Understanding the Basics of Bitcoin and Aml 💡

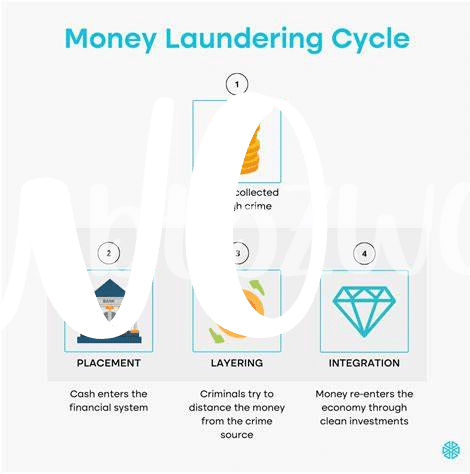

Bitcoin, the pioneering cryptocurrency that revolutionized the financial landscape, operates on a decentralized network without the need for intermediaries like banks or governments. Its underlying technology, blockchain, securely records all transactions, enhancing transparency and security. Anti-Money Laundering (AML) laws aim to prevent illicit activities such as money laundering and terrorist financing within the cryptocurrency realm. By enforcing identity verification measures and transaction monitoring, AML regulations ensure compliance with legal requirements and promote the legitimacy of Bitcoin transactions.

In the dynamic realm of Bitcoin and AML, understanding the basics is fundamental for both novice users and seasoned investors. Awareness of how Bitcoin operates and the implications of AML laws can empower individuals to navigate the evolving regulatory landscape with confidence. By grasping the core concepts of this intricate interplay between technology and financial regulations, users can engage with Bitcoin responsibly while mitigating potential risks.

Examining the Regulatory Landscape in Guyana 🌍

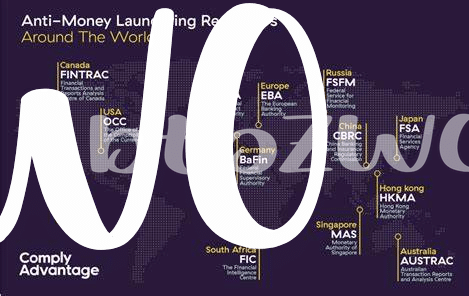

Exploring the regulatory landscape in Guyana unveils a dynamic environment where the intersection of Bitcoin and AML laws takes center stage. Amidst evolving regulations, stakeholders navigate the intricate paths of compliance, seeking clarity and alignment with global standards. As Guyana charts its course in financial oversight, the intricate weave of technology and regulatory frameworks presents both challenges and opportunities for the crypto community. Navigating this ecosystem requires a nuanced understanding of local nuances and global trends to foster innovation while upholding integrity.

Challenges Faced in Implementing Aml Laws ⚠️

Facing the implementation of AML laws in Guyana poses a unique set of challenges, especially in the context of Bitcoin transactions. The decentralized nature of cryptocurrencies like Bitcoin makes it difficult for traditional regulatory bodies to monitor and enforce compliance effectively. Additionally, the rapid pace of technological advancements in the blockchain space often outpaces regulatory frameworks, leading to gaps in oversight and potential loopholes for illicit activities.

Moreover, the global nature of Bitcoin transactions adds another layer of complexity, as regulations may vary significantly from one jurisdiction to another. This lack of uniformity in AML laws across borders further complicates efforts to combat money laundering and terrorist financing through virtual assets like Bitcoin. As a result, stakeholders in Guyana face the ongoing challenge of navigating these intricate regulatory landscapes while striving to uphold the integrity of the financial system.

Impact of Aml Regulations on Bitcoin Users 💸

The implementation of Anti-Money Laundering (AML) regulations in the realm of Bitcoin usage brings forth a significant impact on its users, both in Guyana and globally. With the primary aim of deterring illicit activities and promoting financial transparency, these regulations have the potential to enhance the legitimacy and trustworthiness of Bitcoin transactions. However, the stringent compliance requirements may pose challenges for individual users and businesses operating in this digital currency space. By navigating through the intricate landscape of AML laws and developing robust risk management strategies, Bitcoin users can adapt to the evolving regulatory environment and safeguard their financial operations. Embracing compliance measures not only contributes to a safer financial ecosystem but also signals a proactive approach towards sustainable and transparent practices.

Please refer to the detailed insights on bitcoin anti-money laundering (AML) regulations in Guatemala from this resource: [bitcoin anti-money laundering (AML) regulations in Guatemala](https://wikicrypto.news/understanding-the-legal-landscape-of-bitcoin-aml-rules-in-greece).

Strategies for Compliance and Risk Management 🛡️

– Strategies for Compliance and Risk Management 🛡️

Navigating the complex landscape of Bitcoin AML laws demands a proactive approach to compliance and risk management. Fostering a culture of transparency and accountability within organizations can serve as a solid foundation. Implementing robust KYC (Know Your Customer) procedures and transaction monitoring systems is key to detecting and preventing suspicious activities. Regular staff training and awareness programs can further enhance compliance efforts, ensuring that all stakeholders are equipped with the necessary knowledge and tools to mitigate risks effectively. Collaborating with regulatory bodies and industry peers can also provide valuable insights and best practices in adapting to evolving AML regulations. Taking a holistic approach to compliance, organizations can not only safeguard against potential breaches but also build trust and credibility within the Bitcoin ecosystem.

Future Outlook and Trends in Bitcoin Aml Regulations 🔮

In the rapidly changing landscape of financial regulations, the future outlook for Bitcoin Aml regulations signifies a crucial shift towards stricter adherence and enforcement. The evolving nature of technology poses challenges for traditional regulatory frameworks, prompting authorities to continuously update guidelines to combat illicit activities effectively. As digital currencies gain further acceptance worldwide, it is expected that regulatory bodies will heighten measures to ensure transparency and security in transactions. Trends indicate a growing emphasis on enhanced due diligence procedures and advanced monitoring mechanisms to prevent money laundering and terrorist financing. By staying informed and adapting to these developments, stakeholders can navigate this complex regulatory environment effectively. For further insights, you can explore Bitcoin anti-money laundering (AML) regulations in Grenada by visiting here.