Bitcoin Adoption in Sierra Leone 🌍

In recent years, Sierra Leone has witnessed a growing interest in Bitcoin adoption, reflecting a global trend towards digital currencies. Citizens, particularly the tech-savvy youth population, are increasingly turning to Bitcoin for its potential to facilitate faster and more secure financial transactions. This shift is not only driven by technological advancements but also by the desire for greater financial inclusion and access to global markets.

As Bitcoin gains traction in Sierra Leone, its impact on the traditional financial landscape is becoming more pronounced. With the potential to revolutionize the way individuals and businesses transact, the country faces the dual challenge of embracing this innovative technology while ensuring compliance with existing regulations and international standards. The evolving landscape of Bitcoin adoption in Sierra Leone underscores the need for a balanced approach that harnesses the benefits of digital currencies while mitigating associated risks.

Impact of Aml Regulations on Businesses 💼

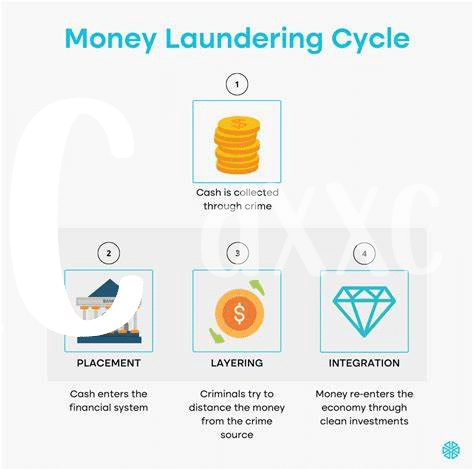

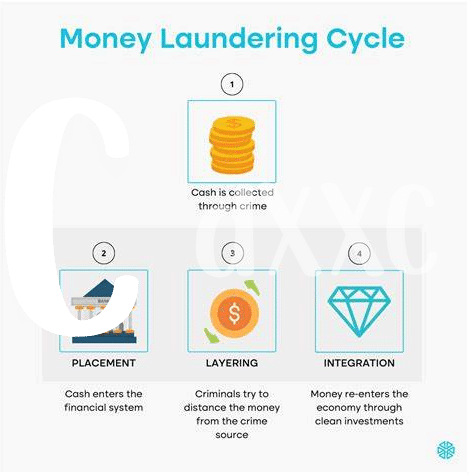

The implementation of Anti-Money Laundering (AML) regulations in Sierra Leone has brought about significant changes for businesses in the region. These regulations have placed a greater emphasis on transparency and accountability, requiring companies to adhere to stringent compliance measures. As a result, businesses are now required to invest more resources and time into ensuring they meet the necessary AML requirements, impacting their daily operations and financial processes.

Furthermore, the introduction of AML regulations has led to a more cautious approach by businesses when dealing with cryptocurrency transactions. The need to verify the legitimacy of transactions and thoroughly screen customers has become a priority, adding an extra layer of complexity to their operations. Despite the challenges, this increased vigilance aligns with the global effort to combat financial crimes and illicit activities, ultimately fostering a more secure environment for businesses to operate within the cryptocurrency space.

Challenges in Implementing Compliance Measures 🚧

Navigating compliance measures in Sierra Leone presents a myriad of intricacies for businesses delving into the realm of Bitcoin transactions. One of the foremost challenges is the lack of standardized guidelines tailored specifically for cryptocurrency operations within the country. This ambiguity often leads to confusion among business owners on how to effectively align their practices with Anti-Money Laundering regulations without clear-cut directives to follow. Moreover, the dynamic nature of the digital asset space further complicates compliance efforts, requiring companies to stay vigilant and adaptive to evolving regulatory landscapes to ensure they remain in adherence to AML protocols. The absence of a cohesive framework that bridges traditional financial laws with the nuances of cryptocurrency transactions poses a significant obstacle in implementing effective compliance measures, warranting a strategic approach to navigate these uncertainties.

Role of Government in Regulating Cryptocurrency 🏛️

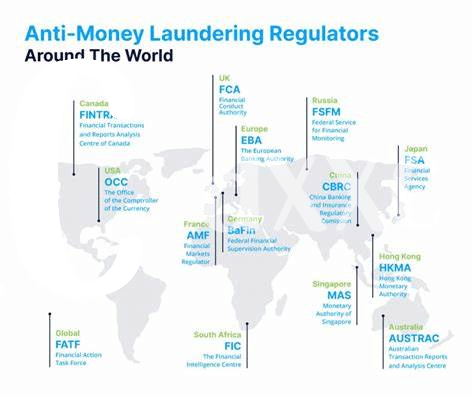

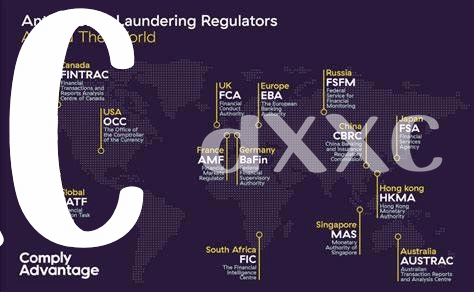

The government in Sierra Leone plays a crucial role in regulating cryptocurrencies like Bitcoin. By establishing clear guidelines and frameworks, they aim to ensure transparency, security, and accountability in the growing digital currency market. These regulations help protect investors, prevent illegal activities, and promote the responsible use of cryptocurrencies within the country. Government involvement is vital in building trust and stability in the cryptocurrency sector, fostering an environment that encourages innovation and economic growth. To learn more about how Bitcoin is evolving under anti-money laundering (AML) regulations in Singapore, check out this insightful article on bitcoin anti-money laundering (aml) regulations in Singapore.

Benefits of a Streamlined Compliance Process 💰

A streamlined compliance process can significantly enhance operational efficiency for businesses in Sierra Leone. By implementing efficient compliance measures, companies can reduce the risks associated with money laundering and ensure their adherence to regulatory requirements. This not only helps in building trust with customers and stakeholders but also improves the overall reputation of the business in the market. Moreover, a streamlined compliance process can lead to cost savings by avoiding potential fines and penalties for non-compliance. In the long run, businesses that prioritize compliance can enjoy sustainable growth and contribute to a more robust and transparent financial ecosystem in the country.

Future Outlook for Bitcoin and Aml in Sierra Leone 🚀

In the realm of cryptocurrency in Sierra Leone, the future outlook for Bitcoin and AML regulations appears dynamic and promising. As the landscape evolves, there is a growing recognition of the importance of balancing innovation with regulatory compliance. With proactive measures and strategic implementations, there is potential for the country to establish a robust framework that fosters both the growth of Bitcoin adoption and the adherence to AML regulations. By staying adaptable and responsive to market changes, Sierra Leone can position itself as a progressive player in the global cryptocurrency arena. Exciting opportunities lie ahead for the integration of Bitcoin and AML protocols in the country’s financial ecosystem.

Link: bitcoin anti-money laundering (aml) regulations in slovenia