Current Aml Regulations 🌍

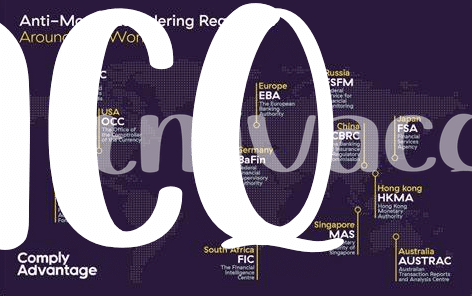

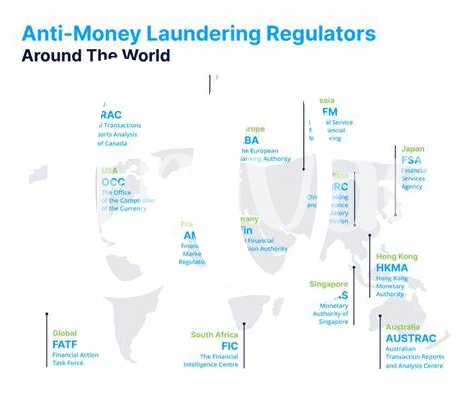

Bitcoin and the financial industry are rapidly evolving, prompting regulators worldwide to adapt. In Serbia, the landscape of Anti-Money Laundering (AML) regulations is continuously evolving to address the unique challenges posed by cryptocurrencies. Regulators are actively monitoring the use of Bitcoin and other virtual assets to ensure compliance with AML laws. The current AML regulations in Serbia not only aim to prevent illicit activities but also strive to foster a safe and transparent environment for digital currency transactions. As the digital economy expands, staying abreast of these regulations is crucial for businesses and individuals engaging in Bitcoin transactions. The regulatory framework plays a vital role in shaping the future of AML compliance for Bitcoin in Serbia.

Bitcoin Adoption Trends in Serbia 👀

Bitcoin adoption in Serbia is gaining momentum as more individuals and businesses are showing interest in utilizing this digital currency for various transactions. With a growing community of users, the demand for Bitcoin is on the rise, reflecting a shifting trend towards digital assets in the country. This surge in adoption is not only driven by the potential for financial gains but also by the convenience and security that Bitcoin offers in an increasingly digital world.

The evolving landscape of Bitcoin adoption in Serbia is reshaping the way people perceive and use traditional currencies, paving the way for innovative payment solutions and investment opportunities. As the awareness and acceptance of Bitcoin continue to expand in Serbia, it is evident that the cryptocurrency’s presence will continue to grow, influencing the financial ecosystem and encouraging further exploration of digital assets in the region.

