Understanding the Legal Requirements 📜

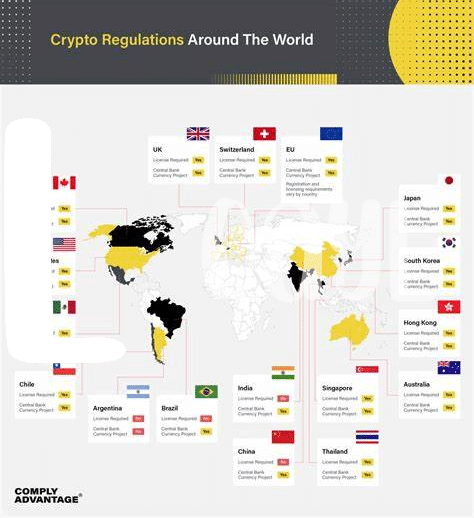

The legal landscape surrounding cryptocurrency exchange licensing in Egypt can seem complex and overwhelming at first glance. However, breaking down the legal requirements into digestible components can help navigate this process with confidence. Understanding the intricacies of the laws and regulations set forth by the Egyptian authorities is crucial for ensuring compliance and avoiding potential pitfalls. Engaging with legal experts who specialize in this field can provide invaluable insights and guidance tailored to the specific needs of cryptocurrency exchanges.

To successfully meet the legal requirements for operating a cryptocurrency exchange in Egypt, thorough research and a proactive approach are paramount. Remaining up to date on any regulatory changes or updates is essential for maintaining compliance and staying ahead of potential challenges. By establishing a solid foundation of legal understanding from the outset, cryptocurrency exchanges can position themselves for long-term success and sustainability in the Egyptian market.

Licensing Application Process 📋

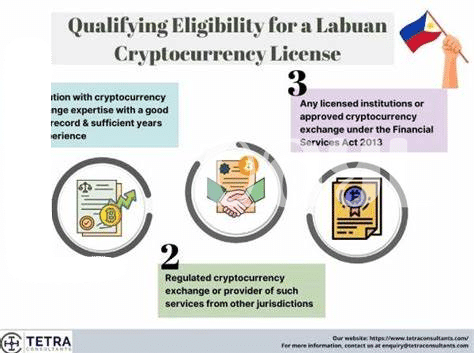

The licensing application process for cryptocurrency exchanges in Egypt involves a series of steps that need to be meticulously followed to ensure compliance with regulatory requirements. From submitting the necessary documentation to demonstrating the operational infrastructure, each stage plays a crucial role in the approval process. Clear communication with the regulatory authorities and a thorough understanding of the application criteria are key factors in streamlining the licensing process, paving the way for a successful outcome.

Ensuring that all the paperwork is in order and that the exchange meets the specified standards is fundamental during the application phase. Attention to detail and a proactive approach can significantly expedite the approval timeline, allowing the exchange to start operating within the legal framework. Working closely with legal advisors and compliance experts can provide valuable insights and guidance throughout the application journey, enhancing the chances of a smooth and efficient licensing process.

Financial Stability and Transparency 💰

Financial Stability and Transparency are crucial pillars for any cryptocurrency exchange operating in Egypt. By maintaining a sound financial standing and fostering transparency in all transactions, exchanges can build trust with their users and regulators. It is essential for exchanges to implement robust financial practices, including regular audits and transparent reporting mechanisms. Through promoting financial stability and transparency, exchanges can enhance their credibility in the eyes of the public and regulatory authorities. This not only fosters a secure environment for users to trade and invest but also contributes to the overall integrity of the cryptocurrency industry in Egypt.

Compliance with Anti-money Laundering Regulations 🔍

In the context of operating a cryptocurrency exchange in Egypt, compliance with anti-money laundering regulations is of paramount importance. These regulations are designed to prevent the misuse of digital assets for illegal activities, such as money laundering and terrorist financing. By adhering to these regulations, exchange operators not only protect their own business but also contribute to the overall integrity of the financial system. It involves implementing robust KYC (Know Your Customer) procedures, monitoring transactions for suspicious activities, and reporting any irregularities to the relevant authorities.

For further insights into the key compliance regulations for cryptocurrency exchanges, particularly in the Dominican Republic, you can refer to this informative article on cryptocurrency exchange licensing requirements in the country: cryptocurrency exchange licensing requirements in Dominican Republic.

Security Measures and Risk Management 🔒

When it comes to operating a cryptocurrency exchange, ensuring robust security measures and effective risk management strategies is paramount. Safeguarding your platform against cyber threats and unauthorized access is a top priority to protect both your assets and those of your users. Implementing strong encryption, multi-factor authentication, and regular security audits are essential components in maintaining a secure environment. Additionally, having a comprehensive incident response plan in place can mitigate potential risks and minimize any potential damages in the event of a security breach. By proactively addressing security concerns and staying vigilant in risk management, you can build trust and credibility with your users while safeguarding the integrity of your exchange.

Ongoing Regulatory Compliance and Reporting 📊

Meeting ongoing regulatory compliance and reporting requirements is crucial for maintaining a cryptocurrency exchange’s operating status in Egypt. Regular audits and reporting ensure transparency and accountability to the authorities. It involves submitting timely and accurate information regarding the exchange’s activities, transactions, and security measures. Staying updated with evolving regulations and promptly adapting the exchange’s practices are essential. Failure to comply with reporting obligations can lead to severe penalties or even suspension of the exchange’s license. By fostering a culture of compliance and diligence within the organization, the exchange can navigate the regulatory landscape effectively and build trust with stakeholders and customers alike. Stay informed, stay compliant.

Insert link to cryptocurrency exchange licensing requirements in Dominica with anchor text cryptocurrency exchange licensing requirements in Czech Republic: cryptocurrency exchange licensing requirements in czech republic