Overview of Cryptocurrency Exchange Licensing Process 📝

Sure, here is the requested text:

Belgium’s cryptocurrency exchange licensing process navigates a complex web of regulations and requirements, offering a glimpse into the intricate world of digital asset trading. By understanding the steps involved, aspiring exchange operators can uncover the pathway to legitimacy in an evolving industry landscape. From initial application submissions to compliance assessments, each stage contributes to the overarching goal of establishing a secure and transparent trading environment. The process emphasizes the importance of adherence to regulatory standards while fostering innovation and market growth. In essence, obtaining a license signifies a commitment to operating within the bounds of legal frameworks, ensuring accountability and consumer protection.

Key Regulations Governing Cryptocurrency Exchanges 📜

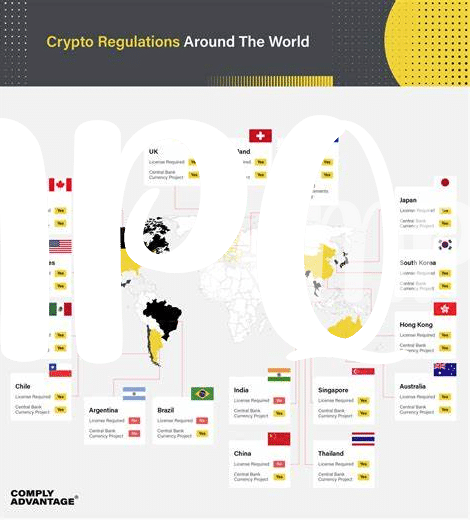

Cryptocurrency exchanges worldwide are subject to a myriad of regulations to ensure transparency and security in the digital asset market. These rules typically cover areas such as customer identity verification, anti-money laundering protocols, and data privacy safeguards. Understanding the key regulations governing cryptocurrency exchanges is crucial for both new entrants and existing players to navigate the complex legal landscape effectively.

Benefits of Obtaining a License in Belgium 💼

3) Belgium offers a compelling array of advantages for cryptocurrency exchanges looking to obtain a license. The streamlined regulatory framework provides clarity and stability, instilling confidence in investors and users alike. By acquiring a license in Belgium, exchanges can access a well-established financial ecosystem, tapping into a supportive network of institutions and professionals. Additionally, being licensed enhances credibility and trust, opening up opportunities for partnerships and expansion within the European market. The benefits of obtaining a license in Belgium extend beyond mere compliance, paving the way for sustainable growth and competitive advantage.

Challenges and Pitfalls to Watch Out for ⚠️

Cryptocurrency exchange licensing in Belgium presents a myriad of challenges and pitfalls that operators need to navigate carefully. From stringent compliance requirements to potential regulatory changes, staying abreast of the evolving landscape is crucial. Cybersecurity threats also loom large, emphasizing the need for robust measures to safeguard user data and funds. Ensuring seamless integration with existing financial systems while adhering to anti-money laundering (AML) and know your customer (KYC) protocols adds another layer of complexity. Moreover, the competitive nature of the industry demands continuous innovation to attract and retain clients while remaining compliant with regulatory guidelines.

For more insights on the implications of licensing requirements in another jurisdiction, explore the intricacies of cryptocurrency exchange licensing requirements in Bahrain [cryptocurrency exchange licensing requirements in Bahrain](https://wikicrypto.news/implications-of-licensing-requirements-on-cryptocurrency-trading-in-bangladesh). By understanding the challenges faced by operators in different jurisdictions, one can gain a more comprehensive perspective on the global regulatory landscape impacting the cryptocurrency exchange sector.

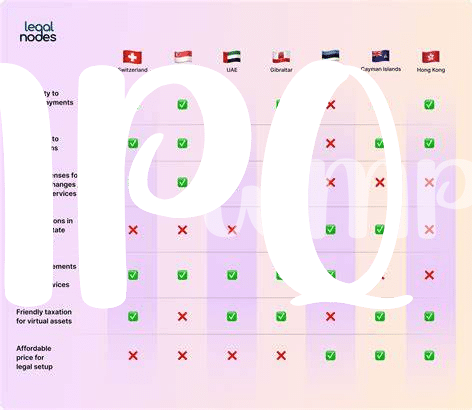

Comparison with Other Countries’ Licensing Frameworks 🌍

Belgium’s cryptocurrency exchange licensing framework holds its unique place among various countries worldwide. While some nations like Japan have embraced cryptocurrencies with detailed regulations and licensing requirements, others such as the United States and South Korea are still navigating the complexities of regulatory frameworks. Each country approaches licensing differently, leading to variations in compliance standards, operational restrictions, and consumer protection measures. By exploring these diverse approaches, stakeholders in the cryptocurrency industry can gain valuable insights into best practices, potential challenges, and opportunities for international collaboration. This comparative analysis sheds light on the evolving landscape of cryptocurrency exchange licensing, showcasing the global diversity of regulatory approaches in a rapidly expanding market.

Future Outlook and Potential Changes in the Industry 🔮

As the cryptocurrency landscape continues to evolve, the future outlook and potential changes in the industry hold significant implications for stakeholders. Technological advancements, regulatory developments, and shifting market trends are poised to shape the trajectory of cryptocurrency exchanges in the coming years. With increasing focus on compliance and investor protection, regulatory bodies are likely to introduce more stringent measures to enhance transparency and security within the sector. Moreover, as the global financial ecosystem adapts to the digital age, innovative solutions such as blockchain technology are expected to revolutionize the way financial transactions are conducted.

For further insights into cryptocurrency regulations in different jurisdictions, consider exploring the bitcoin anti-money laundering (AML) regulations in Suriname to compare with the cryptocurrency exchange licensing requirements in Bangladesh.