Understanding the Latest Aml Regulations in Netherlands 🇳🇱

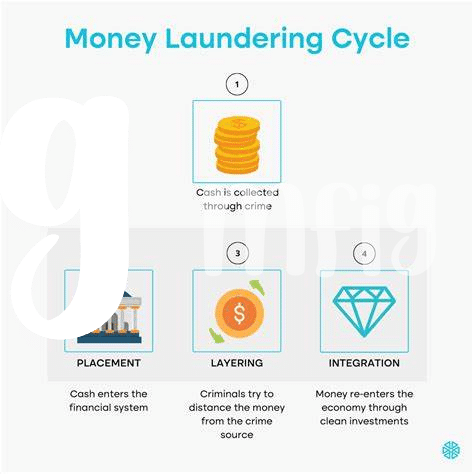

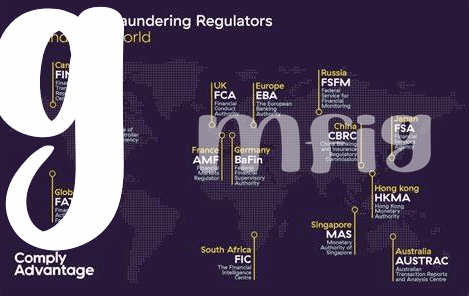

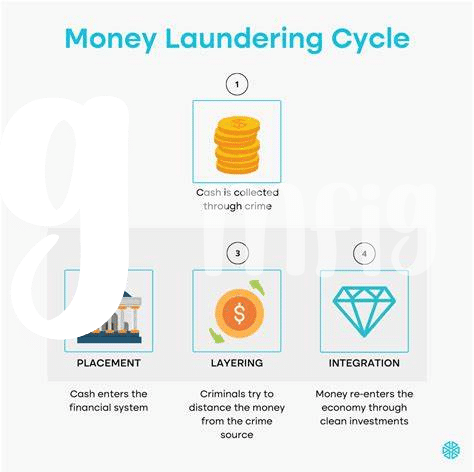

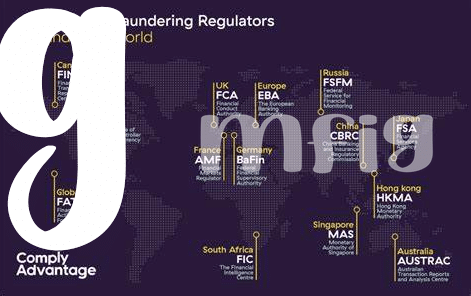

The Netherlands has recently implemented new Anti-Money Laundering (AML) regulations to combat illicit activities within the cryptocurrency space. Understanding these latest guidelines is crucial for Bitcoin wallet providers operating in the country. The AML regulations in the Netherlands aim to enhance transparency, accountability, and security within the digital asset industry, promoting greater trust and credibility among users and authorities alike. Compliance with these regulations is essential to ensure that Bitcoin wallet providers maintain a high standard of integrity and ethics in their operations, safeguarding against potential risks and fraudulent activities. Staying abreast of the latest AML requirements helps companies navigate the evolving regulatory landscape and demonstrates their commitment to upholding best practices in financial crime prevention.

Impact on Bitcoin Wallet Providers 💰

Bitcoin wallet providers are experiencing a significant shift due to the latest AML guidelines in the Netherlands. These regulations are reshaping how these providers operate, emphasizing the need for robust compliance measures. As a result, wallet providers are revamping their processes to adhere to these stringent requirements, which has a direct impact on how users interact with and use their digital assets. This regulatory landscape is prompting wallet providers to enhance their systems to ensure transparency and adherence to AML protocols, ultimately fostering trust and confidence among users.

Compliance Challenges and Solutions 🛡️

Navigating the complex landscape of AML regulations can pose significant challenges for Bitcoin wallet providers. From understanding the intricate requirements to ensuring full compliance, the journey can be daunting. However, with proactive measures and robust solutions in place, providers can address these challenges effectively. Implementing streamlined processes, conducting regular audits, and employing cutting-edge technologies are key steps towards achieving compliance. By staying proactive and adaptive, wallet providers can mitigate risks and safeguard against potential regulatory pitfalls.

Customer Due Diligence Processes 🕵️♂️

Customer Due Diligence Processes are essential steps taken by Bitcoin wallet providers to verify the identity of their users and assess the risks associated with their transactions. This involves collecting and analyzing information such as personal details, source of funds, and transaction history to ensure compliance with the latest AML regulations. By implementing robust due diligence processes, providers can mitigate the risk of financial crimes and protect their platforms from being used for illicit activities.

Ensuring thorough customer due diligence not only helps in complying with regulatory requirements but also enhances the trust and transparency within the Bitcoin ecosystem. It empowers providers to build a stronger relationship with their users, safeguard the integrity of their services, and contribute to a safer and more secure environment for digital transactions. For practical tips on staying AML compliant with Bitcoin, you can explore the detailed guidance on bitcoin anti-money laundering (AML) regulations in Nigeria provided by WikiCrypto News.

Importance of Transaction Monitoring 🔄

Transaction monitoring plays a crucial role in the realm of AML compliance for Bitcoin wallet providers. By closely observing transactions, suspicious activities can be detected and prevented, safeguarding the integrity of the financial system. Monitoring transactions not only ensures regulatory adherence but also fosters trust among users, showcasing a commitment to combating illicit financial activities. It acts as a proactive measure, enabling timely intervention and mitigation of potential risks. Embracing robust transaction monitoring practices empowers Bitcoin wallet providers to uphold transparency, accountability, and security within their operations, contributing to a safer and more resilient ecosystem for digital asset transactions.

Future Outlook for Aml in Bitcoin Industry 🔮

As the Bitcoin industry continues to evolve, the future outlook for AML within this sector is poised for significant developments. Anticipated advancements in technology and regulatory frameworks are expected to shape how AML guidelines are implemented and enforced in the realm of Bitcoin transactions. This evolving landscape underscores the importance of continuous monitoring and adaptation to ensure compliance with AML regulations while fostering innovation in the industry.

In navigating these changes, stakeholders in the Bitcoin ecosystem must remain vigilant and proactive in addressing emerging AML challenges and integrating robust compliance measures. By staying abreast of evolving AML regulations and embracing technological solutions, Bitcoin wallet providers can be better equipped to meet regulatory requirements and maintain the integrity of the cryptocurrency environment.