Understanding Bitcoin Aml Regulations 🌐

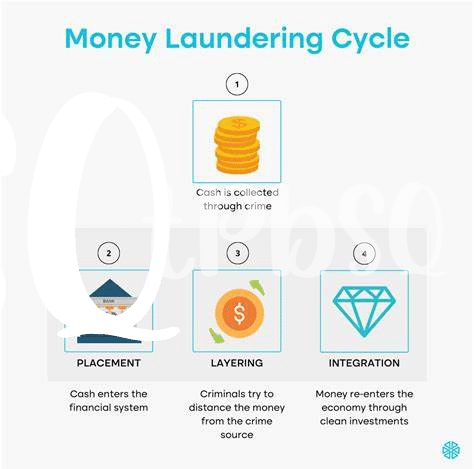

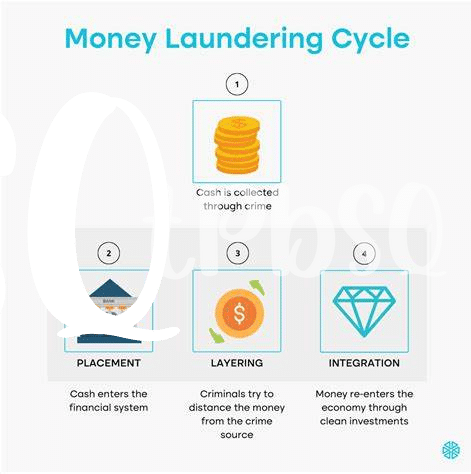

Bitcoin AML regulations serve as a crucial framework that governs the use of digital assets, ensuring transparency and security in transactions. By understanding these regulations, individuals can navigate the complexities of compliance, safeguarding against financial crimes like money laundering and terrorism financing. With proper knowledge of Bitcoin AML regulations, users can confidently engage in cryptocurrency transactions, contributing to a safer and more trustworthy financial ecosystem.

Challenges Faced by Sudanese Bitcoin Users 💼

Bitcoin users in Sudan face a unique set of challenges when it comes to navigating the world of digital currency. Limited access to traditional banking services and fluctuating economic conditions make it difficult for individuals to securely and effectively engage with Bitcoin transactions. Additionally, the lack of clear regulatory guidelines in Sudan poses a significant hurdle for users looking to comply with anti-money laundering (AML) requirements. These factors create barriers to entry and growth within the Bitcoin ecosystem, hindering the potential benefits of decentralized finance for Sudanese individuals. Finding innovative solutions tailored to the specific needs of this market is crucial in overcoming these obstacles and empowering users to participate in the global digital economy.

Impact of Aml Compliance on Financial Inclusion 💰

Aml compliance measures play a pivotal role in enhancing financial inclusion by fostering a secure environment for Bitcoin transactions. Such regulations help build trust among users, especially those in Sudan, ensuring that their investments are protected from illicit activities. By promoting transparency and accountability, AML compliance not only safeguards the integrity of the financial system but also encourages more individuals to participate in the digital economy. Ultimately, by adhering to these standards, Sudan can pave the way for greater financial inclusion and economic empowerment.

Innovative Solutions for Aml Compliance 🚀

Innovative solutions play a crucial role in streamlining AML compliance for Bitcoin in Sudan. Technologies like blockchain analytics tools are revolutionizing the monitoring of transactions for suspicious activities, while ensuring user privacy. Collaborative efforts between regulators, financial institutions, and cryptocurrency businesses are promoting a shared responsibility in combating financial crimes. Implementing robust Know Your Customer (KYC) procedures and transaction monitoring mechanisms are key steps towards enhancing AML compliance in the digital currency space.

Furthermore, leveraging artificial intelligence and machine learning algorithms can enhance the efficiency and accuracy of AML compliance processes, reducing false positives and enhancing detection capabilities. Utilizing these innovative tools can pave the way for a more secure and transparent Bitcoin ecosystem in Sudan, bolstering confidence among users and stakeholders alike. This proactive approach is essential in addressing the evolving challenges posed by illicit activities in the crypto space, fostering a safer environment for digital transactions.

Building Trust and Transparency in Bitcoin Transactions 🔒

Building trust and transparency in Bitcoin transactions is crucial for ensuring a secure and reliable environment for users. By implementing robust verification processes and transaction monitoring systems, stakeholders can enhance the integrity of Bitcoin transactions, fostering trust among participants. Additionally, promoting transparency through public blockchain records can help create a level playing field and deter illicit activities. Embracing these practices can not only strengthen accountability but also contribute to the sustainability of the Bitcoin ecosystem.

Future of Bitcoin Aml Compliance in Sudan 🔮

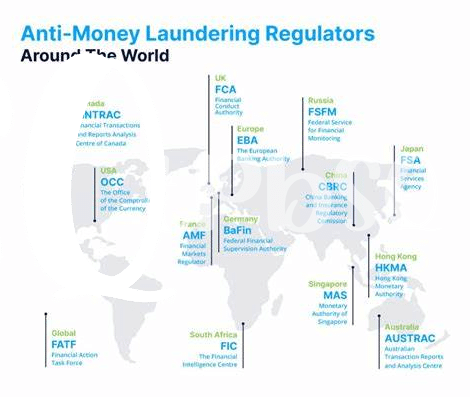

The future of Bitcoin AML compliance in Sudan entails a transformative shift towards more sophisticated technological solutions that streamline regulatory processes while enhancing transparency in financial transactions. As the landscape of digital currencies evolves, regulatory authorities in Sudan are expected to adopt innovative measures to combat money laundering and illicit activities effectively. This will involve closer collaboration between government institutions, financial entities, and blockchain technology developers to ensure robust compliance mechanisms are in place. The regulatory framework is likely to adapt to the changing dynamics of the cryptocurrency market, incorporating advanced monitoring tools and data analytics to uphold the integrity of financial systems with the adoption of best practices identified in bitcoin anti-money laundering (AML) regulations in Somalia.