Current Aml Regulations 🌍

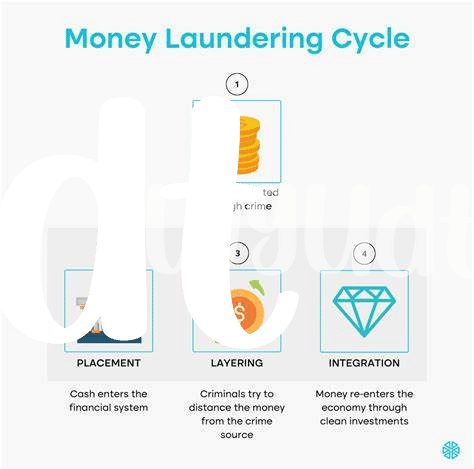

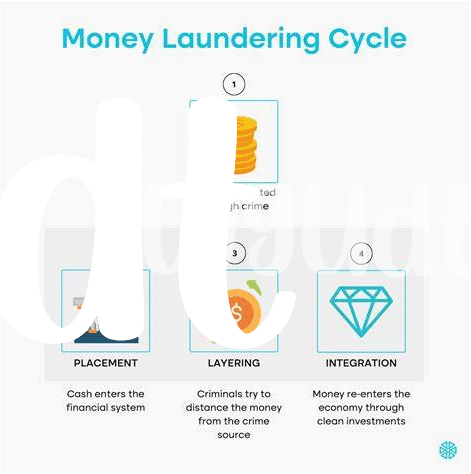

Current AML regulations form a crucial framework to ensure transparency and accountability within the cryptocurrency landscape. These regulations are designed to prevent financial crimes such as money laundering and terrorism financing, safeguarding both the integrity of the financial system and the interests of investors. It is essential for businesses operating in the Bitcoin space to adhere to these regulations, as non-compliance can result in severe penalties and reputational damage. By staying abreast of the current AML regulations, stakeholders can proactively address risks and contribute to a more secure ecosystem for digital assets.

Challenges in Implementing Aml Measures 💡

Implementing Aml measures presents a complex web of obstacles in the evolving landscape of Bitcoin compliance. From the lack of standardized guidelines across jurisdictions to the rapid advancements in technology, companies navigating these challenges must pivot strategically. Cooperation between industry stakeholders and regulators is pivotal to developing efficient solutions and fostering a robust compliance environment that can withstand the tides of change. In this dynamic arena, proactive adaptation and collaboration will be key to overcoming the hurdles ahead.

Emerging Technologies in Aml Compliance 🚀

The integration of advanced technologies like blockchain analytics and artificial intelligence is revolutionizing AML compliance in the cryptocurrency space. These tools empower regulatory bodies and businesses to efficiently monitor and track transactions, detect suspicious activities, and ensure compliance with established guidelines. By leveraging these emerging technologies, the future of Bitcoin AML compliance in Thailand is poised to be more robust and effective, creating a safer environment for all stakeholders involved in the digital currency ecosystem.

Impact of Global Trends on Thai Compliance 📈

Global trends play a crucial role in shaping the landscape of AML compliance in Thailand. As the world becomes increasingly interconnected, the impact of international developments on local regulations cannot be underestimated. From evolving technologies to changing regulatory frameworks, the global context sets the stage for how Thai compliance measures must adapt and evolve. Keeping a pulse on these trends is essential for ensuring that Thai AML regulations remain effective and aligned with international best practices.

For a deeper dive into the intricacies of AML laws within the realm of Bitcoin, particularly in the African context, explore the challenges faced by Tanzania in this insightful article on bitcoin anti-money laundering (AML) regulations in Tanzania. This resource provides valuable insights into the complexities and nuances of AML compliance within the cryptocurrency sphere, shedding light on the broader implications for international efforts in combating financial crimes.

Future Strategies for Bitcoin Aml Monitoring 🔄

Future strategies for Bitcoin AML monitoring require a proactive approach that leverages technology for real-time tracking and analysis of transactions. Implementing robust algorithms and AI tools can enhance the efficiency and accuracy of monitoring efforts, enabling quicker detection of suspicious activities. Additionally, continuous evaluation and adjustment of monitoring protocols based on emerging threats and regulatory updates are essential to stay ahead in the evolving landscape of AML compliance.

To maintain effective AML monitoring for Bitcoin transactions, collaboration among industry stakeholders and regulators is crucial. By sharing insights and best practices, a unified approach can be established to address compliance challenges effectively. This partnership can foster innovation and the development of advanced monitoring solutions that meet the specific needs of the cryptocurrency ecosystem.

Collaboration between Regulators and Industry Players 🔗

Collaboration between regulators and industry players is crucial for effectively managing Bitcoin AML compliance in Thailand. By working together, regulators can gain valuable insights from industry experts, ensuring that regulations are practical and align with technological advancements. Industry players, on the other hand, benefit from clear guidelines and a collaborative approach that fosters innovation while maintaining compliance. This partnership creates a symbiotic relationship where both parties contribute to the development of robust AML frameworks that protect the integrity of the financial system. Through ongoing communication and cooperation, regulators and industry players can address emerging challenges and adapt quickly to changes in the regulatory landscape, ultimately promoting a safe and secure environment for Bitcoin transactions in Thailand.

Insert a link to bitcoin anti-money laundering (aml) regulations in turkey with anchor bitcoin anti-money laundering (aml) regulations in togo using the