Introduction 🌟

The journey of AML regulations for Bitcoin businesses in the UK is a dynamic tale of adaptation and evolving frameworks. From the early stages of regulatory oversight to facing unique challenges in the realm of digital currencies, the landscape has seen significant shifts. As businesses navigated through these hurdles, regulatory bodies responded with changes to keep pace with the rapid innovations in the sector. Amidst this backdrop, compliance strategies have emerged as crucial tools for businesses to adhere to the evolving regulatory landscape effectively. Looking ahead, the future outlook for AML regulations in the UK presents a landscape that will continue to shape the operations of Bitcoin businesses, emphasizing the need for agility and proactive approaches to compliance.

Early Aml Regulations 🕰️

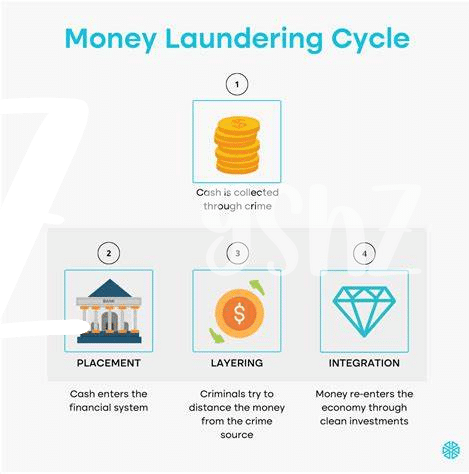

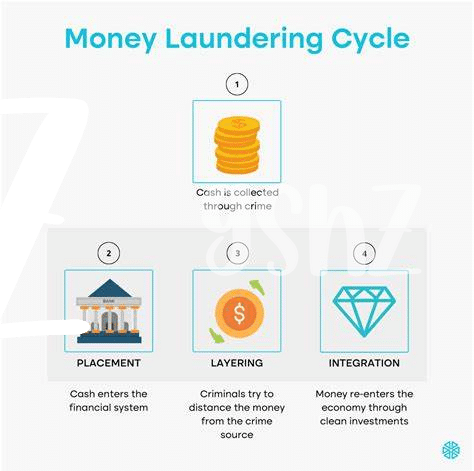

During the early stages of Bitcoin businesses in the UK, navigating Anti-Money Laundering (AML) regulations posed significant challenges. Companies operating in the cryptocurrency space were met with evolving regulatory landscape, where compliance requirements were often unclear and varied. This period marked a crucial time for businesses to establish robust AML frameworks, balancing the need for compliance with the innovative nature of the digital currency sector.

As the demand for cryptocurrencies grew, regulators began to acknowledge the importance of AML measures in mitigating financial risks. This shift led to the development of more defined AML regulations tailored to address the specific needs of Bitcoin businesses. The interplay between technological advancements and regulatory requirements became a focal point, shaping the course of AML compliance within the UK’s cryptocurrency ecosystem.

Bitcoin Business Challenges 💼

Bitcoin businesses face a myriad of challenges in navigating the ever-evolving landscape of regulations. The dynamic nature of the cryptocurrency industry amplifies the complexities surrounding Anti-Money Laundering (AML) compliance. From establishing robust customer due diligence processes to ensuring transparency in transactions, these businesses must constantly adapt to meet regulatory requirements. Furthermore, the anonymity associated with Bitcoin transactions poses additional hurdles in verifying the legitimacy of funds, adding another layer of difficulty for AML compliance.

In addition to regulatory hurdles, Bitcoin businesses also encounter challenges in educating their stakeholders about the importance of AML compliance. As the regulatory environment continues to evolve, staying ahead of the curve and implementing effective compliance measures is crucial for the long-term sustainability and legitimacy of Bitcoin businesses in the UK.

Regulatory Changes 🔄

Regulatory changes play a pivotal role in shaping the landscape for Bitcoin businesses in the UK. As authorities continue to refine their approach towards Anti-Money Laundering (AML) regulations, businesses must adapt to stay compliant and competitive in the evolving market. Keeping abreast of the latest regulatory developments is crucial, as non-compliance can lead to severe consequences, impacting the operations and reputation of Bitcoin enterprises. Understanding the nuances of these changes is essential for businesses to navigate the complex regulatory environment successfully. For further insights into compliance challenges related to Bitcoin AML rules in the UAE, check out this resource on bitcoin anti-money laundering (aml) regulations in tuvalu.

Compliance Strategies 🛡️

Certainly, here is the text for Compliance Strategies 🛡️:

When it comes to navigating the evolving landscape of AML regulations for Bitcoin businesses in the UK, employing robust compliance strategies is paramount. This involves not only staying abreast of the latest regulatory updates but also implementing proactive measures to ensure adherence to the legal requirements. From conducting thorough customer due diligence to enhancing transaction monitoring systems, businesses need to adopt a comprehensive approach to compliance. By integrating technology solutions and fostering a culture of compliance within their operations, Bitcoin businesses can effectively mitigate regulatory risks and demonstrate their commitment to upholding AML standards.

Future Outlook 🔮

The future outlook for Bitcoin businesses in the UK shows a promising landscape with evolving AML regulations. As technology advances and regulators adapt, businesses must stay proactive to meet compliance requirements. Strategies such as regular audits, staff training, and robust internal controls will be crucial for maintaining a secure and trusted operation. Embracing technological solutions for AML compliance, such as advanced monitoring tools, can help businesses stay ahead of regulatory changes. Looking ahead, collaboration between industry players and regulators will be key to shaping a transparent and secure environment for Bitcoin transactions. It’s an exciting time for the industry with opportunities for innovation and growth on the horizon.

Insert bitcoin anti-money laundering (aml) regulations in Ukraine [bitcoin anti-money laundering (aml) regulations in United Arab Emirates]().