Regulatory Framework 📜

Cryptocurrency exchanges in Central African Republic operate within a dynamic regulatory framework meant to ensure transparency, protect investor interests, and prevent financial crimes. The regulatory landscape sets the stage for the industry, outlining key operational guidelines and compliance standards that exchanges must adhere to. By understanding and navigating these regulations effectively, exchanges can foster trust among users and stakeholders while also contributing to the overall growth and legitimacy of the cryptocurrency market within the region. The regulatory framework serves as a critical pillar in shaping the ecosystem, promoting fair practices, and safeguarding against potential risks and vulnerabilities.

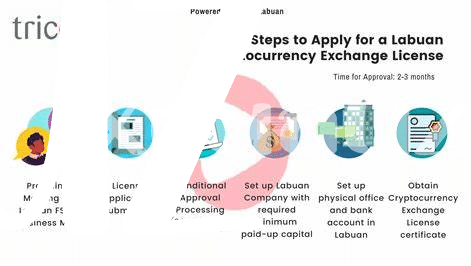

Licensing Requirements 📋

When setting up a cryptocurrency exchange in Central African Republic, it is crucial to understand the specific licensing requirements mandated by the regulatory authorities. These requirements encompass various aspects such as capital reserves, operational standards, and compliance procedures. Obtaining the necessary licenses signifies a commitment to transparency and regulatory compliance, instilling trust among users and investors. By adhering to the licensing requirements, cryptocurrency exchanges can operate legally and securely within the jurisdiction, contributing to the growth and stability of the digital asset ecosystem in the region.

Security Measures 🔒

Cryptocurrency exchanges in Central African Republic prioritize robust security measures to protect user assets and data. Encryption protocols, two-factor authentication, and regular security audits are key components in safeguarding against cyber threats and unauthorized access. By implementing multi-layered security mechanisms, exchanges can enhance user trust and confidence in the platform’s reliability and resilience against potential security breaches.

Furthermore, real-time monitoring and response mechanisms are crucial for promptly identifying and addressing security incidents. Proactive threat intelligence gathering and continuous assessment of security protocols help exchanges stay ahead of evolving cybersecurity risks. Engaging security experts and conducting regular training for staff further strengthen the exchange’s overall security posture, ensuring a safe and secure trading environment for users.

Anti-money Laundering Procedures 💰

Cryptocurrency exchanges in the Central African Republic must prioritize robust systems for detecting and preventing money laundering activities. Implementing Anti-money Laundering Procedures involves thorough monitoring of transactions, verifying customer identities, and reporting suspicious activities to regulatory authorities. By adhering to strict anti-money laundering protocols, exchanges can enhance trust and credibility within the cryptocurrency ecosystem while also mitigating potential risks of financial crime. For more insights on cryptocurrency exchange licensing requirements in Cameroon, check out this comprehensive guide: cryptocurrency exchange licensing requirements in Cameroon.

Customer Due Diligence 🕵️♂️

Customer due diligence is a crucial process in the realm of cryptocurrency exchanges in the Central African Republic. By conducting thorough investigations and verifying the identities of customers, exchanges can mitigate risks associated with fraud and illicit activities. Implementing stringent KYC (Know Your Customer) procedures ensures a safer and more secure environment for all parties involved. This not only promotes trust within the community but also contributes to the overall integrity and compliance of the exchange operations.

Reporting and Compliance Monitoring 📊

For Reporting and Compliance Monitoring in cryptocurrency exchanges, regular and accurate reporting is crucial to ensure adherence to regulations and maintain transparency. Monitoring activities involve tracking transactions, analyzing data, and identifying any suspicious activities that may indicate potential risks. By implementing robust compliance monitoring processes, exchanges can mitigate potential risks of fraud, money laundering, and other illicit activities, thereby enhancing trust among stakeholders and regulatory bodies.

To enhance compliance efforts, exchanges should stay updated on regulatory changes and continuously assess their internal controls. Ongoing monitoring and reporting mechanisms help in identifying and addressing any compliance gaps promptly. By incorporating technology solutions and thorough monitoring practices, exchanges can strengthen their compliance posture and contribute to the overall integrity of the cryptocurrency ecosystem.

Cryptocurrency exchange licensing requirements in Bulgaria can significantly impact the operational framework of exchanges and ensure compliance with international standards.