Montenegro’s Aml Regulations 🌍

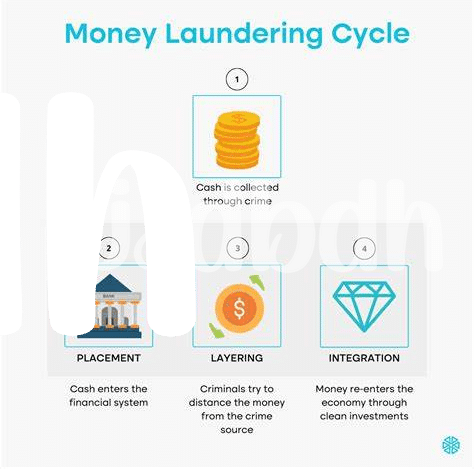

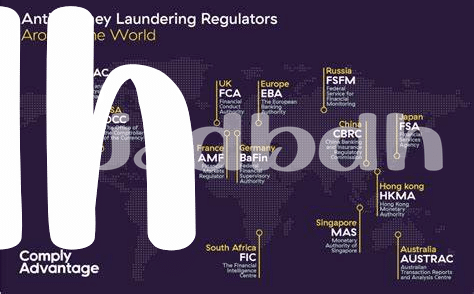

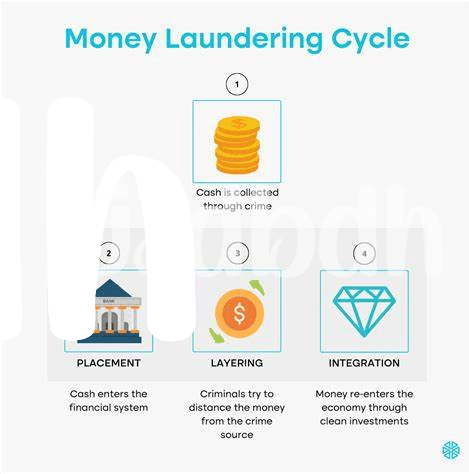

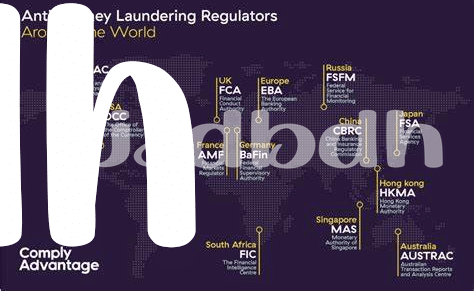

Montenegro’s AML regulations play a crucial role in shaping the landscape for cryptocurrency investors in the region. Understanding the intricacies of these regulations is essential for navigating the market effectively and ensuring compliance with legal requirements. By delving into the specifics of Montenegro’s AML framework, investors can gain valuable insights into the regulatory environment and make well-informed decisions regarding their Bitcoin investments. With a clear understanding of the expectations and guidelines set forth by the authorities, investors can mitigate risks and capitalize on opportunities in the burgeoning cryptocurrency market.

Impact on Bitcoin Market 📈

Montenegro’s AML regulations have a direct impact on the Bitcoin market, influencing investor behavior and market dynamics. Understanding and adhering to these regulations is crucial for navigating the cryptocurrency landscape effectively. The implementation of AML measures can lead to increased transparency and security within the Bitcoin market, shaping its growth and sustainability. As investors navigate this evolving regulatory landscape, they must adapt their strategies to mitigate risks and capitalize on emerging opportunities in the crypto space.

Risks and Opportunities 🚦

Navigating the world of AML regulations in Montenegro brings both risks and opportunities for savvy Bitcoin investors. The evolving landscape poses challenges, including compliance hurdles and potential market volatility. However, these risks are accompanied by promising opportunities for strategic investments and innovative approaches. By carefully assessing the risks and understanding the legal framework, investors can position themselves to capitalize on the growing market potential. Embracing these challenges as stepping stones towards greater insights and success can lead to rewarding outcomes in Montenegro’s AML puzzle.

Investor Strategies 💡

Investor Strategies: When navigating Montenegro’s AML landscape as a Bitcoin investor, it’s crucial to adopt a balanced approach. Diversification is key to mitigating risks while maximizing opportunities. Embracing a long-term perspective can help weather market fluctuations and regulatory changes. As the crypto space evolves, staying informed and adaptable is essential for successful investment strategies.

For more insights on navigating AML regulations in the crypto world, check out this comprehensive guide on **[bitcoin anti-money laundering (AML) regulations in Nepal](https://wikicrypto.news/compliance-tips-for-bitcoin-startups-in-monacos-aml-landscape)**.

Regulatory Compliance Tips 📝

Understanding and adhering to the regulatory compliance requirements in Montenegro is crucial for Bitcoin investors operating within the country. Some essential tips include maintaining detailed records of transactions, conducting thorough due diligence on counterparties, and staying informed about any changes in AML regulations. Implementing robust internal controls and utilizing secure wallets for storing digital assets can also help investors navigate the evolving regulatory landscape effectively. Compliance with these guidelines is key to building trust, mitigating risks, and ensuring sustainable growth in the crypto market.

Future Outlook for Crypto Investors 🔮

The rapidly evolving landscape of cryptocurrencies presents both challenges and opportunities for investors. As we look towards the future, staying informed about the latest trends, regulatory changes, and technological advancements will be crucial. Being proactive in understanding and adapting to these developments can help investors navigate the uncertainties and capitalize on emerging opportunities in the crypto market. By staying vigilant and informed, crypto investors can position themselves strategically to thrive in the ever-changing world of digital assets.

insert link here: bitcoin anti-money laundering (aml) regulations in Monaco