Challenges Faced by Aml Compliance 🤔

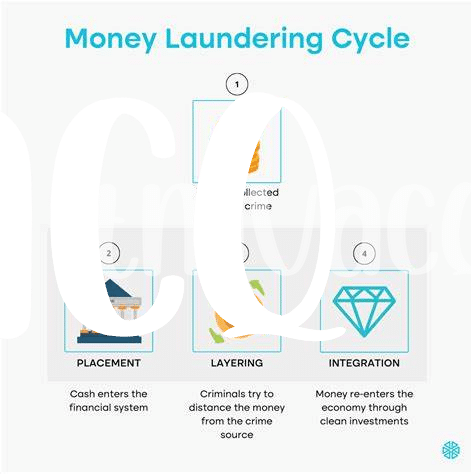

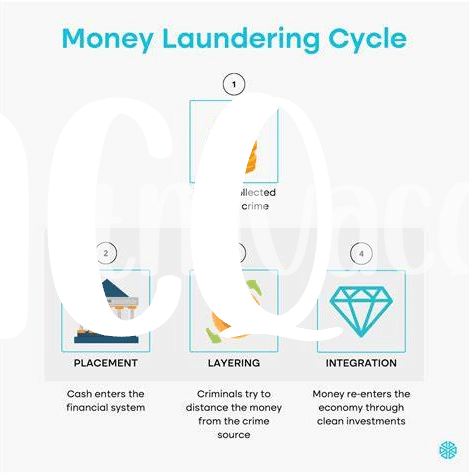

Navigating the landscape of AML compliance poses various challenges, requiring vigilance and adaptability in the face of evolving threats. The ever-changing nature of money laundering tactics and the anonymity associated with cryptocurrencies present hurdles for compliance efforts. Ensuring the proper identification of individuals and monitoring transactions to detect suspicious activities is a complex task. Additionally, the global nature of virtual currencies adds another layer of complexity, as regulatory frameworks differ across jurisdictions. Striking a balance between regulatory requirements and technological advancements is crucial to effectively combat money laundering while fostering innovation in the cryptocurrency space.

Technology Solutions for Enhanced Compliance 🔒

When it comes to enhancing compliance in the field of anti-money laundering (aml) for Bitcoin transactions, technology solutions play a pivotal role. Utilizing advanced tools such as blockchain analysis software and artificial intelligence algorithms can significantly bolster the capabilities of regulatory bodies to monitor and track suspicious activities effectively. These innovative technologies not only streamline the compliance processes but also enable swift identification of potential risks in real-time, ultimately strengthening the overall framework for combating illicit financial activities. By embracing such cutting-edge solutions, the AML landscape in the realm of cryptocurrency can be fortified, paving the way for a more secure and transparent ecosystem.bitcoin anti-money laundering (aml) regulations in senegal

Regulatory Outlook for the Future 📈

As the landscape of AML regulations continues to evolve globally, it is crucial for Serbia to stay abreast of these changes to ensure the effective compliance of Bitcoin transactions. Implementing a forward-thinking regulatory framework that addresses the unique challenges posed by cryptocurrencies will be paramount. This proactive approach will not only enhance the country’s financial system’s integrity but also foster a conducive environment for the growth of the digital asset market in Serbia.

Looking ahead, regulatory bodies in Serbia are poised to play a pivotal role in shaping the future of AML compliance for Bitcoin. By adopting a flexible and technology-driven approach, regulators can effectively mitigate risks associated with money laundering and enhance transparency in the cryptocurrency sector. Collaborative efforts between the government, industry stakeholders, and technology innovators will be essential in developing sustainable solutions that strike a balance between regulatory compliance and fostering innovation in the digital currency space.

Opportunities for Collaboration and Innovation 🚀

Innovative collaborations and forward-thinking initiatives in the realm of Bitcoin AML compliance hold immense potential for propelling regulatory efficiencies and safeguarding against illicit activities. By fostering partnerships between regulatory bodies, industry experts, and technology innovators, the landscape of AML compliance can witness transformative advancements. The fusion of expertise from distinct sectors can pave the way for novel solutions that cater to the evolving complexities of the digital financial ecosystem, ensuring a proactive approach towards combating money laundering and enhancing regulatory frameworks. Embracing innovation through collaborative efforts not only nurtures a culture of continuous improvement but also unlocks opportunities for synergy and knowledge exchange, redefining the future contours of AML compliance within the Bitcoin sector.

Amidst the dynamic interplay of regulatory upgrades and technological innovations, the drive for collaboration and innovation emerges as a linchpin for sustainability and effectiveness in ensuring AML compliance within the Bitcoin domain. By collectively harnessing expertise, resources, and creativity, stakeholders can cultivate an environment ripe for pioneering strategies and cutting-edge tools that fortify the integrity of financial systems. Embracing a culture of collaboration not only fosters collective resilience against illicit activities but also acts as a catalyst for holistic advancements that align with the evolving demands of the digital economy. The ongoing synergy between stakeholders heralds a promising future characterized by heightened vigilance, streamlined processes, and a harmonized approach towards combating financial crimes within the realm of cryptocurrency.

Bitcoin Anti-Money Laundering (AML) Regulations in Sao Tome and Principe