Regulatory Complexity 📝

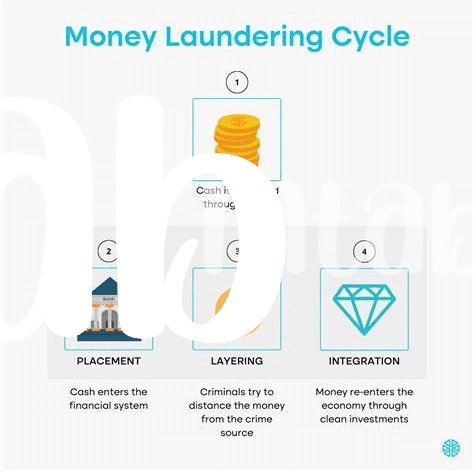

Navigating the regulatory landscape surrounding Bitcoin in Slovakia can feel like deciphering a complex code. The ever-evolving rules and guidelines set forth by regulatory bodies pose a significant challenge to businesses aiming to comply with AML regulations. Understanding and adhering to these regulations requires a meticulous approach, often necessitating expert advice to avoid costly missteps. As the regulatory framework continues to evolve, staying abreast of these changes is crucial to ensure compliance and mitigate risks.

Technological Hurdles 🖥️

Navigating the landscape of compliance challenges in implementing AML rules for Bitcoin in Slovakia can be a daunting journey, filled with obstacles that demand astute navigation. Among these roadblocks are the technological hurdles that arise in the realm of cryptocurrency regulation. Embracing innovative solutions while adhering to stringent AML guidelines poses a significant challenge for businesses operating in this space. Overcoming these technological barriers requires a harmonious blend of adaptability, foresight, and a commitment to staying abreast of the evolving digital landscape.

Compliance Costs 💰

Compliance with Anti-Money Laundering (AML) rules for Bitcoin in Slovakia can pose significant financial challenges for businesses. Implementing the necessary compliance measures often requires substantial investment in technology, manpower, and resources. The costs associated with ensuring adherence to regulations can be a deterrent for smaller businesses and startups looking to venture into the cryptocurrency space. These compliance costs can strain budgets and impact overall profitability, making it crucial for organizations to carefully assess and plan for the financial implications of AML compliance.

Lack of Clarity 🤔

Regulatory requirements surrounding Bitcoin in Slovakia can often be unclear, creating a challenging environment for businesses seeking compliance. The lack of clarity in guidelines and procedures can lead to confusion and potential missteps. This uncertainty can not only hinder the implementation of necessary Anti-Money Laundering measures but also create obstacles in ensuring full adherence to the rules. Navigating through vague or ambiguous regulations can be a daunting task for companies, requiring them to invest additional time and resources in deciphering the requirements accurately, and sometimes even seeking external expertise for guidance. This issue underscores the importance of clear and concise regulatory frameworks to facilitate smoother compliance processes. To gain insights on how similar challenges are managed in other regions, consider exploring the impact of bitcoin Anti-Money Laundering (AML) regulations in Seychelles [bitcoin anti-money laundering (aml) regulations in Seychelles](https://wikicrypto.news/impact-of-aml-regulations-on-bitcoin-exchanges-in-saudi-arabia).

Training and Awareness 🧠

Training and awareness play a crucial role in navigating the complex landscape of AML rules for Bitcoin in Slovakia. Educating employees, stakeholders, and partners about compliance requirements and best practices is essential for maintaining a secure and trustworthy environment. By providing regular training sessions and fostering a culture of vigilance and accountability, businesses can strengthen their defense against potential money laundering activities. Awareness campaigns can also help in spotting suspicious transactions early on, minimizing risks and ensuring regulatory compliance.

Furthermore, increased knowledge and understanding of AML rules can empower individuals to make informed decisions and take proactive steps in safeguarding their organizations. Investing in continuous training programs and staying updated on the latest regulatory developments can significantly enhance the overall compliance efforts. By promoting a culture of compliance and encouraging open communication channels, companies can better equip their teams to uphold the integrity of their operations and protect against financial crimes.

Cross-border Challenges 🌍

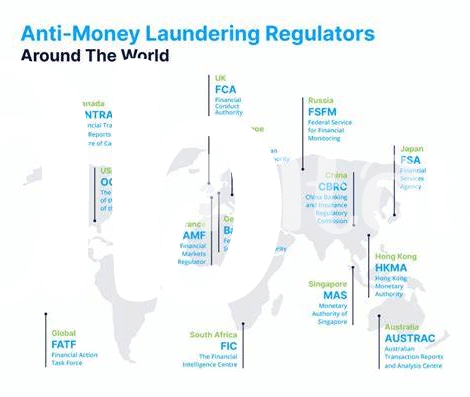

Navigating the complexities of cross-border transactions in the realm of Bitcoin compliance can present a myriad of challenges. From differing regulatory frameworks across various jurisdictions to the need for enhanced due diligence measures, businesses operating in the cryptocurrency space face a daunting task in ensuring compliance with anti-money laundering (AML) regulations.

Moreover, the evolving nature of international laws and the lack of harmonization between countries further compound these challenges. In an increasingly interconnected world, the need for collaboration and information-sharing among regulatory bodies becomes paramount to effectively combatting illicit activities in the cryptocurrency sphere. By staying abreast of regulatory developments and fostering dialogue on a global scale, organizations can better navigate the cross-border landscape while upholding the integrity of the financial system.

inserting link: bitcoin anti-money laundering (aml) regulations in Saudi Arabia