Regulatory Hurdles 🚫

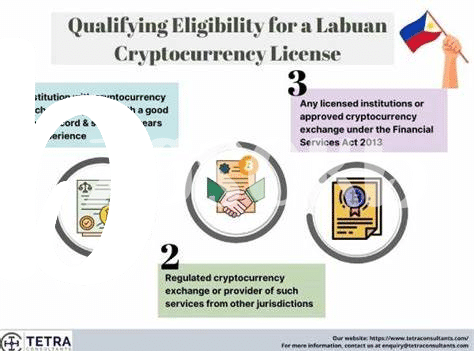

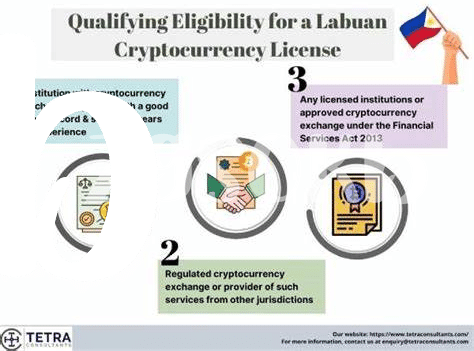

Navigating through the intricate web of regulations in China presents a formidable challenge for cryptocurrency exchanges operating within its borders. The evolving nature of governmental policies, coupled with the ambiguous regulatory framework, often leaves exchange platforms at a loss when striving for compliance. From licensing requirements to restrictions on trading activities, regulatory hurdles loom large, impacting the operational flexibility and growth potential of exchanges in the region. Striking a balance between innovation and adherence to regulatory mandates remains a delicate tightrope walk for industry players in China.

Anti-money Laundering Concerns 💰

Cryptocurrency exchanges in China face several compliance challenges. One notable aspect is the ever-evolving regulatory landscape, which adds complexity and uncertainty to their operations. This dynamic environment requires exchanges to stay vigilant and adaptable to ensure compliance with the latest laws and regulations. Furthermore, the prevalence of money laundering activities within the cryptocurrency space raises significant concerns, prompting exchanges to implement robust anti-money laundering measures to protect their platforms and users from illicit financial activities. This aspect demands continuous monitoring and proactive steps to mitigate risks effectively.

Customer Data Privacy Issues 🔒

Customer data privacy is a crucial concern for cryptocurrency exchanges in China. With increasing regulatory scrutiny and evolving data protection laws, ensuring the privacy and security of user information is paramount. The challenge lies in balancing the transparency required by regulators with the need to safeguard sensitive data from potential breaches. Implementing robust encryption protocols and strict access controls are essential steps to address these privacy issues effectively and maintain the trust of users. Striking a balance between regulatory compliance and protecting customer data is a delicate yet essential task for cryptocurrency exchanges operating in China.

Volatility and Market Manipulation 📉

Volatility and market manipulation pose significant challenges for cryptocurrency exchanges. The unpredictable fluctuations in prices can lead to opportunities for manipulative activities, impacting the overall market integrity. Exchange platforms need to implement robust monitoring systems to detect and prevent such activities effectively. It is crucial for regulators to work closely with exchanges to establish guidelines that mitigate the risks associated with market manipulation, ensuring a fair and transparent trading environment for all participants. For more insights on cryptocurrency exchange licensing requirements in Comoros, check out this informative article: cryptocurrency exchange licensing requirements in Comoros.

Technological Vulnerabilities 🖥️

In the rapidly evolving world of cryptocurrency exchanges, staying vigilant against technological vulnerabilities is paramount. From potential hacking attempts to security breaches, these digital platforms face a myriad of challenges. Ensuring robust encryption protocols, implementing multi-factor authentication, and regularly conducting security audits are critical steps in safeguarding user assets and maintaining trust in the exchange system. By addressing these vulnerabilities head-on, exchanges can enhance their resilience and foster a more secure trading environment for all participants.

International Cooperation for Compliance 🌍

International cooperation among countries is crucial for cryptocurrency exchanges to ensure compliance with varying regulations. Working together allows for the sharing of best practices, facilitating a more uniform approach to regulatory standards. By collaborating on anti-money laundering measures, data privacy protocols, and overall market integrity, exchanges can build trust with international regulators. This cooperation not only strengthens the industry’s integrity but also fosters a global environment conducive to innovation and responsible trading practices.

To operate a cryptocurrency exchange in Cyprus, firms must adhere to licensing requirements set forth by the country’s Securities and Exchange Commission (CySEC). For those interested in establishing a presence in Chile, understanding the cryptocurrency exchange licensing requirements is essential. More information on cryptocurrency exchange licensing requirements in Cyprus can be found here: cryptocurrency exchange licensing requirements in Chile.