Overview of Bitcoin Aml Regulations 🌏

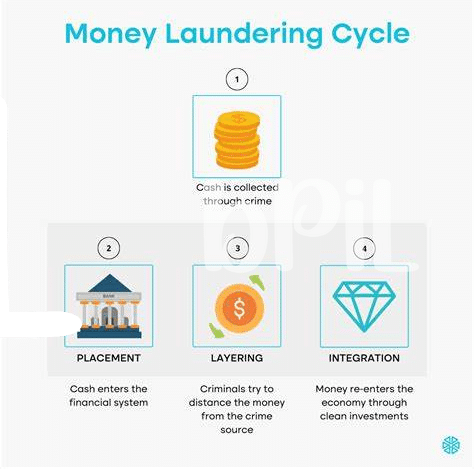

Bitcoin AML regulations have become a focal point in the global financial landscape, shaping how virtual currencies are utilized and monitored. These regulations aim to enhance transparency and security within the digital asset realm, safeguarding against illicit activities such as money laundering and terrorist financing. By imposing identity verification and transaction monitoring requirements, authorities strive to strike a balance between fostering innovation and mitigating financial crime risks.

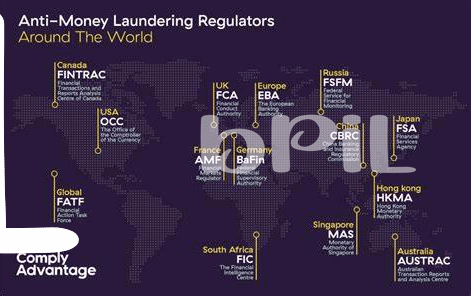

Across jurisdictions, the implementation of Bitcoin AML rules varies, reflecting the diverse approaches taken by governments worldwide. While some regions have embraced stringent measures to fortify their financial systems, others are deliberating on the optimal regulatory framework to govern cryptocurrencies effectively. As digital assets continue to gain traction, the evolution of AML regulations is poised to influence the trajectory of the crypto market, underscoring the importance of proactive compliance efforts in this dynamic landscape.

Impact of Aml Rules on Cryptocurrency Market 💰

The implementation of Anti-Money Laundering (AML) rules has significantly influenced the cryptocurrency market, creating a landscape where transparency and compliance are paramount. With AML regulations in place, cryptocurrency exchanges and businesses are required to adhere to strict protocols, impacting their operations and customer interactions. The push for compliance has led to increased scrutiny on transactions, enhancing security measures within the sector. However, these regulations also pose challenges in terms of operational efficiency and customer convenience.

Compliance Challenges Faced by New Zealand Businesses 🤯

New Zealand businesses operating in the cryptocurrency space often find themselves navigating a complex web of compliance challenges. From stringent anti-money laundering (AML) regulations to the ever-evolving landscape of digital assets, staying on the right side of the law requires a delicate balance of vigilance and expertise. Implementing robust Know Your Customer (KYC) protocols, conducting thorough due diligence on transaction parties, and ensuring compliance with reporting requirements are just a few of the hurdles that businesses must overcome to remain in compliance with Bitcoin AML rules. Additionally, the cross-border nature of cryptocurrency transactions adds another layer of complexity, as businesses must adhere to not only local regulations but also international AML standards to mitigate the risk of financial crimes. Despite these challenges, proactive measures such as engaging with regulators, investing in compliance technology, and fostering a culture of transparency can help New Zealand businesses navigate the intricate regulatory landscape and build trust with stakeholders.

Government Initiatives to Regulate Bitcoin Aml 🏛️

Government initiatives play a crucial role in shaping the landscape of Bitcoin AML regulations in various countries. In New Zealand, authorities have been actively working to establish robust frameworks to regulate the use of cryptocurrency in anti-money laundering efforts. By implementing stringent guidelines and monitoring mechanisms, the government aims to enhance transparency and security within the cryptocurrency sector. These initiatives are pivotal in safeguarding against illicit activities while fostering a more compliant and trustworthy environment for digital asset transactions. Learn more about global approaches to Bitcoin AML regulations in Nauru on WikiCrypto News.

Future Trends in Bitcoin Aml Compliance 🚀

As the landscape of digital assets constantly evolves, the future trends in Bitcoin AML compliance are poised to shape the regulatory framework significantly. One key aspect that is expected to gain prominence is the integration of advanced technological solutions, such as blockchain analytics and artificial intelligence, to enhance regulatory oversight and streamline compliance processes. Moreover, collaborative efforts between regulatory bodies, industry stakeholders, and law enforcement agencies are anticipated to strengthen, leading to more robust AML measures tailored specifically for the cryptocurrency space. This synergy is crucial in adapting to the dynamic nature of Bitcoin transactions and addressing emerging challenges in ensuring financial transparency and security.

Conclusion: Balancing Security and Innovation 🔒

In the dynamic world of Bitcoin AML regulations, striking a balance between security and innovation is paramount for sustainable growth and trust in the cryptocurrency ecosystem. As governments and businesses navigate the evolving landscape of regulatory frameworks, the focus must remain on safeguarding against illicit activities while fostering advancements that drive the industry forward. By embracing compliance measures without stifling creativity and progress, stakeholders can collectively contribute to a more secure and innovative environment for digital assets.

To learn more about Bitcoin AML regulations in Mozambique, visit the resource on bitcoin anti-money laundering (AML) regulations in Nauru.