Introduction to Aml Regulations 🌍

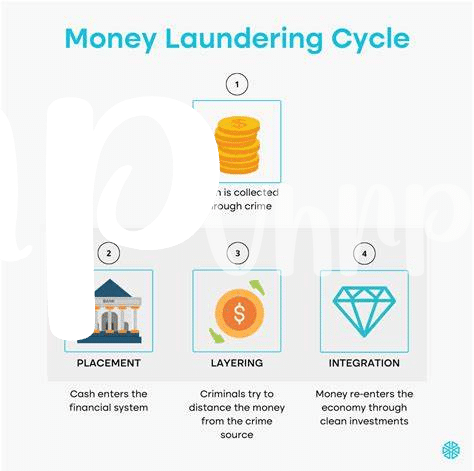

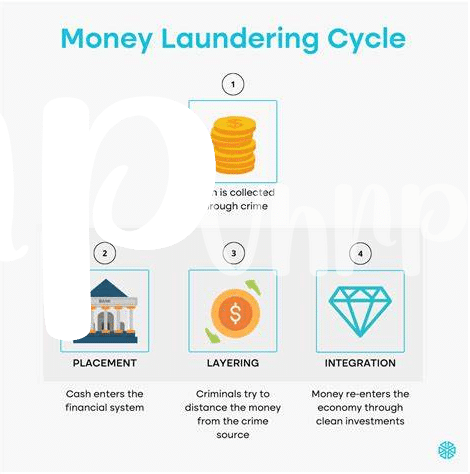

AML regulations are crucial in safeguarding financial systems worldwide, ensuring transparency and deterring illicit activities. In a globalized economy, these regulations serve as a shield against money laundering and terrorist financing, promoting integrity in the financial sector. Understanding the significance of AML regulations is essential for both individuals and businesses to comply with legal requirements and contribute to a more secure financial environment.

Understanding Bitcoin Investment in Portugal 💰

Bitcoin investment in Portugal has been steadily gaining popularity among both seasoned investors and newcomers seeking to explore the world of cryptocurrency. With a growing number of platforms offering opportunities to buy and trade Bitcoin, individuals in Portugal are increasingly turning to digital assets as part of their investment portfolios. The decentralized and borderless nature of Bitcoin appeals to those looking to diversify their assets beyond traditional markets. Additionally, the potential for high returns has caught the attention of many seeking to capitalize on the volatile yet lucrative market of digital currencies. As more people in Portugal delve into the world of Bitcoin investment, understanding the risks and rewards becomes crucial to making informed decisions in this evolving landscape.

Impact of Aml Regulations on Investors 📉

Achieving compliance with Anti-Money Laundering (AML) regulations has placed significant responsibilities on Bitcoin investors in Portugal. The introduction of these regulations has led to increased scrutiny and monitoring of transactions, impacting the way investors conduct their operations. Investors now face the challenge of ensuring their activities align with the regulatory requirements, thereby affecting the flexibility and privacy traditionally associated with Bitcoin investments. Navigating these regulations has become essential for investors to operate within the legal boundaries set forth by the authorities.

Compliance Challenges for Bitcoin Investors 📝

Bitcoin investors in Portugal face a myriad of challenges when it comes to compliance with anti-money laundering (AML) regulations. These regulations are designed to prevent illicit activities such as money laundering and terrorism financing within the cryptocurrency space. Navigating the complex landscape of AML requirements can be daunting for investors, especially in a rapidly evolving regulatory environment. Understanding the nuances of AML compliance is crucial to ensure the legality and legitimacy of Bitcoin investments. To delve deeper into the specific challenges and solutions related to AML compliance for Bitcoin in Panama, check out the comprehensive guide on bitcoin anti-money laundering (AML) regulations in Papua New Guinea [here](https://wikicrypto.news/challenges-and-solutions-aml-compliance-for-bitcoin-in-panama).

Navigating Legal Framework in Portugal 📚

Portugal’s legal framework for Bitcoin investors can be complex to navigate due to evolving regulatory landscapes. Understanding the specific requirements and compliance standards is crucial for investors to operate securely within the country. As regulations continue to adapt to the digital asset market, staying informed about any changes and seeking professional guidance can help investors mitigate risks and ensure adherence to the law. By actively engaging with legal experts and regulatory updates, Bitcoin investors in Portugal can proactively navigate the legal framework to safeguard their investments and contribute to the growth of the cryptocurrency sector in a compliant manner.

Future Outlook and Recommendations for Investors 🔮

In considering the future outlook and recommendations for investors in Portugal amidst the evolving landscape of AML regulations, it is essential for bitcoin investors to stay informed and adaptable. Embracing a proactive approach to compliance and leveraging technological solutions can help navigate the changing regulatory environment effectively. Additionally, fostering partnerships with reputable entities can enhance due diligence efforts and mitigate risks associated with AML regulations in the digital asset space. By staying vigilant and continuously educating themselves on regulatory updates, investors can position themselves strategically for long-term success in the dynamic cryptocurrency market.

A deep dive into the impact of AML regulations on bitcoin investors in Portugal reveals the necessity of staying ahead of compliance challenges and embracing the evolving legal framework. Success in the digital asset market demands not only a keen understanding of AML regulations but also a commitment to proactive compliance measures. By focusing on education, adaptability, and strategic partnerships, investors can navigate the regulatory landscape with confidence and resilience. Embracing a forward-thinking approach will be instrumental in capitalizing on opportunities while mitigating risks inherent in the intersection of bitcoin investments and AML regulations.