Legal Landscape 📝

Nicaragua’s legal landscape in the realm of cryptocurrency exchange is a dynamic tapestry woven with both challenges and opportunities. As the country grapples with the complexities of regulating this emerging asset class, legal frameworks are being scrutinized and revised to ensure a balance between fostering innovation and safeguarding investors. The interplay between existing financial regulations and the unique characteristics of cryptocurrencies presents a multifaceted terrain for policymakers and stakeholders to navigate. Clarity on the classification of digital assets, enforcement mechanisms, and consumer protection measures are integral components shaping the legal landscape in Nicaragua. Amidst this evolving landscape, a nuanced understanding of local laws and global best practices is essential for compliance and sustainability in the cryptocurrency exchange sector.

Licensing Requirements 📋

In setting up a cryptocurrency exchange in Nicaragua, operators must adhere to the specific licensing requirements mandated by the regulatory authorities. These requirements serve as the foundation for ensuring the exchange operates within the legal framework of the country. Key elements of the licensing process may include financial stability criteria, background checks on key individuals, security measures to protect user funds, and compliance procedures to prevent money laundering and illicit activities. By successfully meeting these requirements, cryptocurrency exchanges can gain the necessary permits to operate and provide services to users in Nicaragua, contributing to a secure and regulated digital asset trading environment. For more insights on licensing requirements in various jurisdictions, explore this informative resource on the impact of licensing requirements on cryptocurrency exchanges.

Regulatory Process 🔄

Navigating the landscape of regulations can be a complex maze for cryptocurrency exchanges entering Nicaragua. Understanding and adhering to the regulatory process is crucial for obtaining the necessary licenses to operate legally in the country. From submitting the required documentation to engaging with regulatory authorities, each step plays a pivotal role in the overall compliance strategy. Clear communication and transparency are key factors that can streamline the process and ensure a smoother journey towards establishing a compliant cryptocurrency exchange in Nicaragua.

Compliance Challenges 💼

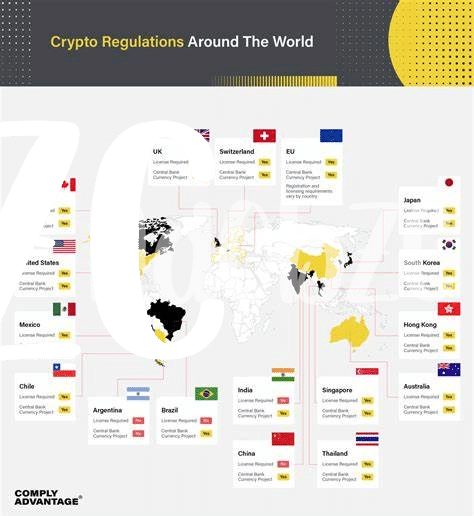

When it comes to navigating the world of cryptocurrency exchange licensing, there are a variety of compliance challenges that businesses must contend with. From staying up-to-date with evolving regulations to ensuring robust security measures are in place, maintaining compliance can be a complex and time-consuming endeavor. Additionally, the global nature of the cryptocurrency market means that businesses must also navigate international standards and regulations, adding another layer of complexity to the compliance landscape.

For cryptocurrency exchanges looking to operate in Nicaragua or other jurisdictions, understanding and addressing these compliance challenges is essential for long-term success in the industry. By staying informed, proactive, and adaptable, businesses can effectively navigate the regulatory environment and position themselves for growth and sustainability in the evolving cryptocurrency market.

International Standards 🌍

International standards play a crucial role in shaping the compliance framework for cryptocurrency exchanges. Adhering to these guidelines not only enhances transparency and security but also boosts credibility in the global market. Embracing international standards demonstrates a commitment to best practices, fostering trust and collaboration among stakeholders worldwide. By aligning with established norms, cryptocurrency exchanges in Nicaragua can navigate cross-border transactions more effectively while mitigating risks associated with money laundering and terrorist financing. Moreover, integrating these standards into regulatory processes can pave the way for smoother interactions with international partners and regulatory bodies. This proactive approach positions Nicaraguan exchanges as reputable players in the evolving landscape of digital asset trading.

Future Outlook 🔮

In considering the future outlook of cryptocurrency exchange licensing in Nicaragua, it is crucial to anticipate the evolving regulatory landscape and potential shifts in compliance requirements. As the market continues to mature, we can expect further alignment with international standards and best practices to enhance transparency and security within the industry. This proactive approach will not only benefit local exchanges but also foster trust and confidence among investors and users alike.

For further insights on cryptocurrency exchange licensing requirements in other jurisdictions, such as Cryptocurrency Exchange Licensing Requirements in New Zealand, click here to learn about the contrasting regulations in Nauru. By understanding the diverse approaches taken by different countries, industry stakeholders can navigate the global landscape more effectively and adapt their compliance strategies accordingly.