Aml Regulations in Malta 🇲🇹

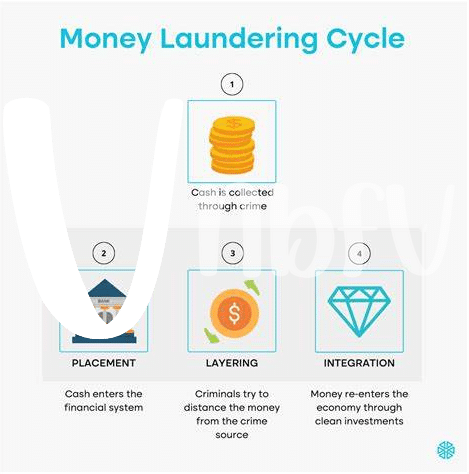

AML regulations in Malta are designed to ensure that financial activities, including those involving cryptocurrencies like Bitcoin, adhere to strict guidelines to prevent money laundering and the financing of illegal activities. Malta has established a comprehensive framework that requires businesses operating in the cryptocurrency space to implement robust AML and KYC practices. By complying with these regulations, Bitcoin users can contribute to a safer and more transparent financial ecosystem within the country. It is essential for individuals and businesses involved in cryptocurrency transactions to familiarize themselves with these regulations to avoid potential penalties and maintain compliance with Maltese law. Investing time and effort in understanding and adhering to AML regulations can help safeguard both the reputation of the cryptocurrency industry and the interests of all parties involved.

Implications for Bitcoin Users 💰

When it comes to navigating the AML landscape in Malta, Bitcoin users must be aware of the regulatory framework that governs their transactions. Understanding how AML regulations apply to cryptocurrency dealings can help users stay compliant and avoid potential pitfalls. By being proactive in their approach and staying informed about the reporting requirements for crypto transactions, Bitcoin users can protect themselves from facing penalties for non-compliance. It is essential for users to consider the implications of these regulations on their Bitcoin activities and take necessary steps to ensure they are operating within the legal boundaries. Additionally, leveraging available resources can aid Bitcoin users in staying abreast of any changes or updates to AML laws that may impact their transactions.

Reporting Requirements for Crypto Transactions 📑

Crypto transactions in Malta are subject to stringent reporting requirements, necessitating thorough documentation and transparency. This process involves providing detailed information about the nature of the transaction, the parties involved, and the source of funds. Additionally, reporting obligations extend to suspicious activities, ensuring that potential illicit behavior is promptly flagged and investigated. By adhering to these reporting requirements, Bitcoin users can demonstrate their commitment to compliance and contribute to the overall integrity of the cryptocurrency ecosystem. These obligations not only enhance regulatory oversight but also play a crucial role in safeguarding against financial crimes within the digital asset space.

Penalties for Non-compliance 🚫

Penalties for non-compliance with AML regulations in Malta can have serious repercussions for Bitcoin users. Violations may result in hefty fines, legal action, or even the suspension of operations. It is crucial for individuals involved in cryptocurrency transactions to be aware of and adhere to the established guidelines to avoid facing these potential penalties. Staying informed about the evolving regulatory landscape and implementing robust compliance measures are essential steps towards mitigating risks and ensuring a smooth operation within the legal framework. For further insights on risk assessment strategies in the Bitcoin sector, refer to the resource provided on bitcoin anti-money laundering (AML) regulations in Marshall Islands.

Key Considerations for Bitcoin Users 🧐

Bitcoin users in Malta should prioritize understanding their AML obligations to ensure compliance with regulations. Keeping detailed records of transactions, conducting thorough due diligence on counterparties, and staying informed about regulatory updates are crucial. Implementing robust internal controls and risk management practices can help mitigate potential compliance risks.

Additionally, maintaining open communication with regulatory authorities and seeking professional advice when needed can further support Bitcoin users in navigating the evolving AML landscape. By staying proactive and adhering to best practices, Bitcoin users can build trust within the regulatory framework and contribute to a more secure and compliant crypto ecosystem.

Resources for Staying Compliant 📚

Resources for Staying Compliant 📚: Staying updated on AML policies and requirements is crucial for Bitcoin users in Malta. To help navigate this landscape, utilizing resources such as the Malta Financial Services Authority (MFSA) website can provide valuable insights. Additionally, engaging with industry forums and attending relevant workshops can offer practical advice and best practices for maintaining compliance.

For a comprehensive overview of Bitcoin AML regulations in various jurisdictions, including Liechtenstein, visit the official resource on bitcoin anti-money laundering (AML) regulations in Malta using the bitcoin anti-money laundering (AML) regulations in Liechtenstein.