Understanding the Legal Framework 📜

The legal framework surrounding cryptocurrencies and exchanges in the DRC sets the stage for operations within the country. Understanding the intricate web of laws, regulations, and policies is crucial for navigating the crypto landscape. From established statutes to emerging guidelines, a comprehensive grasp of the legal framework is essential for compliance and successful business operations.

In the ever-evolving world of crypto, staying ahead of the legal curve is paramount. The dynamic nature of regulations requires continuous monitoring and adaptation to ensure compliance and mitigate risks. Engaging with legal experts and staying informed about updates and changes in the legal framework is not only advisable but necessary for the sustainable growth of crypto exchanges in the DRC.

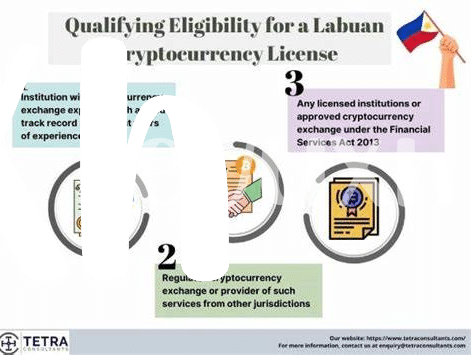

Regulatory Requirements for Licensing 📋

When venturing into the realm of establishing a crypto exchange in the Democratic Republic of Congo (DRC), navigating the regulatory landscape is a crucial aspect. Compliance with licensing requirements is paramount for ensuring legitimacy and trust within the emerging market of digital assets. The regulatory framework set forth by the authorities outlines specific criteria that must be met to obtain the necessary licenses, underscoring the importance of understanding and adhering to these regulatory requirements. Emphasizing transparency, security, and accountability, the licensing process acts as a safeguard to protect both investors and the integrity of the cryptocurrency ecosystem.

To successfully navigate the regulatory requirements for licensing a crypto exchange in the DRC, meticulous attention to detail and thorough compliance with the stipulated guidelines are essential. Ensuring that all regulatory obligations are met not only fosters credibility and trust but also contributes to the overall sustainability and growth of the crypto ecosystem in the region. By aligning with these regulatory standards, crypto exchanges can elevate the level of professionalism and integrity in the burgeoning crypto market of the DRC, paving the way for a robust and secure digital asset environment.

Financial Obligations and Capital Requirements 💰

Navigating the financial landscape when starting a crypto exchange involves understanding the capital requirements and financial obligations necessary for compliance. Ensuring adequate resources are in place can be critical to meeting regulatory standards and building trust with users. By carefully assessing the financial aspects of the venture, you can position your exchange for long-term success and stability in a dynamic market environment.

Security Measures and Compliance Standards 🔒

For point 4 – Security Measures and Compliance Standards, it is essential for a crypto exchange in DRC to implement robust security measures to protect user data and assets. Compliance standards play a crucial role in ensuring the legitimacy and trustworthiness of the exchange within the regulatory framework. By adhering to industry best practices and incorporating cutting-edge security protocols, the exchange can safeguard against potential cyber threats and unauthorized access. Continuous monitoring and update of compliance standards are necessary to adapt to evolving regulations and maintain a secure trading environment for users. To delve deeper into the compliance challenges faced by cryptocurrency exchanges, particularly in the context of Congo-Brazzaville, you can explore this insightful resource on cryptocurrency exchange licensing requirements in Congo (Congo-Brazzaville).

Application Process and Documentation Needed 📝

The process of applying for a license to start a crypto exchange in DRC involves submitting various documentation that proves your business meets the regulatory standards. This includes detailed information about your company structure, key personnel, financial resources, security measures, and compliance protocols. Additionally, you will need to provide a comprehensive business plan outlining your objectives, strategies, and operational model. The documentation needed should demonstrate your commitment to transparency, customer protection, and adherence to anti-money laundering laws. Thoroughly preparing and organizing these documents is crucial for a successful application process.

Maintaining Ongoing Compliance and Updates 🔄

Maintaining ongoing compliance and staying updated with regulatory changes is crucial for the sustainability of a crypto exchange business. It involves consistently monitoring legal requirements, adjusting internal processes to align with evolving standards, and ensuring that security measures are up to date. Regularly reviewing and enhancing compliance protocols not only keeps the exchange operating within legal boundaries but also safeguards customer trust and satisfaction. Additionally, staying abreast of industry developments and technological advancements is essential for adapting to the rapidly changing landscape of the cryptocurrency market.

For more insights on cryptocurrency exchange licensing requirements in Colombia, check out the comprehensive guide on cryptocurrency exchange licensing requirements in China. This comparative analysis can provide valuable insights into the specific regulatory frameworks governing crypto exchanges in different regions, helping you navigate the complexities of international licensing requirements effectively.