Overview of Bitcoin Aml Regulations in France 🇫🇷

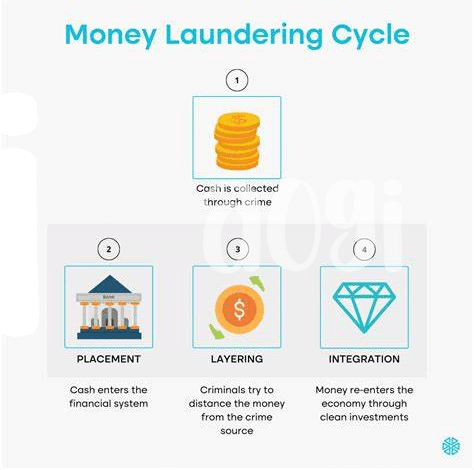

Bitcoin AML regulations in France are steadily evolving to keep pace with the digital currency landscape, aiming to combat money laundering and terrorist financing. The country’s regulatory framework requires virtual asset service providers to register with the French regulatory authority and adhere to strict compliance measures. Recent updates have focused on enhancing transparency and accountability within the cryptocurrency ecosystem, signaling a proactive approach to safeguarding financial integrity. As France continues to refine its AML regulations for Bitcoin, industry participants must stay abreast of the latest requirements to ensure regulatory compliance and foster trust in the growing digital asset market.

Current Challenges and Compliance Issues 💼

Financial institutions in France are grappling with the complexities of Bitcoin AML regulations, requiring astute compliance measures to mitigate risks and ensure transparency. The challenge lies in adapting to the rapidly evolving landscape of digital currencies while adhering to stringent anti-money laundering protocols. Striking a balance between innovation and regulatory requirements is paramount for businesses in navigating the intricacies of compliance. Stay up-to-date with the latest practices to effectively address compliance issues and safeguard against potential vulnerabilities in the digital currency realm. The fusion of technology and regulatory frameworks poses both opportunities and obstacles, necessitating a proactive approach to compliance and risk management.

Impact of Evolving Technology on Regulations 📈

As technology continues to advance at a rapid pace, the landscape of regulatory requirements for Bitcoin AML in France is constantly evolving. The emergence of new tools such as blockchain analysis software and transaction monitoring platforms has enabled regulatory bodies to enhance their oversight capabilities. These technological developments are reshaping how compliance is managed, requiring businesses to stay agile and proactive in adapting to the changing regulatory environment. Moreover, the use of artificial intelligence and machine learning algorithms is revolutionizing the detection of suspicious activities, making it crucial for companies to invest in innovative solutions to ensure they remain compliant with the latest regulations.

Predictions for Future Regulatory Trends 🔮

The future landscape of Bitcoin AML regulations in France holds numerous intriguing possibilities. As the fintech industry continues to evolve at a rapid pace, regulatory bodies are expected to adapt and implement new measures to combat emerging risks effectively. Experts anticipate a shift towards more stringent oversight and enhanced transparency requirements to safeguard against potential illicit activities in the cryptocurrency space. With technological advancements playing a pivotal role in shaping the financial sector, regulatory trends are likely to reflect a balance between innovation and regulatory compliance.

To delve deeper into the intricacies of Bitcoin AML regulations and understand their implications globally, explore insights on bitcoin anti-money laundering (AML) regulations in Fiji. By examining the approaches taken by different countries, businesses can gain valuable insights to navigate the evolving regulatory landscape successfully. Stay informed about the latest developments in AML laws to ensure compliance and foster a secure environment for cryptocurrency transactions.

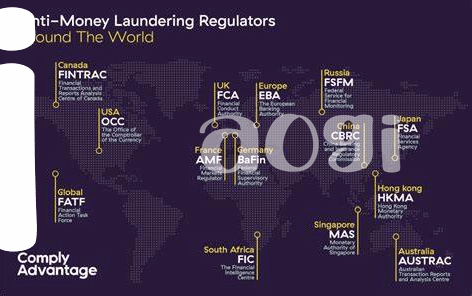

Role of Government and Regulatory Bodies 🏛️

In the ever-evolving landscape of Bitcoin Aml regulations in France, the role of government and regulatory bodies is crucial. These entities play a pivotal role in establishing and enforcing compliance standards to ensure the integrity and security of the financial system. As technology continues to advance, it becomes increasingly essential for government and regulatory bodies to adapt and stay ahead of emerging challenges in the cryptocurrency space. Their proactive approach and collaborative efforts with industry stakeholders are integral in shaping the regulatory framework that will govern the future of Bitcoin Aml regulations in France.

Strategies for Businesses to Navigate Compliance 🚀

Businesses operating in the evolving landscape of Bitcoin AML regulations need to be proactive in their compliance efforts. Implementing robust internal controls, conducting regular risk assessments, and staying updated on regulatory changes are crucial steps to navigate the complex regulatory environment. Collaborating with industry peers, engaging with regulatory bodies, and investing in training programs for employees can also enhance compliance strategies. Leveraging technology solutions and seeking professional guidance can further assist businesses in meeting regulatory requirements effectively. By adopting a comprehensive approach to compliance, businesses can build trust with stakeholders and mitigate potential risks in the rapidly changing regulatory landscape.

Link: bitcoin anti-money laundering (AML) regulations in Finland