Rising Regulatory Scrutiny 🚨

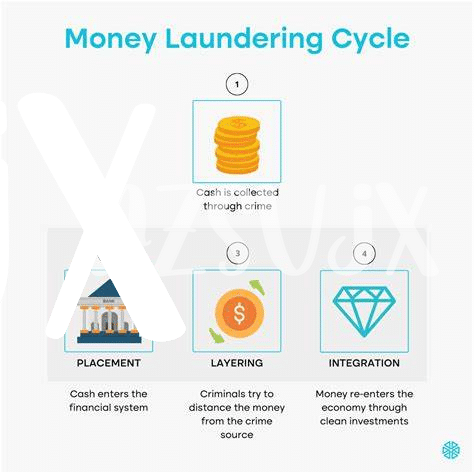

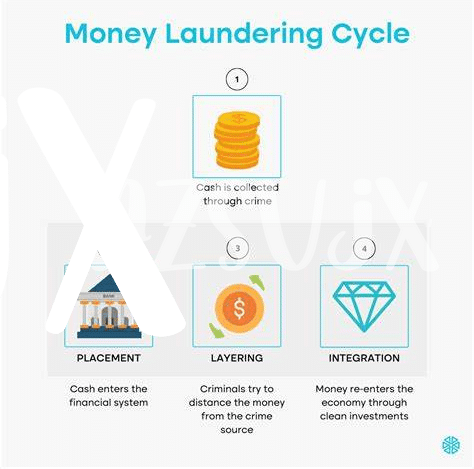

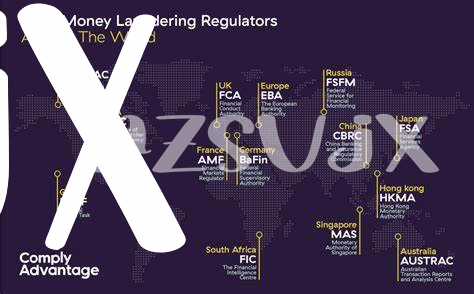

The increasing emphasis on regulatory scrutiny surrounding Bitcoin poses significant challenges and opportunities for the cryptocurrency landscape in the United States. Government bodies are paying closer attention to the use of digital assets, aiming to enhance anti-money laundering (AML) measures and combat illicit activities. This heightened focus signals a shift towards a more regulated environment for virtual currencies, influencing how businesses and individuals engage with Bitcoin. As regulatory requirements evolve, industry players must adapt to these changing landscapes, ensuring compliance while fostering innovation in the burgeoning sector. Navigating this intricate balance between supervision and advancement will be crucial for the future sustainability and growth of Bitcoin within the U.S. market.

Impact on Bitcoin Adoption 📈

The increasing focus on regulatory compliance regarding Bitcoin will have a significant impact on its adoption in the United States. This heightened scrutiny from government bodies will shape how individuals and businesses perceive and engage with cryptocurrencies. As more stringent AML laws come into effect, there may be initial apprehension within the community. However, these regulations are also likely to bring a sense of legitimacy and security to the sector, ultimately fostering greater trust among investors and the public. The evolving landscape of AML compliance laws is expected to influence the trajectory of Bitcoin adoption, steering it towards a more regulated yet potentially more accessible future.

Balancing Innovation and Compliance ⚖️

Balancing the need for innovation while ensuring compliance with regulations is a delicate dance for the cryptocurrency industry. Striking this balance requires forward-thinking strategies that harness the power of technology to streamline compliance processes without stifling innovation. By embracing technology solutions such as blockchain analytics and AI-driven tools, companies can enhance their AML programs while fostering a culture of innovation. Collaboration between industry players, regulators, and law enforcement is also crucial to develop effective AML measures that protect both consumers and the integrity of the financial system. This synergy between innovation and compliance is key to building a sustainable and trusted ecosystem for cryptocurrencies in the US.

Challenges for Cryptocurrency Exchanges 💼

Cryptocurrency exchanges face a myriad of challenges when it comes to navigating the evolving landscape of AML compliance. From keeping pace with changing regulations to implementing robust security measures, these platforms constantly encounter hurdles that require adept solutions. Ensuring effective AML procedures while maintaining user privacy and security is a delicate balancing act that cryptocurrency exchanges must perform with precision and foresight.

Operating in a space characterized by rapid innovation and increased regulatory scrutiny, exchanges are under pressure to fortify their AML frameworks. Moreover, the global nature of cryptocurrency transactions adds another layer of complexity to compliance efforts, demanding heightened vigilance and adaptability. Amidst these challenges, technological advancements and collaborative initiatives provide avenues for exchanges to enhance their compliance mechanisms and foster a more secure trading environment for their users.

bitcoin anti-money laundering (aml) regulations in united kingdom

The Role of Technology Solutions 🤖

Technology solutions play a pivotal role in enhancing AML compliance within the evolving landscape of cryptocurrencies. As digital assets continue to gain traction, the need for robust tools powered by advanced algorithms becomes imperative. These solutions streamline the identification of suspicious transactions, enhance due diligence processes, and enable real-time monitoring to detect potential illicit activities swiftly. Furthermore, the integration of blockchain analytics and AI technologies empowers financial institutions and cryptocurrency exchanges to navigate complex regulatory requirements efficiently and proactively safeguard against money laundering risks.

By leveraging innovative technology solutions, stakeholders can foster trust and transparency in the digital currency ecosystem while upholding regulatory standards. These tools not only bolster compliance efforts but also facilitate seamless transactions, ultimately promoting the responsible growth of the crypto market. Embracing cutting-edge technologies underscores the commitment to combat financial crimes effectively and ensures the sustainable advancement of the industry amidst heightened regulatory scrutiny.

Collaboration for Effective Aml Measures 🤝

Effective anti-money laundering measures in the Bitcoin industry rely on strong collaboration between various stakeholders. This collaborative approach involves not only regulatory bodies and cryptocurrency exchanges but also technology providers and industry experts. By working together, these parties can enhance compliance efforts, share best practices, and develop innovative solutions to combat financial crimes in the digital asset space.

Implementing robust AML measures often necessitates a collective effort that transcends geographical boundaries. While regulatory frameworks may differ from one country to another, the principles of combating money laundering remain universal. Therefore, global cooperation and information sharing play a crucial role in ensuring the integrity of the Bitcoin ecosystem. For example, exploring how Bitcoin anti-money laundering (AML) regulations in Tuvalu align with those in Ukraine can provide insights into regulatory effectiveness and potential areas for harmonization. This collaborative spirit sets the stage for a more secure and compliant environment for Bitcoin transactions worldwide.