Overview of Moldova’s Cryptocurrency Regulations 🇲🇩

Moldova has adopted a proactive stance towards cryptocurrency regulations, aiming to create a clear framework for digital asset transactions within its borders. By implementing guidelines and standards, Moldova seeks to enhance transparency and security in cryptocurrency activities. The regulatory landscape in Moldova reflects a balance between fostering innovation in the blockchain space while safeguarding against potential risks such as money laundering and terrorist financing. This approach signals the country’s commitment to embracing digital currencies responsibly and positioning itself as a progressive player in the global crypto market.

Impact of Bitcoin on the Moldovan Economy 💰

The introduction of Bitcoin has sparked significant changes in Moldova’s economic landscape. As cryptocurrency transactions gain momentum, Moldova experiences a shift in traditional financial dynamics. This digital currency has opened doors for new investment opportunities and avenues for financial growth, shaping the Moldovan economy in innovative ways. With its decentralized nature, Bitcoin offers a unique perspective on financial inclusion and accessibility, influencing Moldova’s economic trajectory. As the country navigates this evolving landscape, the impact of Bitcoin continues to resonate across various sectors, illustrating a transformative wave in the Moldovan economy.

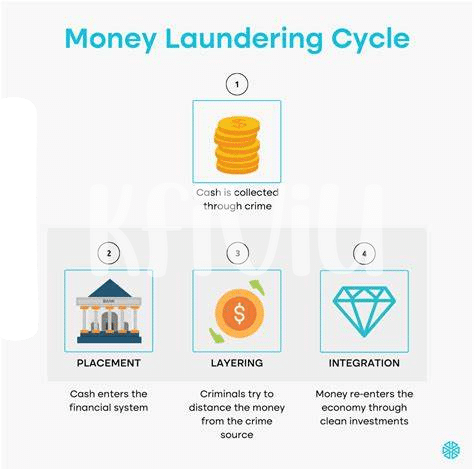

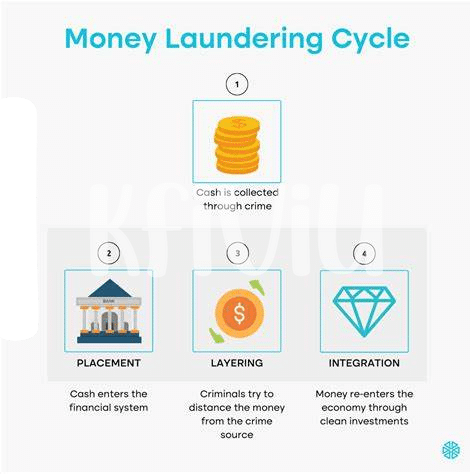

Challenges Faced in Implementing Aml Measures ⚖️

Implementing anti-money laundering measures poses significant challenges in Moldova’s evolving cryptocurrency landscape. The country struggles with ensuring compliance while balancing innovation and regulatory stringency. The decentralized and pseudonymous nature of cryptocurrencies complicates traditional AML efforts, requiring adaptability and technological expertise. Limited resources and expertise further hinder effective implementation, highlighting the need for capacity building and international cooperation. Overcoming these hurdles is crucial to fostering a secure and transparent crypto ecosystem in Moldova and safeguarding against illicit financial activities.

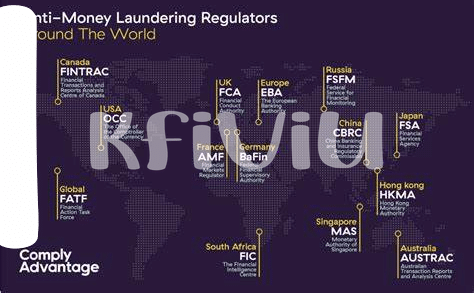

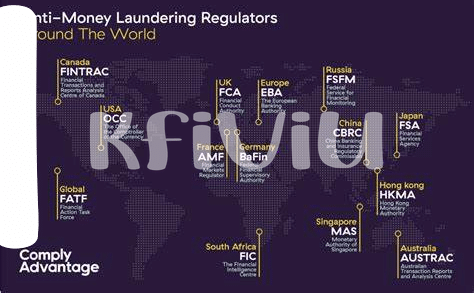

Comparison with Global Approaches to Crypto Regulation 🌎

When exploring Moldova’s approach to regulating cryptocurrency transactions, it’s insightful to compare it with global approaches. Various countries worldwide have varying policies and frameworks in place to monitor and control crypto transactions. Some nations have adopted strict regulations to ensure financial security, while others have opted for more lenient approaches to foster innovation in the blockchain space. Understanding the similarities and differences in global crypto regulation can provide valuable insights for Moldova in refining its own regulatory framework. For further insights on how countries like Monaco are addressing Bitcoin anti-money laundering (AML) regulations, check out this informative article on bitcoin anti-money laundering (AML) regulations in Monaco.

Future Prospects for Cryptocurrency in Moldova 🚀

In Moldova, the growing interest in cryptocurrency presents promising avenues for economic development and financial inclusion. As the regulatory landscape evolves, there is an opportunity for Moldova to position itself as a hub for blockchain innovation in the region. By fostering a supportive environment for crypto businesses and investors, Moldova can attract capital and talent, driving technological advancements and job creation in the sector. Furthermore, embracing cryptocurrency can enhance financial accessibility for unbanked populations, enabling more seamless and secure transactions domestically and internationally.

Recommendations for a Robust Regulatory Framework 🔒

Moldova’s journey towards a robust regulatory framework for cryptocurrencies requires a balanced approach that fosters innovation while safeguarding against illicit activities. Implementing clear guidelines for cryptocurrency exchanges and service providers is crucial to ensure compliance with anti-money laundering (AML) measures. Additionally, enhancing cooperation between government agencies, financial institutions, and international bodies can strengthen the oversight of cryptocurrency transactions, promoting a more secure and transparent ecosystem.

To further reinforce the regulatory framework, continuous monitoring and assessment of emerging risks in the cryptocurrency landscape are essential. Regular updates and refinements to existing regulations based on evolving technologies and market dynamics can help Moldova stay ahead in the global crypto regulatory landscape. By prioritizing communication, collaboration, and adaptability, Moldova can establish a resilient framework that balances innovation with regulatory compliance.

Insert the link to Bitcoin anti-money laundering (AML) regulations in Mongolia with the anchor text “bitcoin anti-money laundering (AML) regulations in Morocco” using