Overview of Crypto Exchange Licensing Regulations 🌍

Crypto exchange licensing regulations play a pivotal role in shaping the operation of digital asset platforms globally. The intricate web of rules and requirements set forth by regulatory bodies aims to safeguard investors, prevent financial crimes, and promote market integrity. Moreover, these regulations often serve as a barometer of a country’s approach towards emerging technologies and its commitment to fostering a conducive environment for innovation and growth.

Adherence to licensing regulations is not just a box to tick for crypto exchanges; it is a cornerstone of their credibility and legitimacy in the eyes of both users and regulators. By obtaining the necessary licenses, exchanges demonstrate their commitment to operating with transparency, accountability, and in alignment with legal frameworks. However, navigating this regulatory landscape presents its own set of challenges, with varying requirements across jurisdictions adding layers of complexity to the licensing process.

Evolution of Regulatory Changes in Greece 📈

The regulatory landscape surrounding crypto exchanges in Greece has experienced a dynamic evolution in recent years. These changes have been influenced by a variety of factors, including shifts in government policies, emerging technologies, and global market trends. As authorities strive to strike a balance between fostering innovation and ensuring investor protection, the regulatory framework governing crypto exchange licensing has undergone significant modifications. These developments reflect a growing recognition of the importance of effectively regulating the crypto market to promote transparency and stability within the financial sector.

The evolving regulatory environment in Greece has necessitated adaptability and proactive engagement from crypto exchanges operating within the country. As new laws and guidelines are introduced, stakeholders must stay informed and responsive to ensure compliance with the evolving standards. This fluid regulatory landscape presents challenges but also opportunities for industry players to demonstrate their commitment to operating responsibly and ethically. By closely monitoring and adapting to regulatory changes, crypto exchanges can navigate the shifting landscape and contribute to a more robust and sustainable ecosystem for digital assets within the Greek market.

Challenges Faced by Crypto Exchanges 🛑

Crypto exchanges encounter a myriad of hurdles in their operations, ranging from security vulnerabilities to regulatory uncertainties. The constant battle against hacking attempts and ensuring the safety of digital assets is a primary challenge. Additionally, navigating through the evolving landscape of regulations while striving to maintain liquidity and customer trust poses another uphill task. Compliance with stringent anti-money laundering measures further adds to the complexity, requiring vigilant monitoring and adherence to regulatory guidelines. These challenges underscore the crucial need for robust risk management strategies and proactive security measures within the crypto exchange ecosystem.

Importance of Compliance for Licensing Approval 🔍

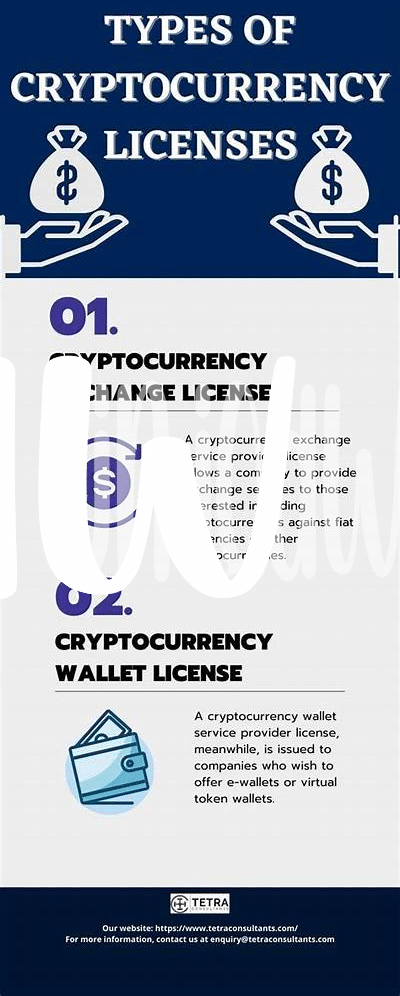

To ensure smooth operations and legitimacy, compliance with regulatory requirements is paramount for obtaining licensing approval in the crypto exchange sector. Adhering to these standards not only exhibits a commitment to transparency and security but also enhances trust among stakeholders. By meeting the necessary criteria, exchanges demonstrate their readiness to operate within the legal framework, safeguarding investor interests, and promoting market integrity. For detailed insights into the key criteria essential for meeting licensing requirements for crypto exchanges in various jurisdictions, including Gambia, refer to a comprehensive guide on cryptocurrency exchange licensing requirements in Georgia.

Potential Impact on the Crypto Market 📊

Cryptocurrency is a sector known for its volatility, and any changes in regulations can have a significant impact on the market dynamics. With the evolving regulatory landscape in Greece, the potential influence on the crypto market is vast and varied. Investors need to closely monitor how these changes affect trading volumes, market capitalization, and overall investor sentiment. Increased regulatory clarity may attract more institutional interest, leading to enhanced market stability, while stricter regulations could potentially dampen speculative activities. The harmony between regulatory requirements and market innovation will play a crucial role in shaping the future trajectory of the crypto market in Greece.

Future Outlook and Implications for Stakeholders 🔮

In contemplating the future landscape of cryptocurrency exchange licensing in Greece, stakeholders find themselves at a crucial juncture where adaptation is key to success. The evolving regulatory framework poses challenges but also opportunities for those willing to navigate the complexities while focusing on compliance. As new guidelines are established, the implications for stakeholders extend beyond mere licensing requirements, influencing market dynamics and shaping the industry’s trajectory. By staying abreast of these changes, stakeholders can proactively position themselves for a sustainable future in the ever-shifting realm of crypto exchanges.

Cryptocurrency Exchange Licensing Requirements in Gambia