Regulatory Landscape 🌍

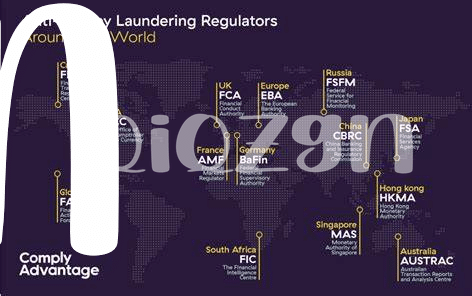

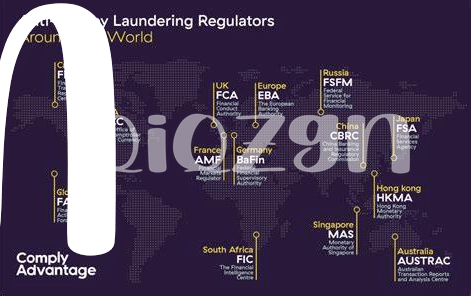

In Tajikistan, navigating the evolving regulatory landscape surrounding Bitcoin poses both challenges and opportunities for compliance. The country’s stance on digital currencies influences the strategies and practices required for businesses operating in this space. Understanding and adapting to the regulatory requirements are essential for maintaining compliance and fostering trust within the industry. Government oversight and regulatory updates play a crucial role in shaping the environment for Bitcoin operations, highlighting the need for proactive engagement and awareness within the sector. Balancing compliance with innovation is key to fostering a sustainable and thriving Bitcoin ecosystem in Tajikistan.

Compliance Challenges 💼

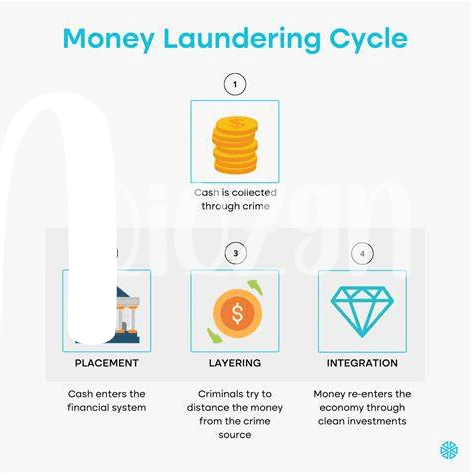

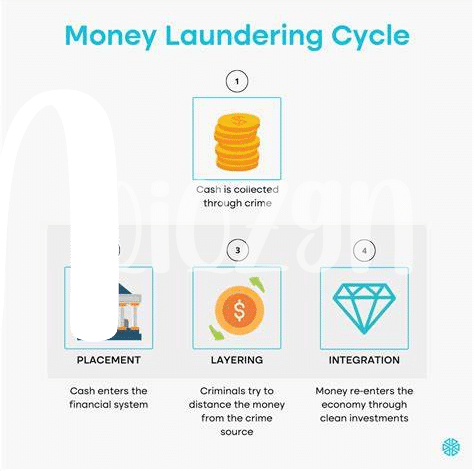

Navigating the complex realm of Anti-Money Laundering (AML) compliance in the realm of Bitcoin transactions presents a myriad of challenges. The decentralized nature of cryptocurrencies coupled with evolving regulatory frameworks poses significant obstacles for businesses operating in the digital asset space. Ensuring robust Know Your Customer (KYC) procedures while balancing user privacy remains a delicate balancing act, oftentimes requiring sophisticated technological solutions to stay ahead of illicit actors. Moreover, the global nature of cryptocurrencies necessitates a deep understanding of international AML regulations and the ability to adapt swiftly to changing requirements to mitigate compliance risks effectively.

In addition to regulatory hurdles, the lack of standardized practices across jurisdictions and the inherent pseudonymous nature of blockchain transactions create further complexities for AML compliance efforts. Educating stakeholders, including industry participants, policymakers, and users, on the importance of AML compliance in the context of Bitcoin transactions is crucial for fostering a culture of transparency and accountability within the ecosystem. Collaboration between industry players, regulators, and law enforcement agencies is essential to address the dynamic challenges posed by financial crime and ensure the sustainable growth and innovation of the digital asset industry.

Technological Solutions 🖥️

Technology plays a crucial role in addressing compliance challenges within the Bitcoin industry in Tajikistan. With the rapid evolution of digital solutions, firms can leverage advanced software tools and blockchain technology to enhance their AML processes. Implementing robust transaction monitoring systems and utilizing AI algorithms can enable real-time detection of suspicious activities, thereby strengthening regulatory compliance efforts. Furthermore, the adoption of secure encryption methods and decentralized platforms can contribute to improving transparency and traceability in financial transactions, creating a more secure environment for Bitcoin operations.

Educating Stakeholders 📚

When it comes to the world of Bitcoin in Tajikistan, educating stakeholders about anti-money laundering (AML) compliance is crucial for fostering a safe and transparent environment. By providing comprehensive information and training sessions, stakeholders can better understand their roles and responsibilities in upholding regulatory standards. This not only ensures compliance but also promotes a culture of accountability and integrity within the industry. Collaborating with experts and utilizing educational resources can further enhance stakeholders’ knowledge and contribute to a more robust AML framework. For more insights into navigating the complexities of AML compliance for Bitcoin, check out this informative article on bitcoin anti-money laundering (AML) regulations in Switzerland.

Industry Collaboration 🤝

Industry collaboration plays a vital role in advancing AML compliance efforts within the Bitcoin sector in Tajikistan. By fostering partnerships among industry players, sharing best practices, and collectively tackling challenges, the overall compliance landscape can be strengthened. Collaborative initiatives enable the exchange of insights and solutions, ultimately enhancing the effectiveness of compliance measures and promoting a more secure environment for Bitcoin transactions. Through partnership and cooperation, the industry can work towards building a more resilient and compliant ecosystem.

Growth and Innovation 📈

The rapid evolution and adoption of Bitcoin in Tajikistan pave the way for unprecedented growth and innovation within the financial sector. As the regulatory landscape continues to adapt to the emergence of digital currencies, opportunities arise for innovative approaches to Anti-Money Laundering (AML) compliance within the Bitcoin industry. Entrepreneurs and stakeholders in Tajikistan explore new avenues to foster growth and enhance financial inclusion through technological advancements and strategic collaborations.

To learn more about Bitcoin AML regulations in Syria, visit the link: Bitcoin AML regulations in Sweden