines for cryptocurrency exchange licensing, emphasizing the importance of adherence to regulatory measures to ensure a safe and transparent marketplace. As part of the licensing process, exchanges must demonstrate robust security protocols to safeguard users’ funds and prevent unauthorized access. Additionally, financial transparency is a key requirement to prevent money laundering and ensure the legitimacy of transactions. Through these stringent licensing requirements, Panama aims to foster trust in the cryptocurrency market and protect the interests of both investors and the general public.

Furthermore, licensing for cryptocurrency exchanges in Panama involves thorough due diligence procedures to verify the identity of users and comply with anti-money laundering regulations. Exchanges are also required to maintain accurate records of transactions and report any suspicious activities to relevant authorities promptly. By implementing these rigorous requirements, Panama seeks to promote a regulatory framework that balances innovation with consumer protection, ensuring the sustainable growth of the cryptocurrency ecosystem within its jurisdiction.

Compliance Measures to Ensure Legal Operations 📝

When operating a cryptocurrency exchange in Panama, implementing robust compliance measures is crucial to ensure legal operations. From thorough customer due diligence procedures to monitoring and reporting suspicious transactions, adherence to regulatory requirements is essential. Additionally, establishing internal controls, conducting regular audits, and staying updated on evolving regulations play a significant role in maintaining compliance. By prioritizing transparency and accountability, cryptocurrency exchanges can not only mitigate risks associated with money laundering and terrorism financing but also build trust with regulators and users alike. With a strong focus on compliance, exchanges can navigate the regulatory landscape effectively and contribute to a more secure and sustainable cryptocurrency market in Panama.

Key Factors to Consider for Obtaining License 🔑

Key Factors to Consider for Obtaining License 🔑

When seeking a license for cryptocurrency exchange operations in Panama, several key factors play a crucial role in the process. Understanding the legal and regulatory requirements is essential to ensure compliance and smooth operations. Additionally, having a robust AML (Anti-Money Laundering) and CFT (Counter Financing of Terrorism) framework in place is pivotal, as authorities prioritize transparency and security in the crypto sector. Collaborating with legal experts who are well-versed in Panama’s licensing procedures can streamline the application process and increase the chances of obtaining the desired license.

For more insights on cryptocurrency exchange licensing requirements in Paraguay, you can refer to this informative article on cryptocurrency exchange licensing requirements in Paraguay.

Impact of Regulations on the Cryptocurrency Market 💸

Cryptocurrency regulations in Panama have a significant impact on the market dynamics by providing a framework for operation and consumer protection. These regulations aim to foster trust and legitimacy within the industry, attracting both investors and users. By setting clear guidelines for exchanges to follow, the government ensures a level playing field, reducing the risk of fraud and illicit activities. The enforcement of regulations also contributes to increasing market stability and credibility, leading to a more sustainable ecosystem for cryptocurrencies to thrive. Moreover, these regulations can influence market behavior and investment decisions, shaping the overall growth and adoption of digital assets within the region.

Future Trends in Panama’s Cryptocurrency Regulation 🔮

In the realm of cryptocurrency regulation in Panama, it is crucial to anticipate the evolving trends that may shape the landscape in the near future. As technology advances and financial markets adapt, regulatory bodies in Panama are likely to refine their approach to overseeing cryptocurrency exchanges and related activities. This may involve greater emphasis on consumer protection, enhanced transparency measures, and potential updates to existing licensing requirements to address emerging challenges and opportunities in the digital asset space.

For further insights into cryptocurrency exchange licensing requirements in Panama’s neighboring region, you can explore the tax implications of Bitcoin trading in Tanzania. Understanding the regulatory frameworks in different jurisdictions can provide valuable perspectives for individuals and businesses navigating the complexities of the global cryptocurrency market. [Cryptocurrency Exchange Licensing Requirements in Papua New Guinea highlighted as – Tax Implications of Bitcoin Trading in Tanzania]