Overview of Aml Laws in the Cryptocurrency Space 🌐

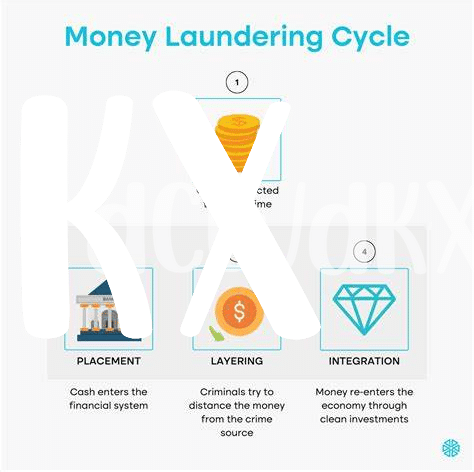

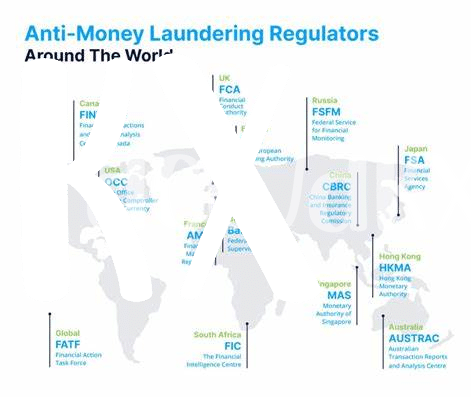

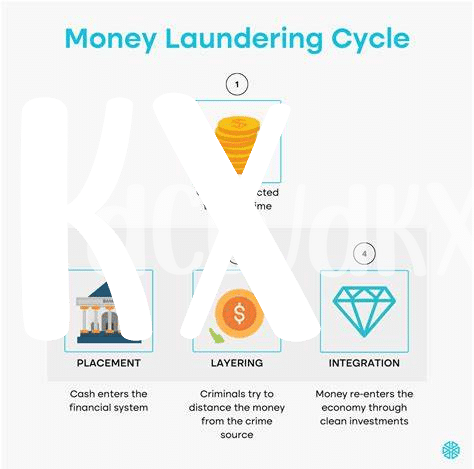

Cryptocurrencies have brought about new challenges in the realm of Anti-Money Laundering (AML) laws, requiring regulators to navigate the unique landscape of digital assets. With the decentralized and pseudonymous nature of cryptocurrencies, AML laws aim to address potential risks such as illicit activities and terrorist financing. This has led to the development of specific regulations tailored to the cryptocurrency space, ensuring that entities involved in digital asset transactions adhere to AML requirements to combat financial crime effectively. As the crypto market continues to evolve, staying informed about the intricacies of AML laws in this dynamic space is crucial for investors and stakeholders alike.

Impact of Aml Regulations on Bitcoin Investors 💰

– The regulatory landscape surrounding AML laws and Bitcoin investments has undoubtedly reshaped the way investors navigate the cryptocurrency space. With stringent regulations in place, investors are compelled to adopt robust compliance measures to combat money laundering risks effectively. These regulations not only demand transparency in transactions but also mandate thorough due diligence processes. As a result, Bitcoin investors are now faced with a heightened level of scrutiny and accountability. Compliance with AML regulations is not just a legal obligation but also a strategic imperative for investors looking to safeguard their investments and uphold the integrity of the digital asset ecosystem. By understanding and adhering to these regulations, investors can contribute to a more secure and reputable environment for cryptocurrency transactions.🔒

Compliance Strategies for Avoiding Aml Violations 🔒

One of the key aspects in navigating the complex landscape of AML laws for Bitcoin investors is the implementation of robust compliance strategies. By adhering to stringent protocols and establishing clear procedures, investors can safeguard themselves against potential AML violations. These strategies may include thorough due diligence processes, ongoing monitoring of transactions, and proactive reporting of suspicious activities. Building a culture of compliance within the organization, coupled with regular training and audits, can further strengthen the defense against AML risks and ensure a more secure investment journey in the cryptocurrency space.

Embracing compliance strategies not only demonstrates a commitment to ethical practices but also serves as a shield against regulatory scrutiny. By integrating AML compliance measures into their operations, Bitcoin investors can stay ahead of evolving regulations and potential threats. As the digital asset landscape continues to evolve, adopting a proactive approach towards AML compliance will be imperative for maintaining trust, integrity, and sustainability in the world of cryptocurrency investments.

Case Studies: Aml Enforcement Actions in Bitcoin 📉

Case Studies: Aml Enforcement Actions in Bitcoin 📉

In recent years, several high-profile cases have shed light on the importance of Anti-Money Laundering (AML) enforcement in the Bitcoin space. One notable example is the case of a prominent exchange facing hefty fines for failing to implement robust AML measures, resulting in legal repercussions and a tarnished reputation. These instances emphasize the crucial role of compliance in safeguarding both investors and the integrity of the cryptocurrency market. By learning from such cases, investors can better understand the significance of AML regulations and strive to uphold best practices. Stay informed on bitcoin anti-money laundering (AML) regulations in Timor-Leste to navigate the evolving landscape effectively.

Understanding the Role of Kyc in Aml Compliance 🛡️

Know Your Customer (KYC) procedures play a pivotal role in Anti-Money Laundering (AML) compliance by verifying the identity of individuals engaging in cryptocurrency transactions. KYC helps in safeguarding against illicit activities by ensuring transparency and accountability in financial dealings. By collecting and verifying customer information, including identity and transaction details, companies can enhance their AML efforts and minimize risks associated with money laundering and terrorist financing. KYC acts as a foundational element in the broader AML framework, promoting a safer and more secure environment for Bitcoin investors.

Future Trends in Aml Regulations for Bitcoin Investments 🚀

In the ever-evolving landscape of cryptocurrency, the future trends in AML regulations for Bitcoin investments point towards a continued emphasis on transparency and accountability. As governments and regulatory bodies strengthen their oversight, investors can expect to see more stringent compliance requirements and increased enforcement measures. Collaboration between industry stakeholders and authorities will play a crucial role in shaping these regulatory developments, with a focus on balancing innovation and security in the digital asset space. Stay informed and adapt to the changing regulatory environment to navigate the future of AML regulations for Bitcoin investments effectively.

For more information on Bitcoin anti-money laundering (AML) regulations in Turkmenistan, please visit bitcoin anti-money laundering (AML) regulations in Tonga.