Current Status of Bitcoin Aml Regulations 🌐

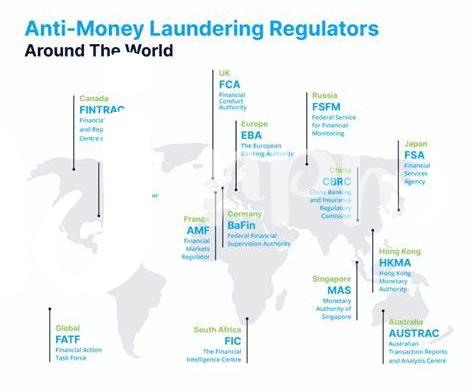

The current landscape of Bitcoin Aml regulations in Latvia signifies a growing awareness of the need for oversight in the digital currency realm. Authorities are increasingly emphasizing the importance of Anti-Money Laundering (AML) measures to mitigate risks associated with Bitcoin transactions. As the adoption of cryptocurrencies rises, regulators are striving to strike a balance between facilitating innovation and safeguarding against illicit activities within the Bitcoin ecosystem. This evolving regulatory framework underscores the necessity of adapting to the dynamic nature of virtual currencies, reflecting a broader trend of regulatory maturation in the fintech sector.

Challenges Faced by Bitcoin Users and Regulators 💡

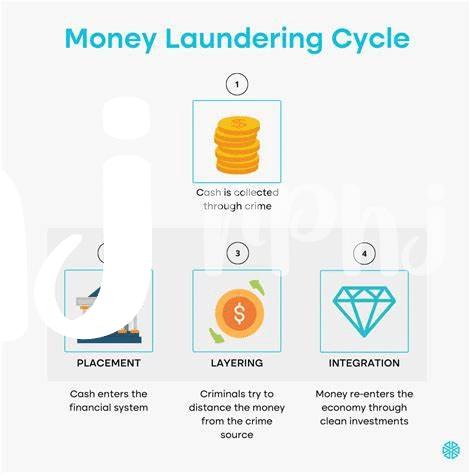

Bitcoin operates in a dynamic landscape where both users and regulators encounter a variety of challenges. For Bitcoin users, the decentralization of the currency can lead to vulnerabilities in security and a lack of recourse in cases of fraud or theft. On the regulatory side, the borderless nature of cryptocurrencies creates difficulties in enforcement and monitoring transactions for illicit activities. Striking a balance between fostering innovation and ensuring compliance remains a key obstacle for both parties involved.

Impact of Aml Regulations on Bitcoin Market 🔍

The introduction of AML regulations into the Bitcoin market in Latvia has sparked a wave of changes, creating a more transparent and accountable environment. The increased scrutiny and compliance requirements have led to a shift in how Bitcoin is traded and utilized. Market participants have been forced to adapt to the new regulatory landscape, with some embracing the changes while others have faced challenges in maintaining their operations. Despite initial resistance, the impact of AML regulations has ultimately helped to bolster trust and legitimacy within the Bitcoin market, paving the way for greater adoption and acceptance by a wider range of users and institutions.

Innovations in Aml Technology for Bitcoin 🚀

In the ever-evolving landscape of Bitcoin Aml technology, advancements continue to shape the way transactions are monitored and regulated. From sophisticated algorithms to blockchain analytics, these innovations are revolutionizing the detection and prevention of illicit activities within the cryptocurrency space. With an increased focus on transparency and accountability, the integration of cutting-edge Aml tools is paving the way for a more secure and compliant Bitcoin ecosystem. To delve deeper into the role of regulatory authorities in Bitcoin Aml oversight, explore the comprehensive insights provided by Wikicrypto News on bitcoin anti-money laundering (aml) regulations in Laos.

Future Predictions for Bitcoin Aml in Latvia 🌟

The evolving landscape of Bitcoin AML in Latvia reveals a path towards increased collaboration between regulators and industry players. As technology advances, we anticipate more sophisticated tools for compliance and risk management that cater to the unique challenges of the cryptocurrency realm. In the future, we foresee a balanced approach where AML regulations adapt to the dynamic nature of Bitcoin transactions while fostering innovation in the market. With a proactive stance on regulatory updates and a commitment to ethical practices, stakeholders can navigate the evolving AML landscape in Latvia with resilience and adaptability towards a more secure and transparent Bitcoin ecosystem.

Strategies for Compliance and Risk Management 🛡️

When it comes to navigating the landscape of Bitcoin AML regulations in Latvia, having robust strategies for compliance and risk management is crucial. Implementing thorough due diligence procedures, incorporating advanced monitoring technologies, and fostering a culture of compliance are key components to staying ahead in this rapidly evolving space. By proactively engaging with regulatory updates and investing in training for staff members, organizations can effectively mitigate risks and ensure adherence to the changing AML landscape. Embracing these strategies not only safeguards against potential pitfalls but also fosters a reputation of trust and integrity within the industry.