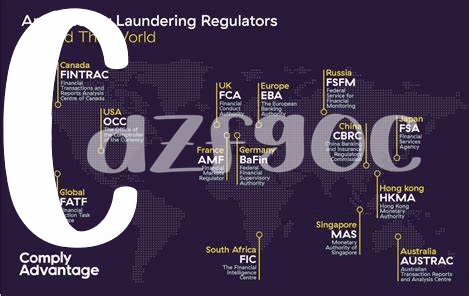

Introduction to Aml Regulations 🌍

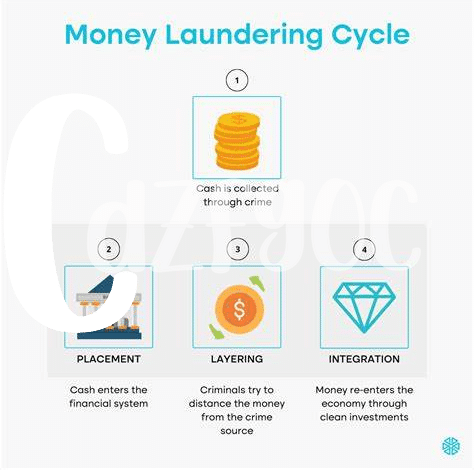

In the dynamic landscape of financial regulations, Anti-Money Laundering (AML) guidelines play a crucial role in safeguarding the integrity of transactions. Understanding and adhering to AML regulations is essential for the operation of Bitcoin exchanges in Papua New Guinea. These regulations are designed to prevent illicit activities such as money laundering and terrorist financing, promoting transparency and accountability within the cryptocurrency market. By navigating through the regulatory framework, exchanges can foster trust among users and cultivate a secure environment for digital asset transactions. Compliance with AML regulations not only upholds legal standards but also contributes to the overall stability and credibility of the cryptocurrency ecosystem.

Overview of Bitcoin Exchanges in Png 💱

Bitcoin exchanges in Papua New Guinea have experienced significant growth in recent years, offering a platform for users to buy and sell cryptocurrencies. These exchanges play a crucial role in the local economy, providing access to the global digital asset market. As the demand for cryptocurrencies rises, these platforms have adapted to meet the needs of their users by offering a range of services such as secure wallets, fast transactions, and customer support.

Additionally, Bitcoin exchanges in Papua New Guinea have become key players in promoting financial inclusion, allowing individuals from diverse backgrounds to participate in the digital economy. The convenience and accessibility of these platforms have opened up new opportunities for both experienced traders and newcomers looking to explore the world of cryptocurrencies. Through innovative technologies and user-friendly interfaces, these exchanges continue to shape the landscape of digital finance in the region.

Compliance Challenges and Solutions 💡

Navigating through the complex landscape of AML regulations can present a myriad of challenges for Bitcoin exchanges in Papua New Guinea. From ensuring proper customer due diligence to implementing robust transaction monitoring systems, compliance remains a top priority. One of the key challenges faced by exchanges is staying abreast of the evolving regulatory environment and adapting internal processes accordingly. In response, innovative solutions such as automated compliance software and specialized training programs have been instrumental in enhancing regulatory adherence. By fostering a culture of compliance and embracing technological advancements, exchanges can effectively navigate the intricacies of AML regulations while safeguarding the integrity of their operations.

Impact of Regulations on Users 🧑💼

Regulations in Papua New Guinea have significantly impacted users of Bitcoin exchanges, requiring enhanced verification processes and diligence in transactions. Users are now experiencing a more secure environment, albeit with added steps for compliance. This shift highlights the importance of safeguarding against illicit activities within the cryptocurrency space, ultimately fostering trust and credibility among users. As this landscape continues to evolve, staying informed and adaptable remains key for individuals engaging in digital asset exchanges. For further insights on best practices in AML compliance, check out the resource on bitcoin anti-money laundering (AML) regulations in Qatar.

Future Trends in Aml for Exchanges 🚀

The evolving landscape of AML regulations for Bitcoin exchanges anticipates increased emphasis on robust customer due diligence measures. Recognizing the importance of staying ahead of financial crimes, future trends point towards enhanced transaction monitoring tools and advanced technologies to detect suspicious activities in real-time. Additionally, collaborations with regulatory bodies and industry peers will be critical in shaping proactive strategies to combat emerging threats and ensure compliance with evolving AML standards.

In response to the dynamic regulatory environment, exchanges are expected to invest in sophisticated compliance frameworks that incorporate artificial intelligence and blockchain analytics to enhance risk assessment capabilities. By prioritizing proactive compliance measures and fostering a culture of transparency, exchanges in PNG can navigate the shifting AML landscape with agility and integrity, positioning themselves as trusted entities in the global cryptocurrency ecosystem.

Conclusion: Navigating Success in Png 🌟

Navigating success in PNG requires a deep understanding of AML regulations and their impact on Bitcoin exchanges. By staying informed and adaptable, businesses can overcome compliance challenges and provide a secure environment for users. Embracing future trends in AML technology will be crucial for maintaining trust and confidence in the evolving landscape of digital currency. As the regulatory framework continues to shape the industry, strategic navigation will be key to unlocking the potential for growth and innovation in Papua New Guinea.