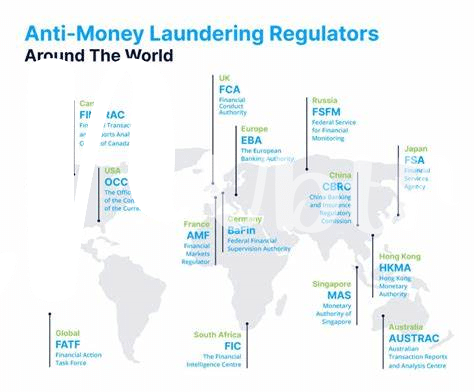

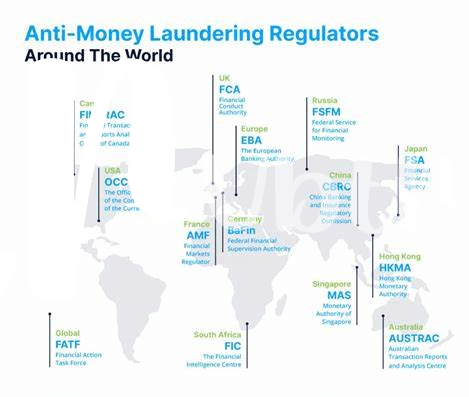

Understanding Aml Regulations 🌐

When it comes to navigating the complex world of AML regulations, having a solid understanding is key. It’s like having a roadmap that guides you through the twists and turns of compliance requirements. Depending on the jurisdiction and industry, these regulations can vary in specifics, making it crucial to stay informed and up-to-date. By grasping the fundamentals of AML regulations, investors in Tonga can make informed decisions and ensure their activities align with legal standards. It’s not just about following rules; it’s about safeguarding investments, protecting against illicit activities, and contributing to a secure financial ecosystem.

Importance of Compliance 👍

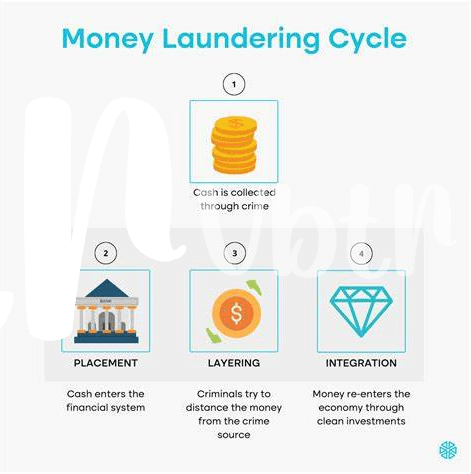

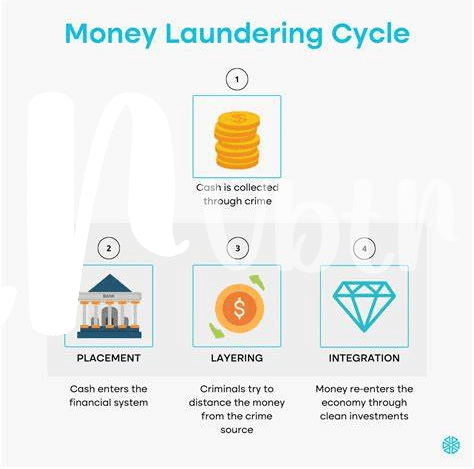

In the world of Bitcoin investing, understanding and adhering to Anti-Money Laundering (AML) regulations holds significant weight. Compliance brings a sense of trust and security not only to investors but also to the broader financial ecosystem. By following AML guidelines diligently, investors demonstrate their commitment to ethical practices and help combat financial crimes. This proactive approach not only safeguards their own investments but also contributes to the long-term sustainability of the digital currency market. Compliance is not just a regulatory requirement; it is a cornerstone for a thriving and trustworthy Bitcoin investment landscape.

Risks of Non-compliance 💰

Non-compliance with AML regulations in Tonga can pose significant financial risks to Bitcoin investors. Failure to adhere to the necessary guidelines may result in hefty fines, legal repercussions, and reputational damage. Additionally, non-compliance could lead to the freezing of assets, loss of business opportunities, and even criminal investigations. It is crucial for investors to understand and follow the established regulations to safeguard their investments and maintain trust within the cryptocurrency community.

Due Diligence Practices 🕵️♂️

In the realm of Bitcoin investments in Tonga, implementing due diligence practices is essential for safeguarding your assets and ensuring compliance with regulations. By conducting thorough research and verifying the identities of individuals involved in transactions, investors can mitigate the risks of fraud and money laundering. Due diligence also involves staying updated on the latest regulatory requirements and industry trends to make informed decisions. Proactive measures such as background checks and transaction monitoring help in maintaining transparency and credibility within the cryptocurrency space. Embracing a culture of diligence not only protects investors but also contributes to the overall integrity of the digital currency market. To delve deeper into due diligence practices and their significance, visit bitcoin anti-money laundering (aml) regulations in Tunisia.

Reporting Suspicious Activity 🚨

To maintain a secure environment within the Bitcoin community in Tonga, it is vital for investors to be knowledgeable about the procedures involved in reporting suspicious activities. Recognizing red flags and understanding how to properly document and escalate such incidents is key to safeguarding against financial crimes and illicit behavior. By promptly reporting any questionable transactions or behaviors to the appropriate authorities, investors contribute to upholding the integrity of the cryptocurrency market and protecting themselves and others from potential risks. Awareness and diligence in reporting suspicious activity serve as essential pillars in fostering a compliant and thriving Bitcoin ecosystem in Tonga.

Staying Ahead with Ongoing Education 📚

Investing in Bitcoin requires a commitment to ongoing education to navigate the evolving landscape of compliance and regulations. By staying informed about the latest AML guidelines and industry best practices, investors can proactively adapt their strategies to meet regulatory requirements. Continuous learning not only ensures compliance but also helps investors stay ahead of potential risks and make informed decisions in the dynamic cryptocurrency market.

One valuable resource for Bitcoin investors is the set of Bitcoin Anti-Money Laundering (AML) regulations in Thailand. Understanding and adhering to these regulations is crucial for maintaining compliance and safeguarding against illicit activities. Regularly educating oneself on such regulations can enhance due diligence practices and contribute to building a trustworthy and sustainable investment approach.