Current Aml Practices 🌍

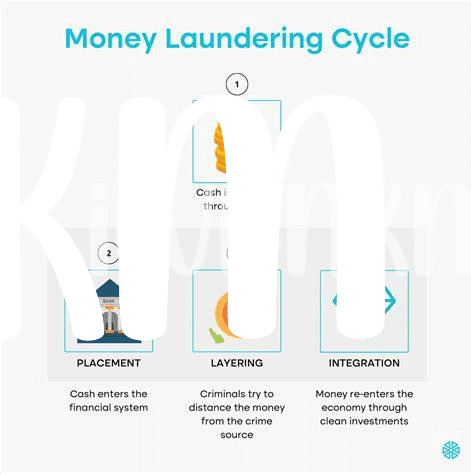

The landscape of current Anti Money Laundering practices in Nigeria reflects a dynamic interplay of regulatory frameworks, financial institutions’ obligations, and technological advancements. Implementing robust AML measures has become imperative to combat illicit activities and ensure the integrity of financial transactions. Various entities, from banks to crypto exchanges, are adapting their procedures to adhere to AML regulations and foster a more transparent financial ecosystem. As the digital landscape evolves, new challenges and opportunities continue to shape the way AML practices are implemented and enforced in the Nigerian context.

With a focus on enhancing transparency and accountability, current AML practices in Nigeria are witnessing a shift towards more proactive and technology-driven approaches. Leveraging data analytics, blockchain technology, and machine learning, financial institutions are exploring innovative solutions to strengthen their AML frameworks and mitigate risks effectively. The ongoing evolution in AML practices underscores the need for continuous collaboration among stakeholders, regulators, and technology providers to stay ahead of financial crimes and ensure a compliant ecosystem.

Regulatory Challenges in Nigeria 🇳🇬

Navigating the landscape of AML compliance in Nigeria presents a unique set of hurdles. The evolving regulatory framework requires a delicate balance to ensure effective oversight without stifling innovation. Keeping pace with technological advancements while meeting stringent AML requirements remains a significant challenge for industry players. Moreover, the lack of standardized practices and inconsistent enforcement further complicates the compliance landscape, necessitating a proactive approach to address these regulatory challenges.

Impact of Bitcoin on Financial Landscape 💰

Bitcoin’s influence on the financial landscape is undeniable, revolutionizing traditional concepts of money and challenging conventional banking systems. Its decentralized nature and borderless transactions have the potential to empower individuals financially, transcending geographical boundaries and banking restrictions. The increased adoption of Bitcoin is reshaping the global economy, prompting financial institutions to rethink their strategies and adapt to the evolving digital era. This digital currency not only provides financial inclusivity to the unbanked but also fosters innovation in payment systems and financial services. As Bitcoin continues to gain momentum, its impact on the financial landscape will catalyze a shift towards a more interconnected and digitalized financial future.

Innovations in Aml Technology 🌐

Innovations in AML technology are transforming the landscape of compliance in the Nigerian Bitcoin industry. These technological advancements are paving the way for more efficient and effective methods of monitoring and preventing money laundering activities. With the rise of blockchain technology, solutions such as automated transaction monitoring, risk assessments, and identity verification are becoming more sophisticated, enhancing regulatory compliance efforts. By leveraging the power of artificial intelligence and machine learning, financial institutions are better equipped to detect suspicious transactions and mitigate potential risks proactively.

As the industry evolves, collaborations between fintech companies and regulatory bodies are crucial to staying ahead of emerging threats and ensuring robust AML practices. By embracing innovative technologies and fostering partnerships, the Nigerian Bitcoin industry is poised to strengthen its compliance framework and safeguard against illicit financial activities. For further insights on how AML regulations are shaping the global cryptocurrency landscape, explore the article on bitcoin anti-money laundering (AML) regulations in New Zealand.

Collaborations for Effective Compliance 🤝

Collaborations between financial institutions, regulatory bodies, and technology providers play a pivotal role in ensuring effective AML compliance within the Nigerian Bitcoin industry. By working together, these stakeholders can share expertise, resources, and best practices to stay ahead of evolving regulatory requirements and combat financial crimes. Such partnerships foster a collaborative approach to compliance, allowing for the development of innovative solutions and the establishment of industry standards. Through these collaborations, the Nigerian Bitcoin industry can strengthen its resilience against illicit activities and enhance trust among stakeholders, paving the way for a more secure and transparent financial ecosystem.

Future Trends and Predictions 🔮

As the Nigerian Bitcoin industry continues to evolve, future trends and predictions suggest a shift towards more robust AML practices and increased regulatory scrutiny. Greater emphasis is expected on the development and implementation of innovative technologies to enhance compliance measures in the face of emerging challenges. Collaborations among industry stakeholders are likely to play a pivotal role in shaping the future landscape of AML compliance, fostering a more cohesive and effective approach towards mitigating risks associated with cryptocurrency transactions. These anticipated trends highlight the industry’s proactive response towards enhancing transparency and accountability in alignment with global standards and best practices.

For further insights into Bitcoin AML regulations in Nigeria and Mozambique, you can refer to the official documentation on bitcoin anti-money laundering (AML) regulations in Nigeria.