Regulator Awareness 🚨

Regulator Awareness is crucial in navigating Singapore’s Bitcoin market. Understanding the guidelines and requirements set forth by regulatory bodies is the foundation for ensuring compliance and mitigating risks. By staying informed about the ever-evolving landscape of regulations, businesses can proactively adapt their practices to align with legal standards. This awareness not only safeguards against potential penalties but also builds trust with regulators, showcasing a commitment to operating ethically and transparently within the market. Keeping a pulse on regulatory updates and developments empowers organizations to make informed decisions and maintain integrity in their operations.

Compliance Training 📚

Compliance Training involves equipping your team with the knowledge and skills necessary to navigate the complexities of AML regulations effectively. By providing comprehensive training materials and interactive sessions, employees can grasp the significance of compliance measures and implement them seamlessly in their daily tasks. From understanding regulatory requirements to identifying suspicious activities, a well-structured compliance training program ensures that your organization remains vigilant and proactive in combating money laundering risks.

Kyc Best Practices ✔️

Ensuring robust and effective Know Your Customer (KYC) practices is crucial in the Singaporean Bitcoin market. By implementing thorough verification processes, businesses can better identify and authenticate customers, reducing the risk of potential illicit activities. Emphasizing the importance of accurate identification documentation and regular updates can significantly enhance compliance efforts and strengthen the overall integrity of the cryptocurrency ecosystem. Adopting a proactive approach to KYC not only aids in building trust with regulatory authorities but also safeguards against financial crimes within the rapidly evolving digital asset landscape.

Transaction Monitoring 🔄

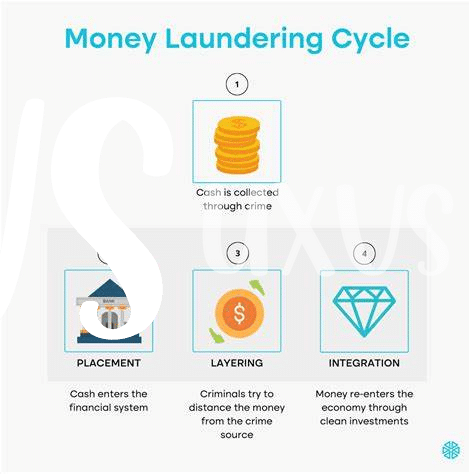

In the realm of managing and overseeing financial transactions, meticulous monitoring plays a crucial role in ensuring compliance with regulatory requirements. This involves scrutinizing and analyzing the flow of funds to detect any suspicious activities that may indicate potential money laundering or illicit transactions. By implementing robust transaction monitoring mechanisms, businesses can stay vigilant and proactive in identifying and addressing any potential risks promptly. It not only helps in maintaining the integrity of the financial ecosystem but also demonstrates a commitment to upholding regulatory standards and combating financial crimes effectively.

Anti-money Laundering Tools 🛡️

1) Anti-money laundering tools play a crucial role in safeguarding against illicit activities within the financial realm. These sophisticated resources are designed to detect and prevent suspicious transactions, ensuring compliance with regulatory standards. By utilizing cutting-edge technology, businesses can actively combat money laundering and protect their integrity in the market.

2) Incorporating anti-money laundering tools into your operational framework not only enhances security measures but also fosters trust among stakeholders. These tools enable swift identification of red flags, enabling prompt action to mitigate risks effectively. By investing in robust anti-money laundering solutions, organizations demonstrate a commitment to upholding ethical practices and fortifying the integrity of the Bitcoin market in Singapore.

Regular Audits 🔍

Regular audits are an essential component of ensuring compliance in Singapore’s Bitcoin market. By conducting regular audits, companies can proactively identify and address any potential issues related to anti-money laundering practices. These audits provide a comprehensive review of internal processes, controls, and transactions to validate adherence to regulatory requirements. Through regular audits, businesses can demonstrate their commitment to operating ethically and transparently in accordance with AML regulations. Stay ahead of the curve by incorporating regular audits into your compliance strategy.

bitcoin anti-money laundering (aml) regulations in serbia