Cryptocurrency Regulations in Morocco: 💼

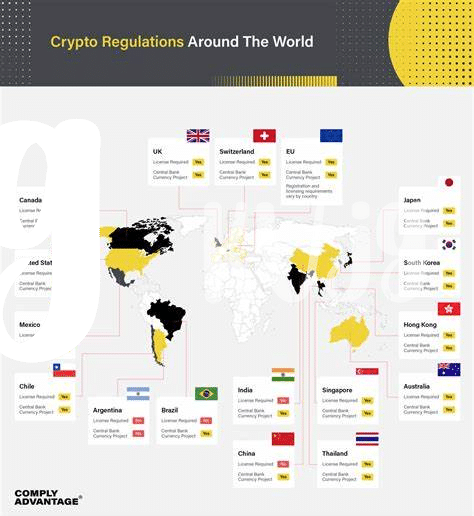

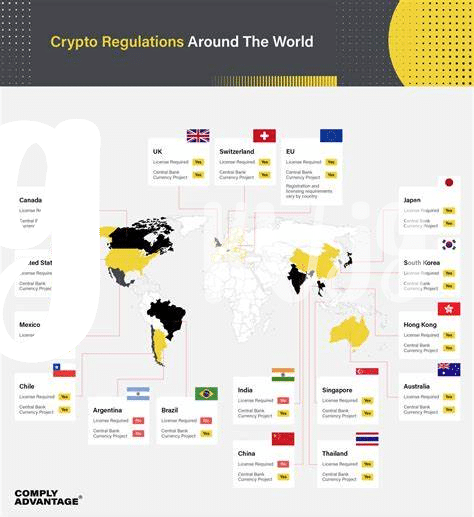

Morocco, like many countries, is navigating the evolving landscape of cryptocurrency regulations. The government is taking steps to understand and adapt to the digital currency market, considering consumer protection, financial stability, and potential risks. As the use of cryptocurrencies grows, Morocco is working on establishing a framework that strikes a balance between enabling innovation and ensuring compliance with existing laws.

There have been discussions about the need for clear guidelines to regulate the trading and use of cryptocurrencies within the country. The evolving nature of the cryptocurrency market presents both opportunities and challenges for regulators in Morocco as they aim to foster a secure environment for investors while also encouraging the growth of this innovative technology.

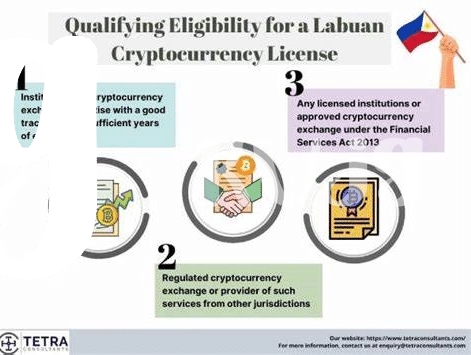

Licensing Requirements for Crypto Exchanges: 📝

To operate a cryptocurrency exchange in Morocco, businesses must adhere to specific licensing requirements set by regulatory authorities. These requirements typically include thorough background checks of key personnel, financial audits to ensure solvency, and compliance with anti-money laundering regulations. Additionally, exchanges are mandated to implement robust security measures to safeguard user funds and personal data. By meeting these stringent criteria, exchanges can enhance consumer trust and contribute to the overall legitimacy of the cryptocurrency market in Morocco.

Compliance Measures for Security and Privacy: 🔒

Cryptocurrency exchanges in Morocco are increasingly prioritizing compliance measures to enhance security and protect user privacy. Implementing robust security protocols such as encryption techniques and multi-factor authentication plays a crucial role in safeguarding user funds and sensitive information from potential cyber threats. Moreover, stringent privacy policies are being enforced to ensure that user data is handled in a transparent and secure manner, aligning with global best practices in data protection.

As the regulatory landscape evolves, cryptocurrency exchanges are adapting by continuously enhancing their security measures to address emerging threats and vulnerabilities. Regular security audits and assessments are conducted to evaluate existing protocols and identify areas for improvement, demonstrating a proactive approach towards maintaining a secure trading environment. By integrating comprehensive compliance measures, exchanges can instill trust among users and regulators, fostering a conducive atmosphere for sustainable growth in the cryptocurrency market.

Tax Implications for Cryptocurrency Trading: 💰

Tax implications play a crucial role in the realm of cryptocurrency trading. Understanding the tax treatment of gains and losses incurred from trading digital assets is essential for individuals and businesses alike. Given the evolving nature of cryptocurrencies, tax authorities are continually adapting their regulations to ensure compliance and revenue collection. It is imperative for traders to keep abreast of the latest tax laws and reporting requirements to avoid potential penalties. By staying informed and seeking professional advice, traders can navigate the complex landscape of cryptocurrency taxation with confidence and peace of mind. For more detailed insights on licensing requirements for cryptocurrency exchanges, check out cryptocurrency exchange licensing requirements in Moldova.

Impact of Regulatory Changes on the Market: 📉

Cryptocurrency regulations can have a significant impact on the market dynamics in Morocco. As regulatory changes are implemented, crypto investors and exchanges may need to adapt their strategies to comply with the new rules. This can lead to shifts in trading volumes, market liquidity, and overall investor sentiment. Additionally, regulatory clarity can also bring more stability and credibility to the cryptocurrency market, attracting more institutional investors and fostering long-term growth opportunities. It is essential for stakeholders to closely monitor how regulatory changes unfold and navigate the evolving landscape to make informed decisions for sustainable market participation.

Future Outlook and Potential Developments: 🔮

In the ever-evolving landscape of cryptocurrency regulations, Morocco is poised to explore new horizons and potential developments in the coming years. As the global crypto market continues to expand, the future outlook for Morocco’s regulatory framework holds promise and challenges alike. With a keen eye on fostering innovation while mitigating risks, stakeholders in the cryptocurrency ecosystem are awaiting key decisions that could shape the industry’s trajectory in the region.

For those venturing into the realm of cryptocurrency exchange licensing requirements, it’s essential to stay informed about the specific guidelines set forth by each jurisdiction. To understand the nuances between different regulatory frameworks, exploring cryptocurrency exchange licensing requirements in Mauritius provides valuable insights into compliance measures and operational expectations. By delving into the intricacies of licensing prerequisites, businesses can navigate the evolving landscape with greater clarity and strategic foresight.