Current Status of Cryptocurrency Exchange Licensing in Libya 🌍

The landscape of cryptocurrency exchange licensing in Libya is continually evolving, influenced by both global trends and local dynamics. Regulatory bodies are increasingly recognizing the importance of establishing clear frameworks to govern the operation of exchanges, aiming to foster trust and stability in this burgeoning sector. Amidst these developments, entities seeking to operate within the Libyan market are navigating a landscape that presents both opportunities and challenges, shaped by legal, economic, and technological factors.

As the demand for digital assets grows in Libya, the licensing process for cryptocurrency exchanges plays a pivotal role in shaping the industry’s trajectory. Understanding the current status of licensing requirements provides valuable insights into the regulatory environment and sets the stage for exploring future possibilities in this dynamic space. By delving into the nuances of these licensing regulations, stakeholders can better position themselves to thrive in a market ripe with potential for innovation and growth.

Key Regulations Governing Cryptocurrency Exchanges 📜

Cryptocurrency exchanges operate within a framework of regulations that aim to ensure transparency, security, and accountability in the digital asset space. These regulations typically cover aspects such as KYC (Know Your Customer) requirements, AML (Anti-Money Laundering) procedures, and licensing prerequisites. Adhering to these key regulations is essential for exchanges to maintain compliance and integrity in their operations. By following these guidelines, exchanges can help build trust with users and regulators, fostering a more secure environment for trading and investment in cryptocurrencies.

In addition to the basic regulatory requirements, cryptocurrency exchanges may also need to comply with specific rules related to data protection, cybersecurity, and financial reporting. These regulations help protect investors and prevent fraudulent activities within the crypto market. By understanding and abiding by these key regulations, exchanges can navigate the evolving regulatory landscape and contribute to the overall legitimacy and sustainability of the cryptocurrency industry.

Challenges Faced by Cryptocurrency Exchanges in Libya 🛑

Cryptocurrency exchanges operating in Libya encounter various obstacles unique to the local landscape. The lack of clear regulatory frameworks poses a significant challenge for these platforms, leading to uncertainties regarding compliance and legal implications. Additionally, the ongoing political instability in the region further complicates the operations of cryptocurrency exchanges, impacting trust and user participation. Navigating these challenges requires a delicate balance of adaptability and strategic planning to ensure sustainable growth and resilience in the face of evolving circumstances.

Impact of Licensing Requirements on the Market 💼

Cryptocurrency exchange licensing requirements play a pivotal role in shaping the market landscape. These regulations not only ensure the legitimacy and security of exchanges but also influence investor trust and participation. By establishing clear guidelines and standards, licensing requirements help mitigate risks associated with fraud and illicit activities, ultimately fostering a more robust and sustainable ecosystem for cryptocurrency trading. Understanding and complying with these mandates is crucial for exchanges to operate effectively and gain a competitive edge in the market. To delve deeper into successful licensed cryptocurrency exchanges, explore the insights shared on cryptocurrency exchange licensing requirements in Lesotho.

Future Prospects for Cryptocurrency Exchanges in Libya 🚀

– As the landscape of digital assets evolves globally, Libya stands at the cusp of embracing the potential offered by cryptocurrency exchanges. With increasing interest from both individual traders and institutional investors, the future prospects for cryptocurrency exchanges in Libya are filled with promise. The growing acceptance of digital currencies and the desire for financial inclusion in the region pave the way for a potentially vibrant market. However, regulatory clarity and enforcement will be key in shaping how these exchanges operate and thrive in the country. By fostering a conducive regulatory environment that balances innovation with investor protection, Libya has the opportunity to establish itself as a hub for cryptocurrency trading in the region, unlocking new avenues for economic growth and technological advancement.

Recommendations for Navigating the Licensing Process 🗺️

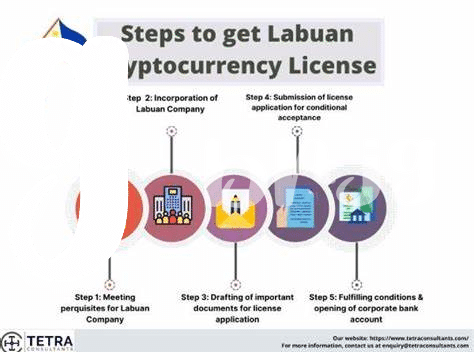

When navigating the licensing process for cryptocurrency exchanges in Libya, it is crucial to stay updated on the evolving regulations and requirements set by the governing bodies. Conduct thorough research and seek guidance from legal professionals well-versed in the cryptocurrency industry. Building strong relationships with regulatory authorities can also help smoothen the licensing journey. Additionally, ensuring compliance with anti-money laundering (AML) and know your customer (KYC) regulations is paramount for a successful licensing application.

For more detailed insights on cryptocurrency exchange licensing requirements in Laos, click here to compare them with the cryptocurrency exchange licensing requirements in Kyrgyzstan.