Introduction to Aml Laws in Togo 🌍

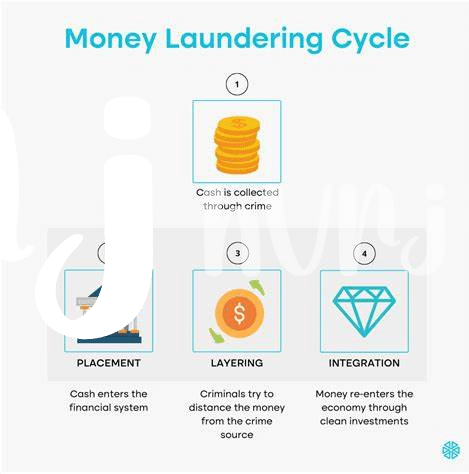

Anti-money laundering (AML) laws in Togo aim to combat illicit financial activities and promote transparency within the country’s financial system. These regulations require financial institutions and other relevant entities to implement measures that help identify and prevent money laundering and terrorism financing. By adhering to AML laws, Togo aims to safeguard its financial integrity and strengthen its position in the global fight against financial crimes. Understanding these laws is crucial for businesses operating in Togo, as compliance is essential to avoid legal repercussions and maintain trust with customers and partners. Additionally, staying informed about AML requirements can help businesses contribute to a more secure and stable financial environment in Togo.

In the context of a rapidly evolving digital landscape, the intersection of AML laws and Bitcoin presents unique challenges and opportunities for stakeholders in Togo. As virtual currencies continue to gain popularity globally, Togo must adapt its regulatory framework to address the specific risks posed by cryptocurrencies like Bitcoin. Ensuring compliance with AML laws while embracing the innovation of digital assets is a delicate balance that requires collaboration between businesses, regulators, and law enforcement. By navigating the complexities of AML laws and embracing technological advancements responsibly, Togo can position itself as a progressive player in the digital economy while maintaining a robust framework for financial integrity and security.

Impact of Bitcoin on Compliance 🌐

The rise of Bitcoin has brought about significant changes in the realm of compliance. Its decentralized nature and borderless transactions have challenged traditional regulatory frameworks, prompting authorities to reassess their approaches to anti-money laundering (AML) laws. As more businesses and individuals turn to Bitcoin for its convenience and global accessibility, the need for effective compliance measures becomes increasingly urgent. The impact of Bitcoin on compliance extends beyond national borders, requiring a collaborative effort among regulators, businesses, and users to ensure the integrity of financial systems. In navigating these new dynamics, proactive strategies and innovative solutions are essential to staying ahead of evolving AML challenges in the digital age.

Challenges Faced by Businesses 💼

Businesses operating in the cryptocurrency space in Togo encounter various hurdles when it comes to compliance with AML laws. From the complexity of verifying the source of funds to the constantly evolving regulations, staying compliant can be a daunting task. Additionally, the decentralized nature of Bitcoin adds another layer of challenge for businesses, as traditional regulatory frameworks may not directly apply. These obstacles require a proactive and adaptive approach to compliance to ensure the smooth operation of businesses in the country.

Government Regulations and Enforcement 🏛️

Government regulations and enforcement play a crucial role in shaping the compliance landscape for businesses operating in the Bitcoin space. In Togo, authorities are increasingly focusing on implementing and enforcing AML laws to address potential risks associated with digital currencies. By ensuring that businesses adhere to these regulations, the government aims to enhance transparency and mitigate illicit activities within the cryptocurrency sector.

Stay updated on the latest developments regarding bitcoin anti-money laundering (AML) regulations in Trinidad and Tobago by visiting [Wikicrypto](https://wikicrypto.news/challenges-and-opportunities-in-aml-compliance-for-bitcoin-in-tajikistan). Understanding the regulatory environment in different countries can provide valuable insights for navigating compliance challenges effectively.

Strategies for Navigating Compliance 🧭

Navigating compliance with AML laws for Bitcoin in Togo requires a proactive approach that integrates robust risk assessment procedures with ongoing monitoring mechanisms. Businesses must prioritize implementing comprehensive KYC (Know Your Customer) processes to verify the identity of users engaging in Bitcoin transactions. Additionally, fostering strong partnerships with reputable compliance providers can offer valuable insights and support in aligning operations with evolving regulatory frameworks. Emphasizing continuous training for staff on compliance best practices can further enhance organizational readiness to adapt to changing AML requirements effectively.

Future Trends in Aml for Bitcoin 💡

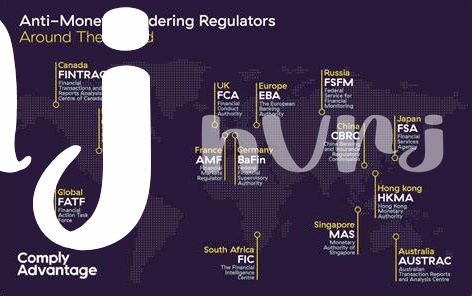

The landscape of Aml regulations for Bitcoin is constantly evolving, with emerging trends shaping the future of compliance. As the digital currency space continues to expand, there is a growing emphasis on implementing innovative technologies to enhance Aml measures, such as blockchain analytics and machine learning algorithms. Moreover, international collaborations and partnerships are crucial for establishing uniform standards across borders, ensuring a more robust Aml framework for the cryptocurrency sector. Stay updated on the latest developments to navigate these changing trends effectively.

Don’t hesitate to explore more on bitcoin anti-money laundering (aml) regulations in Taiwan and its impact by visiting bitcoin anti-money laundering (aml) regulations in Tajikistan for a comprehensive understanding of global regulatory approaches in the cryptocurrency realm.