Regulatory Framework 📝

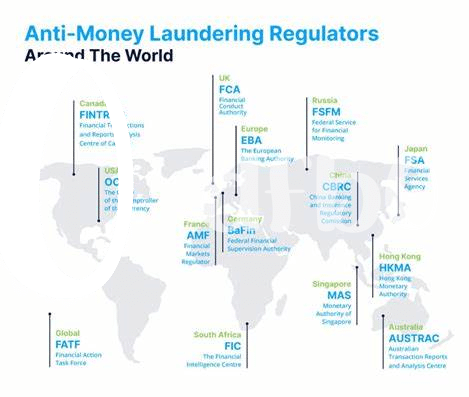

A strong regulatory framework forms the backbone of Zimbabwe’s Bitcoin ecosystem, providing guidelines and standards to ensure compliance and transparency. In this setting, regulations serve as guardrails, steering businesses towards ethical practices while protecting both consumers and the integrity of the market. By outlining clear rules and expectations, the regulatory framework creates a level playing field where innovation can thrive within defined boundaries. This structure not only fosters trust but also sets the stage for sustainable growth and development in the burgeoning cryptocurrency sector.

Risk Assessment 🧐

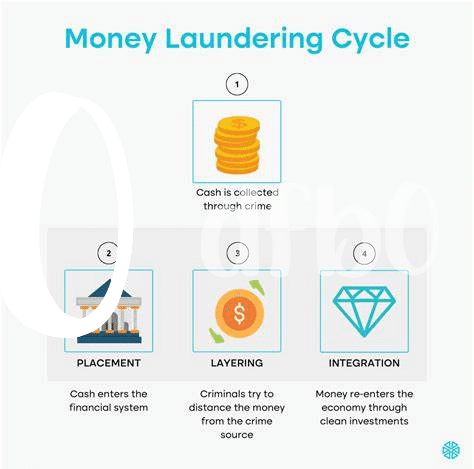

When it comes to Risk Assessment within Zimbabwe’s Bitcoin ecosystem, it is crucial to carefully evaluate and understand the potential risks involved in cryptocurrency transactions. By conducting thorough risk assessments, companies can identify, prioritize, and mitigate risks that may arise from their operations. This proactive approach not only helps in safeguarding against financial losses but also ensures compliance with AML regulations. Analyzing factors such as transaction volumes, customer profiles, and emerging threats enables businesses to implement effective risk management strategies. Ultimately, a comprehensive risk assessment serves as a foundation for establishing robust AML compliance measures tailored to mitigate specific risks within the dynamic landscape of the cryptocurrency industry.

Customer Due Diligence 🤝

Ensuring robust customer due diligence practices is essential within Zimbabwe’s Bitcoin ecosystem. By verifying the identities of individuals engaging in transactions, businesses can mitigate risks related to money laundering and financing of illicit activities. Implementing thorough KYC procedures, including identity verification and source of funds checks, not only enhances compliance but also fosters trust among stakeholders. Building a strong foundation of trust through effective due diligence measures is key to sustaining a secure and compliant cryptocurrency environment in Zimbabwe.

Transaction Monitoring 💸

Transaction monitoring plays a crucial role in AML compliance within Zimbabwe’s Bitcoin ecosystem, ensuring that suspicious activities are detected and reported promptly. By continuously scrutinizing transactions, financial institutions can identify patterns that may indicate money laundering or terrorist financing. Implementing robust monitoring systems not only helps mitigate risks but also fosters trust among stakeholders, ultimately strengthening the integrity of the cryptocurrency market. The careful oversight provided by transaction monitoring mechanisms reinforces regulatory efforts and underscores the commitment to operating within legal frameworks, safeguarding the interests of both businesses and customers. For more insights on AML regulations in different jurisdictions, including cryptocurrency exchange licensing requirements in Afghanistan, you can explore this comprehensive article on AML rules for Bitcoin in Yemen.

Reporting Obligations 📊

Ensuring compliance with reporting obligations is crucial in the Bitcoin ecosystem of Zimbabwe. This involves promptly and accurately documenting and submitting required reports to the relevant authorities. By diligently fulfilling these obligations, companies can contribute to maintaining transparency and accountability within the industry. Keeping detailed records and adhering to reporting deadlines not only demonstrates a commitment to regulatory compliance but also helps in detecting and preventing potential financial crimes.

Failing to meet reporting obligations can result in severe penalties and reputational damage. Therefore, it is essential for businesses operating within Zimbabwe’s Bitcoin ecosystem to prioritize this aspect of AML compliance. By establishing robust reporting processes and mechanisms, companies can enhance trust with regulators and customers alike, fostering a secure and reliable environment for cryptocurrency transactions.

Staff Training and Awareness 🎓

In ensuring robust AML compliance within Zimbabwe’s Bitcoin ecosystem, investing in ongoing staff training and awareness is paramount. By equipping employees with the necessary knowledge and skills to identify and mitigate potential risks, organizations can proactively strengthen their AML defenses. Regular training sessions on the latest regulatory updates, emerging trends in financial crime, and scenario-based simulations can enhance staff preparedness to navigate evolving threats effectively. Fostering a culture of compliance and accountability through training not only safeguards the organization but also bolsters its reputation as a responsible player in the digital asset space. 🎓

bitcoin anti-money laundering (aml) regulations in yemen