Introduction to Bitcoin Exchange Platforms 🌟

Bitcoin exchange platforms serve as digital marketplaces where individuals can buy, sell, and trade cryptocurrencies. These platforms facilitate transactions between users looking to exchange various forms of digital currency, including the popular Bitcoin. With the increasing popularity of cryptocurrencies, Bitcoin exchanges play a crucial role in the digital economy by providing a convenient way for users to engage in crypto trading securely.

In the ever-evolving landscape of digital assets, Bitcoin exchange platforms have become essential pillars in the realm of decentralized finance. As technology continues to advance, these platforms are at the forefront of enabling the seamless exchange of digital currencies, shaping the future of financial transactions globally.

Overview of Regulatory Landscape 📜

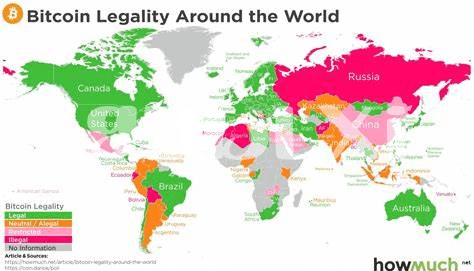

The regulatory landscape surrounding Bitcoin exchange platforms is a critical aspect that shapes the operations of these platforms. Understanding the regulatory framework is essential for both the platforms themselves and the users who engage with them. Regulations can vary significantly from one country to another, impacting issues such as licensing requirements, reporting standards, and compliance measures. This diverse regulatory environment presents challenges for Bitcoin exchanges as they navigate the complexities of operating in multiple jurisdictions. By examining these regulations closely, insights can be gained into the evolving relationship between digital currencies and traditional financial systems.

A thorough analysis of the regulatory landscape provides valuable insights into the legal requirements that Bitcoin exchange platforms must adhere to. By exploring the different approaches taken by governments worldwide, a clearer picture emerges of the opportunities and obstacles facing the cryptocurrency industry. Regulatory frameworks not only influence the day-to-day operations of exchanges but also shape broader trends in the adoption and acceptance of digital currencies. As the regulatory landscape continues to evolve, stakeholders in the cryptocurrency market must stay informed and proactive to ensure compliance and foster a sustainable ecosystem for digital assets.

Case Study: Current Exchanges in Laos 🇱🇦

Within the landscape of Laos, the current scenario of Bitcoin exchanges reveals a burgeoning interest in digital asset trading. These exchanges serve as vital platforms where individuals can seamlessly buy and sell cryptocurrencies, facilitating financial inclusion among the populace. The existing exchanges in Laos exhibit a diverse range of services, catering to both novice and experienced traders. As these exchanges navigate the evolving regulatory environment, they play a pivotal role in shaping the country’s digital economy. Despite facing challenges, such as regulatory uncertainties and market volatility, these platforms continue to adapt and innovate to meet the needs of a growing user base.

Challenges Faced by Bitcoin Exchanges 💡

Bitcoin exchanges encounter a myriad of challenges in their operations. From navigating complex regulatory requirements to ensuring robust security measures against cyber threats, these platforms must also manage liquidity, handle volatile price fluctuations, and build trust among users. Moreover, combating money laundering, fraud, and illicit activities remains a constant battle. Adapting to evolving technologies and regulatory landscapes adds another layer of difficulty. Striking a balance between innovation and compliance is crucial for the sustainable growth of Bitcoin exchanges in Laos and beyond.

International Comparisons and Best Practices 🌍

In exploring global practices, it is evident that some countries have established robust regulatory frameworks for Bitcoin exchanges, ensuring consumer protection and market integrity. For instance, countries like Japan have implemented licensing requirements to safeguard users’ funds and operational transparency. Similarly, in the United States, exchanges must comply with stringent anti-money laundering and cybersecurity standards. These international comparisons highlight the importance of proactive regulatory measures to foster trust and credibility within the cryptocurrency exchange ecosystem. By drawing from best practices worldwide, Laos can enhance its regulatory framework to promote a secure and thriving Bitcoin exchange market.

Future Outlook and Potential Developments 🔮

For the future outlook and potential developments in the Bitcoin exchange landscape, the trajectory is poised for interesting shifts. As more countries evaluate and establish regulatory frameworks surrounding cryptocurrencies, including Bitcoin, there is a growing need for coherent and consistent guidelines to govern exchanges. With evolving technologies and increased interest from institutional investors, the space is likely to witness a broader acceptance and integration of digital assets into mainstream financial systems. This progression could lead to enhanced transparency, security measures, and overall legitimacy for Bitcoin exchanges globally.

In exploring the landscape further, insights from jurisdictions like Lesotho and Kyrgyzstan provide valuable perspectives on the legality and regulatory frameworks for Bitcoin. Understanding the nuances of these diverse approaches can offer valuable insights for shaping future developments and regulations in other countries. The ongoing discourse on the legal status of Bitcoin in various regions is expected to influence the direction of the cryptocurrency market, ushering in a new era of acceptance and innovation within the exchange platforms.