Understanding Aml Compliance in Bitcoin Businesses 🕵️♂️

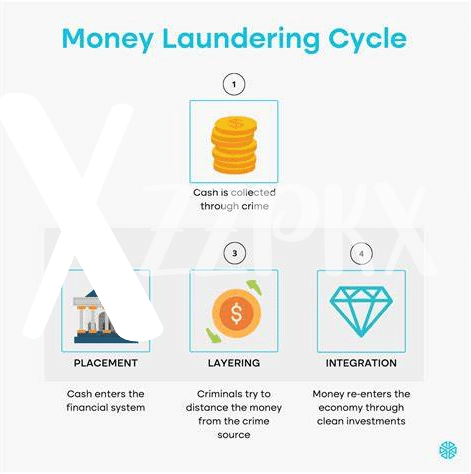

In the world of Bitcoin businesses, understanding AML compliance is crucial. It involves following strict regulations to prevent money laundering and illicit activities. AML compliance ensures that transactions are transparent and traceable, safeguarding the integrity of the cryptocurrency industry. By adhering to AML guidelines, businesses can build trust with customers and regulators, fostering a secure and sustainable environment for financial transactions. It is essential to stay updated on the latest AML practices to navigate the evolving landscape of compliance requirements in the digital currency realm.

Regulatory Requirements for Aml in Oman 📝

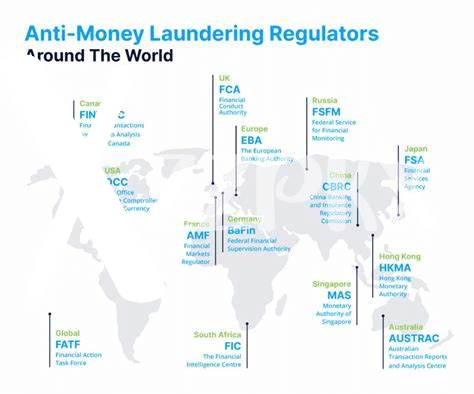

In Oman, businesses dealing with Bitcoin must adhere to stringent regulatory requirements to ensure compliance with Anti-Money Laundering (AML) standards. These regulations aim to prevent illegal activities such as money laundering and terrorist financing. Entities operating in Oman’s cryptocurrency space must implement robust customer due diligence measures, record-keeping procedures, and reporting mechanisms to monitor and detect suspicious transactions effectively. By aligning with these regulatory requirements, Bitcoin businesses in Oman can contribute to the integrity of the financial system and enhance trust among stakeholders.

To navigate the regulatory landscape in Oman successfully, Bitcoin businesses need to stay informed about evolving AML regulations and ensure alignment with the prescribed guidelines. Effective AML compliance not only mitigates risks related to financial crimes but also fosters a culture of transparency and accountability within the cryptocurrency industry. By proactively addressing regulatory requirements, businesses can safeguard their operations and uphold the principles of AML compliance to support a secure and compliant financial ecosystem.

Implementing Effective Aml Policies and Procedures 💼

Implementing effective AML policies and procedures is crucial for Bitcoin businesses in Oman to ensure compliance with regulations and deter illicit activities. By establishing clear guidelines and protocols, businesses can better identify and prevent money laundering and terrorist financing risks. These policies should outline the steps for customer due diligence, transaction monitoring, and reporting suspicious activities. Regular review and updates to these procedures are essential to adapt to the evolving AML landscape and stay ahead of potential threats. Training staff on these policies and procedures is equally important to ensure consistency in implementation across the organization.

Importance of Regular Aml Training for Staff 🎓

The ongoing training of staff members on AML practices is crucial for the smooth operation of Bitcoin businesses. Regular AML training sessions not only ensure that employees are up to date with the latest compliance requirements but also empower them to detect and prevent potential money laundering activities effectively. By investing in continuous education and skill development in the realm of AML, businesses can create a culture of awareness and accountability among their team members, ultimately strengthening their defenses against illicit financial activities.

Staff members who receive consistent AML training become valuable assets in safeguarding the integrity of their organizations and the broader financial ecosystem. Through knowledge enrichment and skill-building initiatives, employees can better understand the risks associated with money laundering and enhance their capabilities in identifying suspicious transactions. This proactive approach not only enhances the overall compliance posture of Bitcoin businesses but also contributes to the collective effort of combating financial crimes effectively.

Conducting Ongoing Aml Risk Assessments 📊

To effectively manage risks, Bitcoin businesses in Oman must conduct ongoing AML risk assessments. These assessments involve regularly evaluating the potential risks associated with money laundering and terrorist financing within the business operations. By identifying and analyzing these risks on a continuous basis, businesses can adapt their AML policies and procedures to address any emerging threats and vulnerabilities. Ongoing risk assessments enable companies to stay proactive in their compliance efforts, ensuring that they remain compliant with regulatory requirements while also safeguarding their reputation and financial integrity.

Dealing with Aml Non-compliance and Consequences ⚖️

6) Failing to comply with AML regulations can have serious consequences for Bitcoin businesses in Oman. Not only can it result in hefty fines, but it can also damage the reputation of the business and lead to potential legal action. Therefore, it is crucial for companies to have stringent AML policies in place to ensure compliance at all times. In the event of non-compliance, quick action must be taken to rectify the situation and prevent further violations. By staying proactive and diligent in upholding AML standards, businesses can protect themselves from the severe implications of non-compliance.

a hrefs=’bitcoin-aml-regulations-north-macedonia’>bitcoin anti-money laundering (aml) regulations in netherlands