Regulatory Approach 📝

In the realm of regulatory approach, the key disparities between AML rules for Bitcoin and traditional finance come to light. While traditional financial institutions are subjected to well-established regulatory frameworks enforced by central authorities, the decentralized nature of Bitcoin poses challenges in governance. This distinction underscores the need for adaptable regulatory strategies that cater to the unique characteristics of virtual assets. Balancing innovation with compliance remains a pivotal task in bridging the regulatory divide between these two financial spheres.

Tracking Transactions 📊

In the realm of regulating financial transactions involving Bitcoin and traditional finance, there are notable differences in how Tracking Transactions is approached. Understanding the flow of funds and monitoring the movement of assets is crucial for ensuring compliance with Anti-Money Laundering (AML) rules. Cryptocurrency transactions often present distinct challenges compared to traditional financial transactions, requiring innovative solutions for effective tracking and oversight. Implementing robust tracking mechanisms is essential in addressing the unique characteristics of digital assets to prevent illicit activities.

Compliance Costs 💰

Compliance costs vary significantly between Bitcoin and traditional finance systems. While traditional financial institutions typically incur high expenses to meet regulatory requirements, Bitcoin transactions often involve lower compliance costs due to the decentralized nature of the network. The lack of intermediary involvement and streamlined verification processes can contribute to reduced expenses for users. However, the evolving regulatory landscape surrounding cryptocurrencies may lead to increased compliance costs in the future as authorities strive to monitor and regulate this growing sector. As the industry continues to mature, balancing regulatory compliance with cost-efficiency will be crucial for both Bitcoin users and traditional financial institutions seeking to navigate this complex regulatory environment.

Privacy Concerns 🔒

Privacy Concerns in the realm of Bitcoin and traditional finance differ significantly, reflecting the varying degrees of transparency and anonymity each system offers. In Bitcoin transactions, the decentralized nature provides a pseudo-anonymous layer, making it challenging for authorities to identify individual users. On the other hand, traditional financial systems usually require more personal information for transactions, raising concerns about data privacy and potential misuse of sensitive data. Furthermore, with the increasing focus on data protection laws globally, ensuring privacy compliance becomes a crucial aspect for both sectors.

For a deeper understanding of how Bitcoin AML regulations differ across various regions, including Saudi Arabia, check out this insightful article on bitcoin anti-money laundering (AML) regulations in Saudi Arabia.

Enforcement Mechanisms 🔨

Enforcement mechanisms in the realm of Bitcoin and traditional finance play a pivotal role in upholding the rules and regulations set forth by governing bodies. While traditional finance often relies on centralized institutions for enforcement, the decentralized nature of Bitcoin poses unique challenges. In traditional finance, institutions like banks and government agencies actively monitor and enforce compliance through audits and penalties. On the other hand, the enforcement mechanisms in the world of Bitcoin primarily involve transparency through the public ledger, coupled with self-regulatory measures within the community. This distinction underscores the evolving landscape of enforcement mechanisms in both sectors, with traditional finance emphasizing centralized oversight and Bitcoin embracing decentralized protocols.

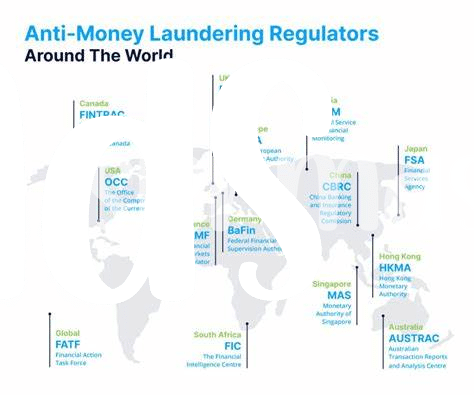

Global Reach 🌍

In the realm of Bitcoin and traditional finance, the key differences in Anti-Money Laundering (AML) rules manifest most notably in their global reach. The decentralized nature of cryptocurrencies like Bitcoin transcends geographical boundaries, making it challenging for regulators to enforce uniform AML standards across countries. Unlike traditional financial systems, where regulation is more centralized, the cross-border nature of cryptocurrencies presents a unique compliance hurdle. While efforts are underway to establish international cooperation on AML regulations for digital assets, the inherent global reach of Bitcoin poses ongoing challenges for regulatory authorities worldwide. [bitcoin anti-money laundering (AML) regulations in sierra leone](bitcoin anti-money laundering (AML) regulations in singapore)