Regulatory Maze: Understanding Bitcoin Aml Rules 🧩

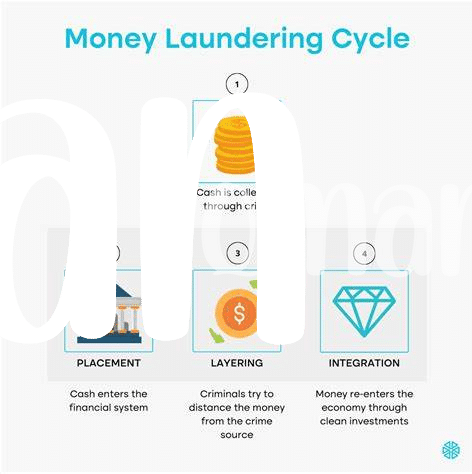

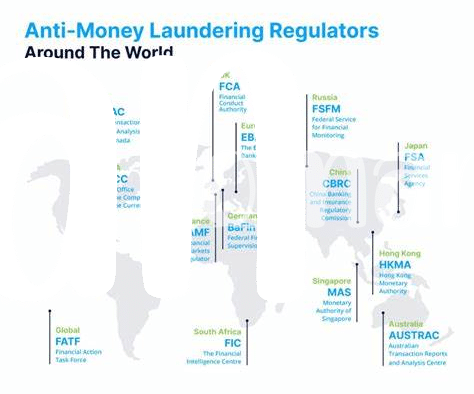

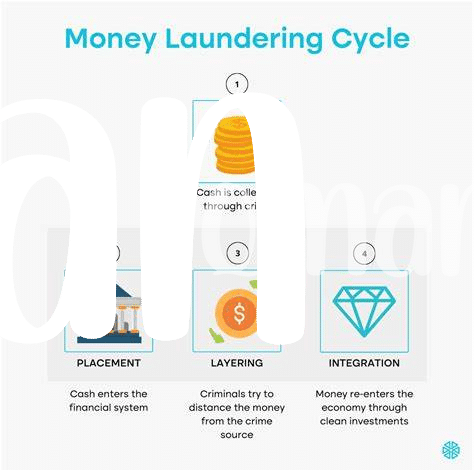

Navigating the intricate landscape of Bitcoin AML regulations can feel like deciphering a complex puzzle. These rules are designed to ensure compliance and combat illicit activities, but understanding them thoroughly requires patience and dedication. From transaction monitoring to reporting obligations, each piece of the regulatory maze plays a crucial role in upholding the integrity of the cryptocurrency ecosystem. By delving deep into the nuances of Bitcoin AML rules, individuals and businesses can navigate this maze with confidence and transparency.

As regulatory bodies continue to refine their approaches to crypto compliance, staying informed and adaptable is essential. With constant updates and evolving standards, grasping the nuances of Bitcoin AML rules is a dynamic process. By embracing a proactive mindset and engaging with industry experts, individuals can stay ahead of the curve and navigate the regulatory maze with agility and insight.

Dark Web Dangers: Challenges of Anonymous Transactions 🔒

Navigating the realm of online transactions can be fraught with perils, especially when it comes to the anonymity that the dark web offers. The challenges of conducting anonymous transactions present a significant hurdle for compliance in the Bitcoin world. Understanding and mitigating these risks is crucial to ensure the integrity and security of financial transactions in the digital landscape. Efforts must be made to address these challenges head-on in order to foster a safer environment for all users involved.

Compliance Hurdles: Navigating Kyc Requirements 📝

Navigating KYC requirements in the realm of Bitcoin AML regulations can often feel like unraveling a complex puzzle. The need to verify customer identities while ensuring compliance with evolving regulatory standards poses a significant challenge for businesses. As the digital landscape expands, adapting to ever-changing KYC demands becomes a crucial aspect of operational success, requiring a delicate balance between meeting regulatory obligations and providing a seamless customer experience.

In the world of cryptocurrency, the importance of robust KYC procedures cannot be overstated. From scrutinizing user identities to monitoring transactional patterns, the intricacies of navigating KYC requirements underscore the critical role these processes play in safeguarding against illicit financial activities. As financial institutions and businesses grapple with the complexities of compliance, the effective implementation of KYC measures becomes a cornerstone in fostering trust, transparency, and accountability within the evolving ecosystem of Bitcoin AML regulations.

Legal Loopholes: Implications for Financial Institutions 🕳️

Legal loopholes in anti-money laundering (AML) regulations present significant challenges for financial institutions operating in the cryptocurrency space. These gaps in the legal framework can be exploited by malicious actors to circumvent AML controls and engage in illicit financial activities. Financial institutions must constantly adapt their compliance strategies to address these vulnerabilities and mitigate the risks associated with potential regulatory breaches.

To learn more about navigating the complex landscape of AML compliance in the realm of cryptocurrencies, including important insights on Bitcoin AML regulations in Palau, check out the comprehensive guide on bitcoin anti-money laundering (AML) regulations in Palau provided by WikiCrypto News [here](https://wikicrypto.news/aml-compliance-for-bitcoin-businesses-in-oman-everything-you-need-to-know).

Technology Vs. Regulation: Striking a Balance ⚖️

In the dynamic realm of cryptocurrency, the interplay between technology and regulation is a delicate dance. Striking a balance between fostering innovation and safeguarding against illicit activities is paramount. Technology advances at a rapid pace, often outpacing regulatory frameworks designed to govern it. Adapting regulations to harness the benefits of technology while mitigating risks requires continuous dialogue and collaboration between industry stakeholders and policymakers. Finding this equilibrium is essential for building trust in the burgeoning world of digital assets. As the landscape evolves, maintaining this equilibrium will be crucial in shaping the future of crypto compliance.

Future Forecast: Evolving Landscape of Crypto Compliance 🌐

The evolving landscape of crypto compliance presents a dynamic future where regulatory frameworks continually adapt to the fast-paced world of digital currencies. As technology advances and global financial systems intersect with decentralized networks, the need for flexible and effective compliance measures becomes paramount. Striking a delicate balance between innovation and regulation will be crucial in shaping the future of cryptocurrency use and its integration into mainstream financial ecosystems. Keeping pace with these changes will be essential for businesses and individuals navigating the complex world of crypto transactions. Explore more on Bitcoin anti-money laundering (AML) regulations in North Korea with anchor bitcoin anti-money laundering (AML) regulations in Oman here.