Understanding Bitcoin Aml Regulations in Ukraine 🇺🇦

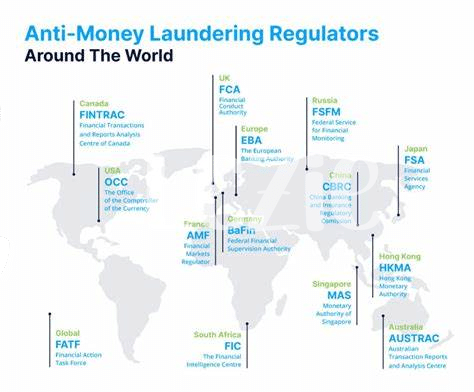

Ukraine has established clear regulations regarding Bitcoin AML compliance, aiming to ensure transparency and security within the cryptocurrency sector. These regulations outline the responsibilities and obligations that businesses and individuals must adhere to when engaging in Bitcoin transactions in the country. By understanding these AML regulations, stakeholders can navigate the evolving landscape of virtual assets and contribute to a safer financial environment for all parties involved.

As the cryptocurrency market continues to expand, staying informed about Bitcoin AML regulations in Ukraine is crucial for businesses seeking to operate within the legal framework. Compliance with these regulations not only fosters trust among stakeholders but also mitigates the risks associated with money laundering and terrorist financing. By actively engaging with the regulatory requirements set forth by Ukrainian authorities, companies can demonstrate their commitment to maintaining integrity and accountability in their Bitcoin-related activities.

The Importance of Compliance for Businesses 💼

Businesses operating in the realm of Bitcoin must prioritize compliance with Anti-Money Laundering regulations to safeguard their operations and reputation. Ensuring adherence to AML requirements not only mitigates legal risks but also fosters trust among customers and partners. By embracing compliance measures, businesses signal their commitment to integrity and accountability, setting a foundation for sustainable growth and credibility in the dynamic landscape of Bitcoin transactions. Failure to comply with AML regulations can lead to severe consequences, including hefty fines and potential damage to the brand’s standing in the market. Embracing a culture of compliance establishes a competitive advantage, demonstrating a commitment to ethical practices that resonate with stakeholders and enhance the overall trust in the business ecosystem.

Key Challenges Faced in Bitcoin Aml Compliance 🤔

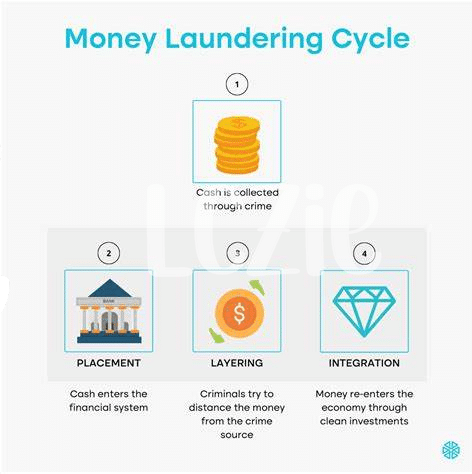

Navigating Bitcoin AML compliance in Ukraine presents several intricate challenges for businesses in the cryptocurrency space. One key obstacle is the constantly evolving regulatory landscape, where laws and guidelines are subject to frequent updates, requiring diligent monitoring and adaptation. Additionally, the pseudonymous nature of Bitcoin transactions can complicate efforts to trace and verify individuals involved, raising concerns about the potential for illicit financial activities to occur under the radar. Moreover, the decentralized structure of cryptocurrencies poses unique hurdles in implementing robust AML measures, as traditional methods may not always be directly applicable to this innovative digital asset. Overcoming these challenges demands a proactive approach, encompassing thorough risk assessments, ongoing training, and collaboration with regulatory authorities to stay ahead in the dynamic realm of Bitcoin AML compliance.

Best Practices for Maintaining Compliance 🌐

When it comes to maintaining compliance with Bitcoin AML regulations in Ukraine, it is crucial for businesses to adopt best practices. This includes conducting thorough customer due diligence, implementing robust transaction monitoring systems, and continuously updating policies and procedures to align with regulatory requirements. By staying informed about the latest developments in AML compliance and investing in training for employees, businesses can effectively mitigate the risks associated with money laundering and terrorist financing activities. For more insights on this topic, check out the article on bitcoin anti-money laundering (AML) regulations in the United Arab Emirates.

Implementing Effective Aml Strategies for Bitcoin 💡

Implementing effective Anti-Money Laundering (AML) strategies for Bitcoin involves utilizing robust transaction monitoring tools, conducting thorough customer due diligence, and staying informed about regulatory updates. By integrating blockchain analytics to trace transactions, businesses can enhance their AML efforts and detect suspicious activities. Employee training programs on AML procedures and regular audits are vital components of a proactive compliance approach. Leveraging technology solutions that enhance transparency and data security can help streamline the compliance process and mitigate risks associated with illicit financial activities. Collaborating with industry peers and regulatory bodies to share best practices and insights can further strengthen AML frameworks within the Bitcoin ecosystem.

Future Outlook and Trends in Bitcoin Aml Compliance 🚀

The evolution of Bitcoin AML compliance is poised for dynamic shifts in response to emerging technologies and regulatory developments. As blockchain continues to weave its way into various sectors, the landscape of AML compliance in the realm of digital assets is becoming increasingly complex. Innovations such as AI-driven monitoring tools and decentralized finance are reshaping how compliance measures are implemented and enforced. Adaptation to these trends will be crucial for businesses navigating the evolving AML regulatory environment. Stay tuned for further advancements in compliance methodologies and the swift response to emerging risks in the realm of Bitcoin AML.

Bitcoin anti-money laundering (AML) regulations in Uganda with anchor “Bitcoin anti-money laundering (AML) regulations in Timor-Leste.”