Importance of Bitcoin Aml Regulations ⚖️

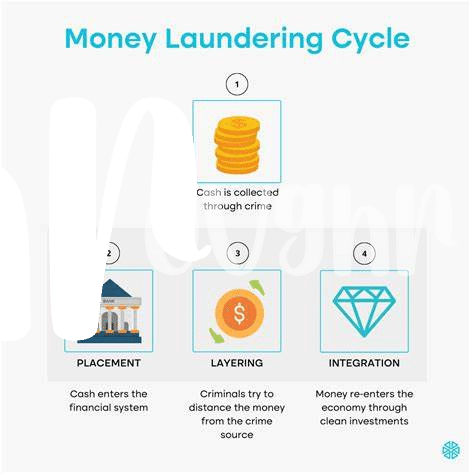

Bitcoin AML regulations play a crucial role in maintaining the integrity and security of the cryptocurrency ecosystem. By establishing guidelines for Anti-Money Laundering practices within the bitcoin space, these regulations ensure transparency and accountability among market participants. Compliance with AML regulations not only fosters trust and credibility in the industry but also safeguards against illicit activities such as money laundering and terrorist financing. It marks a significant step towards legitimizing bitcoin as a legitimate financial asset in the global economy.

Tools for Monitoring Compliance 📊

Monitoring compliance in the Bitcoin AML space is crucial for upholding regulatory standards and preventing illicit activities. To achieve this, various tools come into play, offering sophisticated monitoring capabilities that track transactions and flag any suspicious behavior. These tools provide valuable insights into the flow of funds, helping cryptocurrency businesses stay on top of their compliance obligations. By leveraging real-time data analysis and pattern recognition, companies can proactively identify potential risks and take appropriate action, ensuring a secure and transparent environment for all participants. Investing in efficient monitoring tools is key to demonstrating a commitment to regulatory compliance and fostering trust within the digital currency ecosystem.

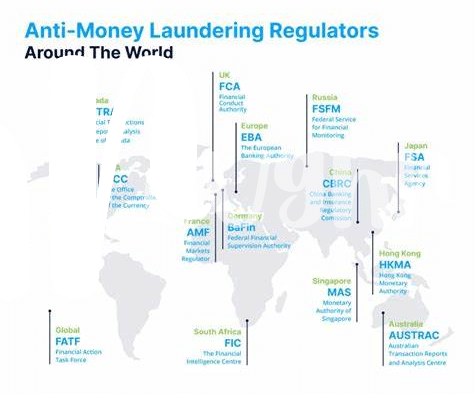

Role of Regulatory Authorities 🕵️♂️

Regulatory authorities play a crucial role in enforcing Bitcoin AML regulations, ensuring that businesses and individuals comply with the necessary rules and standards. These authorities work to monitor and oversee the implementation of AML measures, investigate potential violations, and impose penalties on those found to be non-compliant. By creating a framework for compliance and actively enforcing it, regulatory authorities help to maintain the integrity and security of the Bitcoin ecosystem, ultimately fostering trust and confidence among users and stakeholders.

Impact of Non-compliance Penalties 💸

Non-compliance with Bitcoin AML regulations can lead to severe penalties that significantly affect businesses or individuals. These penalties serve as a deterrent and reinforce the importance of adhering to regulatory requirements. Financial repercussions, such as fines or monetary sanctions, are common consequences of non-compliance, causing financial strain and reputational damage. Additionally, regulatory authorities may impose restrictions or sanctions, further complicating operations and potentially leading to legal consequences.

For more insights on the impacts of Bitcoin AML rules, especially in the context of global compliance, refer to this detailed article on the bitcoin anti-money laundering (AML) regulations in the Netherlands: bitcoin anti-money laundering (AML) regulations in the Netherlands.

Technology Solutions for Aml Enforcement 🖥️

In today’s digital landscape, innovative technology solutions have emerged as vital tools for tackling AML enforcement challenges. Advanced software platforms equipped with robust algorithms and machine learning capabilities are revolutionizing the way compliance monitoring is conducted. These sophisticated tools can quickly analyze vast amounts of data, detect suspicious activities, and generate real-time alerts for further investigation. Additionally, blockchain analytics tools play a crucial role in identifying illicit transactions and tracing their origins through the intricate web of cryptocurrency transactions. By harnessing the power of technology, regulatory authorities are better equipped to enforce AML regulations effectively and mitigate financial crime risks in the digital realm.

Future Trends in Aml Enforcement 🌐

In the realm of anti-money laundering (AML) enforcement, future trends point towards an increasing reliance on advanced technological solutions. These innovations aim to streamline compliance processes, enhance data analysis capabilities, and strengthen the overall efficiency of AML measures. As regulatory authorities worldwide continue to adapt to the evolving landscape of financial crimes, a proactive stance on adopting cutting-edge technologies will likely define the future of AML enforcement efforts. Amidst these advancements, collaboration between public and private sectors will be crucial in mitigating emerging risks and safeguarding the integrity of financial systems.