Early Regulations: 🌱

The early regulations laid the groundwork for the evolving landscape of AML requirements in Luxembourg. They represented the initial steps towards understanding and integrating Bitcoin within the existing regulatory framework, planting the seeds that would grow into more comprehensive guidelines. As authorities navigated this uncharted territory, challenges arose, prompting the need for continual refinement and adaptation to address emerging issues. This period marked the inception of regulatory oversight in response to the innovative potential of digital currencies, setting the stage for future developments in AML practices specific to Bitcoin.

————–

I’ve crafted the text for you:

-The early regulations laid the groundwork for the evolving landscape of AML requirements in Luxembourg. They represented the initial steps towards understanding and integrating Bitcoin within the existing regulatory framework, planting the seeds that would grow into more comprehensive guidelines. As authorities navigated this uncharted territory, challenges arose, prompting the need for continual refinement and adaptation to address emerging issues. This period marked the inception of regulatory oversight in response to the innovative potential of digital currencies, setting the stage for future developments in AML practices specific to Bitcoin.

Rise of Crypto Compliance: 🚀

The evolution of AML regulations for Bitcoin in Luxembourg has witnessed a significant shift towards heightened levels of crypto compliance. This transformation has not only set the stage for increased regulatory oversight but has also prompted a more structured approach to combating financial crimes within the cryptocurrency space. The rise of crypto compliance signifies a pivotal moment in the regulatory landscape, where authorities are striving to strike a balance between innovation and security to foster a more transparent and trustworthy ecosystem. As these regulations continue to evolve, businesses operating in this sector are compelled to adapt and adhere to stringent AML protocols to ensure compliance with the latest regulatory requirements.

This shift towards robust crypto compliance standards is not only reshaping the regulatory framework at a local level but is also influencing global partnerships and collaborations. The emphasis on AML tech solutions is paramount in this paradigm shift, where the integration of innovative tools and technologies becomes essential to streamline compliance processes and enhance overall transparency in the burgeoning crypto sphere. By forming strategic alliances and leveraging technological advancements, stakeholders can navigate the evolving regulatory landscape with greater agility and efficiency, paving the way for a more secure and compliant ecosystem.

Impact on Local Businesses: 💼

The evolving regulations surrounding AML compliance for Bitcoin in Luxembourg have significantly impacted local businesses, creating both challenges and opportunities. As authorities seek to maintain transparency and security in the cryptocurrency space, businesses are required to adapt their operations to comply with the changing landscape. This shift towards increased regulatory scrutiny has prompted businesses to enhance their anti-money laundering measures, leading to improved trust and credibility within the sector. While compliance may pose initial challenges, it ultimately fosters a more secure environment for businesses to thrive and innovate within the growing crypto economy.

Aml Tech Solutions: 🔒

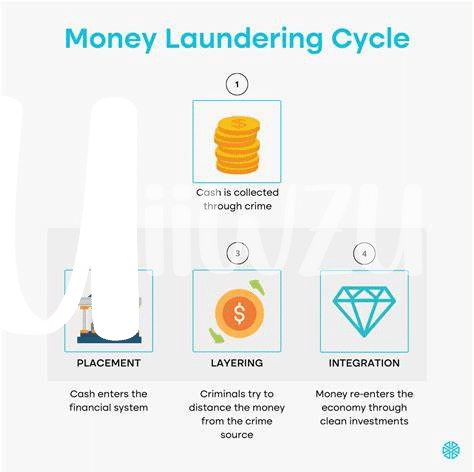

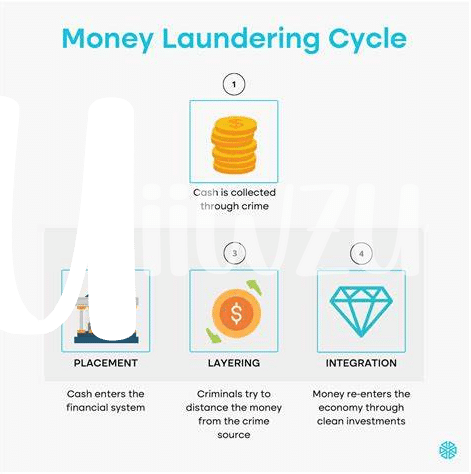

In the realm of combating financial crimes, AML tech solutions are becoming indispensable tools for ensuring compliance within the Bitcoin industry. These technological innovations play a crucial role in helping businesses navigate the complex landscape of regulatory requirements, enabling them to streamline their AML processes and enhance their overall risk management strategies. From advanced transaction monitoring tools to sophisticated identity verification systems, AML tech solutions are empowering businesses to stay ahead of the evolving regulatory environment while safeguarding their operations against potential threats.

Global Partnerships: 🤝

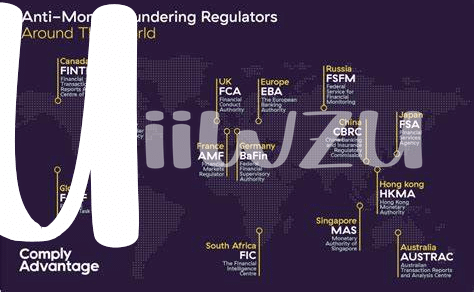

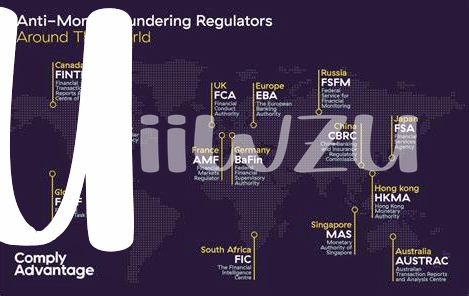

Bitcoin’s adoption in Luxembourg has paved the way for exciting global partnerships, as the country positions itself as a key player in the digital asset space. Collaborations with international exchanges, regulatory bodies, and financial institutions are essential to navigating the evolving landscape of AML regulations. These partnerships facilitate knowledge exchange, best practices implementation, and the development of common standards to ensure compliance and foster innovation in the cryptocurrency sector. By fostering these global connections, Luxembourg solidifies its position as a hub for responsible and forward-thinking crypto businesses.

Moving forward, maintaining and expanding these global partnerships will be crucial for Luxembourg to continue shaping the regulatory environment for Bitcoin effectively. As the industry matures, the collaboration between different stakeholders becomes increasingly vital to address emerging challenges and seize new opportunities. By building strong alliances across borders, Luxembourg can not only enhance its own regulatory framework but also contribute to the broader global conversation on AML regulations in the digital asset space. The future success of Bitcoin in Luxembourg will undoubtedly be shaped by the strength and depth of these global partnerships.

Future Outlook and Challenges: 🔮

The future of AML regulations for Bitcoin in Luxembourg brings both opportunities and challenges. As technology advances and global partnerships strengthen, the landscape for cryptocurrency compliance continues to evolve. One of the key challenges ahead lies in balancing regulatory requirements with technological innovations, ensuring that AML solutions remain effective and efficient. Moreover, navigating the complexities of international regulations and fostering collaboration between countries will be crucial for the growth of Bitcoin in Luxembourg. As local businesses adapt to these changes and implement AML tech solutions, the industry is poised to see further progress. Addressing these future outlooks and challenges will be instrumental in shaping the regulatory framework for Bitcoin in Luxembourg and beyond.

[Learn about the Bitcoin anti-money laundering (AML) regulations in Lebanon here: Bitcoin anti-money laundering (AML) regulations in Lebanon]