Understanding Monaco’s Aml Regulations 🧐

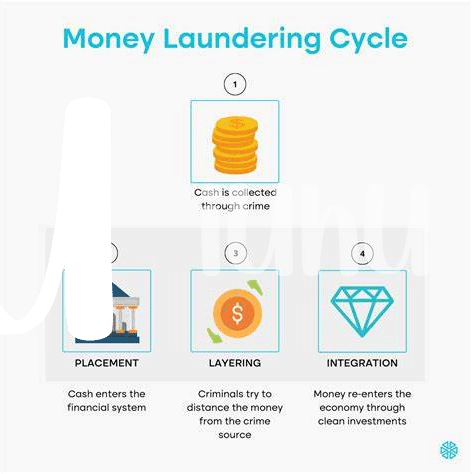

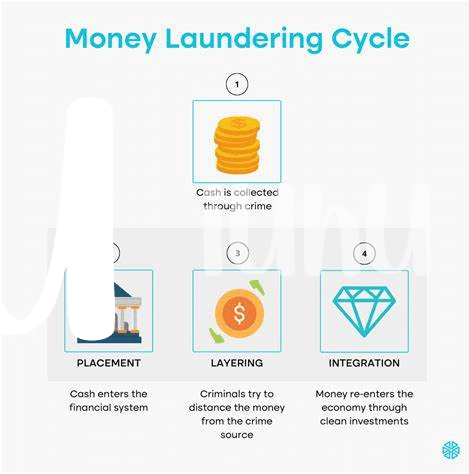

Monaco’s AML regulations play a crucial role in shaping the compliance landscape for Bitcoin startups in the region. Understanding these regulations is vital for ensuring that startups operate within the legal framework set forth by regulatory authorities. By familiarizing themselves with Monaco’s AML regulations, startups can navigate the complexities of compliance more effectively and mitigate the risk of potential sanctions or penalties for non-compliance. It is essential for startups to stay informed about any updates or amendments to these regulations to adapt their compliance strategies accordingly and maintain a strong regulatory standing.

Importance of Kyc Compliance 📝

Knowing your customer (KYC) compliance is a cornerstone in the world of Bitcoin startups, ensuring trust, security, and regulatory adherence. By verifying the identities of users, businesses can mitigate risks such as fraud, money laundering, and terrorist financing. KYC compliance not only safeguards your venture but also fosters credibility within the industry, attracting investors and customers alike. Embracing KYC practices demonstrates a commitment to transparency and integrity, essential elements for sustainable growth in the evolving landscape of cryptocurrencies. Combining efficiency with due diligence, KYC compliance sets the foundation for a resilient and ethical business framework.

Leveraging Blockchain Technology for Transparency 🔗

Blockchain technology has revolutionized the way information is stored and verified, offering a level of transparency that was previously unprecedented. By utilizing blockchain technology, Bitcoin startups in Monaco can showcase a clear and immutable record of transactions, enhancing transparency within their operations. This not only helps in building trust with clients and investors but also ensures compliance with regulatory requirements, demonstrating a commitment to upholding the highest standards of integrity and accountability. Additionally, the decentralized nature of blockchain technology adds an extra layer of security, safeguarding sensitive data and mitigating the risk of fraud or manipulation. Leveraging blockchain for transparency not only aligns businesses with regulatory expectations but also reinforces their reputation as trustworthy entities in the evolving landscape of digital finance.

Building Trust with Regulatory Authorities 💼

Building trust with regulatory authorities is crucial for Bitcoin startups in Monaco. By demonstrating a commitment to compliance and transparency, businesses can establish a positive relationship with the governing bodies. Proactive communication, adherence to AML regulations, and willingness to collaborate can help foster trust and credibility. Maintaining open channels of dialogue and consistently meeting regulatory expectations are key in building a strong partnership with the authorities. This collaboration not only ensures legal compliance but also paves the way for long-term success in the evolving landscape of cryptocurrency regulation.

Implementing Robust Security Measures 🔒

In the fast-paced world of cryptocurrency startups, ensuring robust security measures is paramount. Safeguarding sensitive data and digital assets against potential threats requires a multi-faceted approach. From encryption protocols to stringent access controls, the implementation of a comprehensive security framework is essential to mitigate risks and build trust with users and stakeholders. By proactively addressing vulnerabilities and staying vigilant against emerging cyber threats, Bitcoin startups in Monaco can fortify their defenses and uphold the integrity of their operations. Prioritizing security not only fosters a safe environment for transactions but also demonstrates a commitment to compliance and safeguarding the interests of all parties involved.

Staying Updated on Evolving Compliance Requirements 🔄

Staying current with the evolving landscape of compliance requirements is crucial for Bitcoin startups in Monaco. By regularly monitoring and adapting to changes in regulations, companies can proactively address any potential issues before they escalate. This proactive approach not only ensures compliance but also demonstrates a commitment to transparency and accountability. Keeping abreast of new guidelines and industry best practices enables startups to navigate the complex regulatory environment effectively and stay ahead of potential risks. Investing in continuous education and maintaining open communication channels with regulatory authorities are key strategies for upholding compliance standards in the dynamic realm of cryptocurrency operations.

To delve deeper into Bitcoin anti-money laundering (AML) regulations in Morocco, click on this link: Bitcoin anti-money laundering (AML) regulations in Mexico.