Understanding the Importance of Aml Regulations 🧐

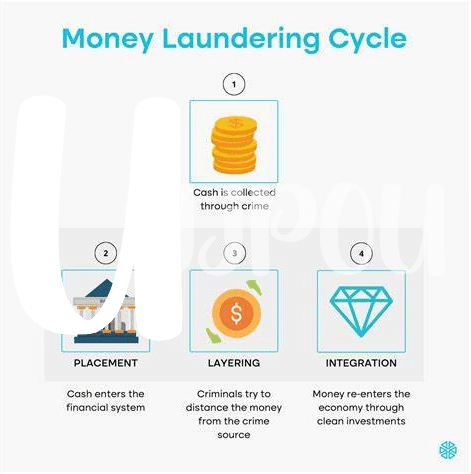

Amidst the ever-evolving landscape of financial transactions, Anti-Money Laundering (AML) regulations play a pivotal role in safeguarding against illicit activities. By understanding the importance of AML regulations, individuals and businesses gain insight into the crucial framework designed to combat money laundering and terrorist financing. These regulations not only foster trust in the financial system but also uphold integrity and transparency in transactions. Embracing AML requirements is not merely a legal obligation but a strategic move towards a more secure and sustainable financial ecosystem.

Key Components of Aml Requirements in Guinea 💼

In Guinea, understanding the framework of Anti-Money Laundering (AML) regulations is crucial for navigating the Bitcoin landscape effectively. The regulatory landscape in Guinea necessitates several key components to be adhered to when it comes to AML requirements. Compliance with customer due diligence, record-keeping, and reporting obligations are integral aspects that ensure transparency and accountability within Bitcoin operations. By grasping the specifics of these AML components, businesses and individuals can operate within the legal boundaries set forth by the governing authorities.

Comprehending the nuances of AML requirements in Guinea provides the foundation for robust compliance strategies in Bitcoin transactions. These regulations serve as pillars to safeguard against illicit financial activities and promote a secure environment for engaging in digital currency exchanges. Embracing the core components of AML requirements not only fosters trust within the cryptocurrency ecosystem but also underlines the commitment to upholding regulatory standards in Guinea’s evolving financial landscape.

Impact of Non-compliance on Bitcoin Transactions 💰

Bitcoin transactions in Guinea are subject to stringent AML regulations to combat money laundering and protect against financial crimes. Failing to comply with these requirements can lead to severe consequences, disrupting the flow of transactions and potentially freezing assets. Non-compliance not only poses a risk to the integrity of the Bitcoin ecosystem but also undermines trust in the broader financial system. It is crucial for individuals and entities engaged in Bitcoin transactions to prioritize AML compliance to avoid such detrimental impacts.

Strategies for Ensuring Compliance with Aml Laws ⚖️

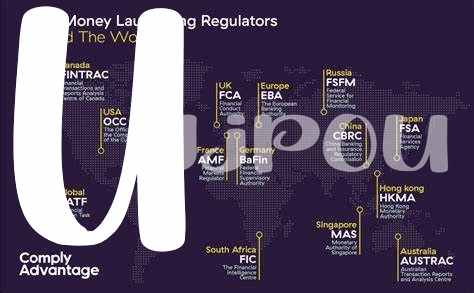

Strategies for Ensuring Compliance with AML Laws involve implementing robust monitoring systems to track and report suspicious activities, conducting regular audits to assess adherence to regulations, and providing comprehensive staff training on AML protocols. A proactive approach to compliance, coupled with clear communication of policies and procedures, can mitigate the risk of non-compliance and enhance the overall integrity of Bitcoin operations in Guinea. To delve deeper into the complexities of Bitcoin AML laws in Guyana, check out this insightful article on bitcoin anti-money laundering (AML) regulations in Honduras.

Implementing Aml Best Practices in Bitcoin Operations 🔍

Implementing AML best practices in Bitcoin operations involves establishing robust Know Your Customer (KYC) procedures, conducting thorough due diligence on customers, and implementing transaction monitoring systems. By integrating blockchain analysis tools and engaging in risk-based assessments, companies can enhance compliance efforts and mitigate potential illicit activities. Training staff on AML regulations and conducting regular audits can further strengthen internal controls. Collaboration with regulatory authorities and industry peers can also provide insights into emerging trends and enhance overall compliance measures. By prioritizing AML best practices, Bitcoin operations can safeguard against financial crimes and ensure a secure ecosystem for users.

Navigating the Future of Aml Compliance in Guinea 🚀

Navigating the future of AML compliance in Guinea involves staying proactive and adaptable to regulatory changes. As technologies evolve and financial landscapes shift, the AML framework will also continue to transform. It is essential for Bitcoin operators to remain vigilant, continuously educate themselves on new guidelines, and adapt their compliance strategies accordingly. By fostering a culture of compliance and embracing emerging technologies, businesses can navigate the evolving AML landscape with resilience and agility. Keeping abreast of regulatory updates and investing in robust compliance measures will be pivotal in ensuring long-term sustainability within the Guinea AML framework. [Bitcoin anti-money laundering (AML) regulations in Guinea-Bissau](bitcoin anti-money laundering (AML) regulations in Guinea-Bissau)