Understanding Aml Regulations 📝

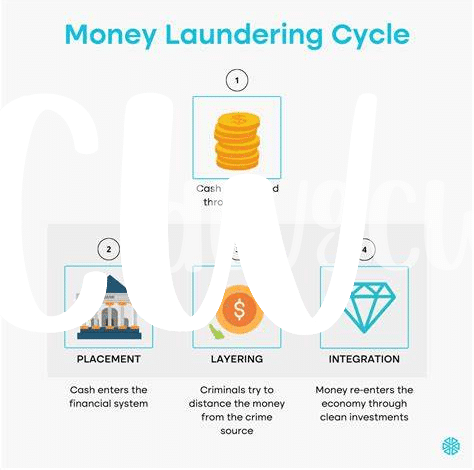

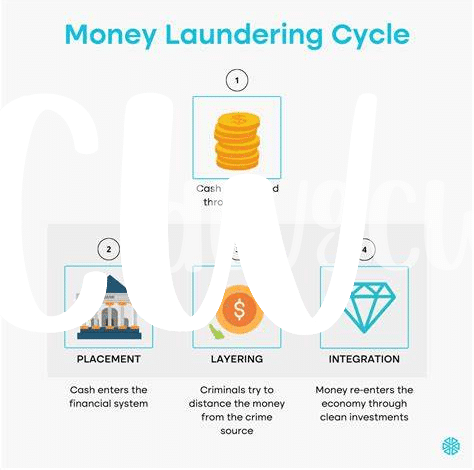

As an investor in Bitcoin, it is crucial to navigate the intricate landscape of Anti-Money Laundering (AML) regulations. These guidelines aim to prevent illicit activities within the cryptocurrency realm, ensuring a safe and transparent environment for all stakeholders involved. By understanding the nuances of AML regulations, investors can protect themselves and contribute to the integrity of the digital asset market. Being aware of the requirements and implications set forth by regulatory bodies is key to making informed decisions in the dynamic world of Bitcoin investments.

Importance of Due Diligence 🔍

The Importance of Due Diligence in Bitcoin investments cannot be overstated. It serves as a crucial safeguard, allowing investors to thoroughly assess the risks associated with their ventures. By conducting thorough due diligence, investors can gain valuable insights into the legitimacy and credibility of the entities they are dealing with, helping to mitigate potential pitfalls and fraudulent activities. This proactive approach not only protects investors from financial losses but also contributes to upholding the integrity of the cryptocurrency market.

Moreover, the process of due diligence empowers investors to make well-informed decisions based on accurate information. It enables individuals to delve into the intricacies of a Bitcoin investment opportunity, scrutinizing key aspects such as regulatory compliance, financial stability, and overall operational transparency. By prioritizing due diligence, investors can navigate the complexities of the digital asset landscape with confidence and prudence, positioning themselves for long-term success in the evolving world of cryptocurrencies.

Risk Factors in Bitcoin Investments ⚠️

Bitcoin investments come with several factors that potential investors should be aware of before diving in. One key aspect to consider is the volatility of the cryptocurrency market, which can lead to significant price fluctuations in a short period. Additionally, since Bitcoin operates independently of any central authority, regulatory changes or government actions can impact its value unexpectedly. Security risks, such as hacking and theft, are also prevalent in the digital asset space, emphasizing the importance of implementing robust security measures for safeguarding investments. Finally, lack of liquidity and market manipulation are additional risks that investors should evaluate before committing funds to Bitcoin. By understanding and addressing these risk factors proactively, investors can make more informed decisions in navigating the complexities of the digital currency landscape.

Reporting Obligations for Investors 📊

When it comes to participating in Bitcoin investments, investors need to be aware of the reporting obligations that may apply to them. These obligations are put in place to ensure transparency and compliance with anti-money laundering (AML) regulations. By fulfilling reporting requirements, investors contribute to the overall integrity of the cryptocurrency market and help in the prevention of illicit activities. Staying informed and proactive in meeting these obligations is not only a legal requirement but also a way to foster a trustworthy and secure environment for all participants in the digital asset space.

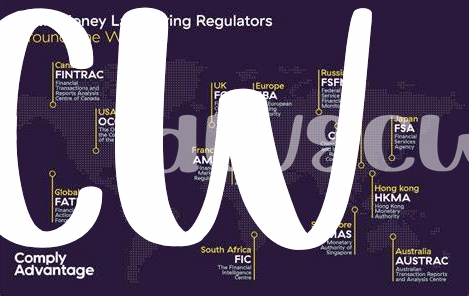

To gain a deeper understanding of how AML regulations are implemented globally, particularly in the context of Bitcoin, one can explore the case studies and success stories from various regions. For instance, the article on bitcoin anti-money laundering (AML) regulations in Russia provides valuable insights into the approaches and challenges faced in implementing such regulations effectively. By studying real-world examples like these, investors can better grasp the practical implications of AML requirements and enhance their compliance strategies accordingly.

Compliance Strategies for Security 🛡️

When it comes to ensuring the security of your investments, having robust compliance strategies in place is crucial. These strategies not only help in safeguarding your assets but also play a significant role in maintaining trust and credibility within the Bitcoin investment community. By incorporating industry best practices and staying updated on the latest security measures, investors can proactively mitigate potential risks and threats. From implementing multi-factor authentication protocols to regularly conducting security audits, prioritizing compliance in security measures is key to establishing a resilient investment framework that enhances overall protection and fosters a secure environment for investors.

Future Trends in Aml Compliance 🚀

The landscape of Anti-Money Laundering (AML) regulations is continuously evolving, and staying ahead of future trends is crucial for Bitcoin investors. As technology advances and financial transactions become more complex, regulators are expected to implement stricter AML measures to combat illicit activities in the digital currency space. Proactive compliance strategies, such as enhanced due diligence and robust Know Your Customer (KYC) procedures, will likely become essential for investors navigating the evolving regulatory environment.

In order to adapt to these upcoming changes, Bitcoin investors must prioritize ongoing education and training to ensure they are well-informed about the latest AML requirements. Monitoring regulatory updates and engaging with industry experts can provide valuable insights into future trends, helping investors proactively address compliance challenges. By staying abreast of emerging AML guidelines and trends, investors can safeguard their investments and uphold the integrity of the cryptocurrency market.

Bitcoin Anti-Money Laundering (AML) Regulations in Poland: bitcoin anti-money laundering (aml) regulations in Poland