Understanding the Basics 💡

Bitcoin and other cryptocurrencies have gained significant attention in the investment world. To navigate this innovative landscape effectively, it is crucial to grasp the fundamental aspects surrounding these digital assets. Understanding how Bitcoin functions, its decentralized nature, and the technology behind it are key to making informed investment decisions. Additionally, grasping the importance of private keys, wallets, and exchanges is essential for engaging in transactions securely and proficiently. Familiarizing oneself with the basic concepts of cryptocurrency is the first step towards becoming a savvy Bitcoin investor.

A sound comprehension of the fundamentals can empower investors to navigate the dynamic and ever-evolving cryptocurrency market with confidence. By acquiring a solid foundation in the basics, individuals can mitigate risks, maximize opportunities, and make informed decisions when venturing into the world of Bitcoin. Whether exploring blockchain technology or assessing the potential of digital currencies, a clear understanding of the basics lays the groundwork for successful engagement in the realm of cryptocurrency investments.

Risks and Compliance Challenges 💼

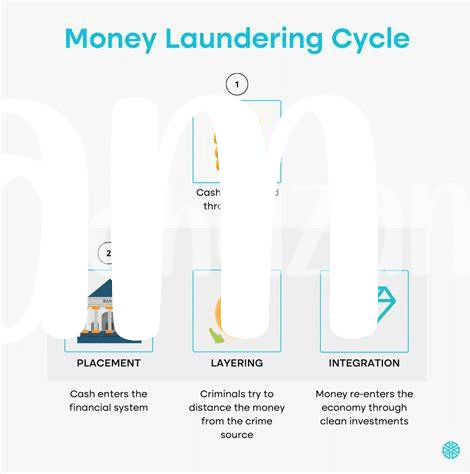

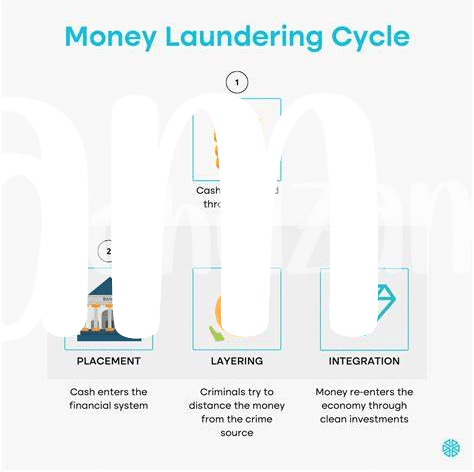

Navigating the legal landscape in the realm of Bitcoin investment brings forth numerous challenges that investors must be aware of. One primary concern is the ever-evolving nature of risks associated with cryptocurrencies, including potential market fluctuations and regulatory uncertainties. Maintaining compliance with Anti-Money Laundering (AML) regulations poses another hurdle for investors, as the decentralized and pseudonymous nature of Bitcoin transactions can make tracking and verifying sources of funds a complex task. Staying abreast of the evolving compliance landscape is crucial to mitigate these risks effectively and ensure a secure investment environment for all stakeholders involved.

Addressing these challenges requires a multifaceted approach that combines proactive risk management strategies with a thorough understanding of regulatory requirements. Implementing robust AML compliance measures not only safeguards investors against potential illicit activities but also fosters trust and transparency within the Bitcoin investment ecosystem. By embracing best practices and leveraging technological solutions to enhance compliance efforts, investors can navigate these challenges successfully and contribute to the continued growth and legitimacy of the digital asset industry.

Importance of Aml Regulations 📝

– In the fast-paced world of cryptocurrency investments, it’s crucial to recognize the pivotal role that Anti-Money Laundering (AML) regulations play. These regulations are designed to safeguard the integrity of financial systems by combating illicit activities such as money laundering and terrorist financing. By adhering to AML regulations, investors not only protect themselves from legal repercussions but also contribute to the overall security and stability of the burgeoning digital asset market.

Best Practices for Clients 💰

When it comes to navigating the world of Bitcoin investments, clients must adhere to the best practices to ensure compliance and security. One key practice is always conducting thorough due diligence before engaging in any transactions. This includes verifying the legitimacy of the parties involved and the source of funds. Additionally, implementing robust Know Your Customer (KYC) procedures can help mitigate potential risks and maintain transparency. By staying informed and proactive in their approach, clients can safeguard their investments and contribute to a more secure cryptocurrency ecosystem. For more insights on anti-money laundering measures related to Bitcoin in Kazakhstan, check out this informative article on bitcoin anti-money laundering (aml) regulations in Kazakhstan.

Role of Financial Institutions 🏦

Financial institutions play a crucial role in the Bitcoin investment landscape. As gatekeepers of the traditional financial system, they are tasked with ensuring compliance with AML regulations to curb money laundering and illicit activities. By implementing robust monitoring and reporting mechanisms, financial institutions not only protect themselves from regulatory scrutiny but also instill trust and credibility in the cryptocurrency market. Their collaboration with regulators and industry stakeholders is vital in shaping a secure and reliable environment for Bitcoin investors. Embracing innovative technologies and proactive risk management practices, financial institutions can foster a sustainable ecosystem that encourages responsible participation in the digital asset space.

Future Trends and Opportunities 🚀

In the dynamic landscape of Bitcoin investing, future trends and opportunities are ripe for exploration. As technology continues to evolve, new avenues for growth and innovation emerge, presenting investors with potential pathways to navigate and capitalize on. From advancements in blockchain technology to shifting regulatory environments, staying informed and adaptable will be key in seizing the opportunities that lie ahead.

For further insights into Bitcoin anti-money laundering (AML) regulations, check out the detailed guidelines in Israel and Jamaica. Bitcoin anti-money laundering (AML) regulations in Jamaica