Understanding Aml Regulations 📜

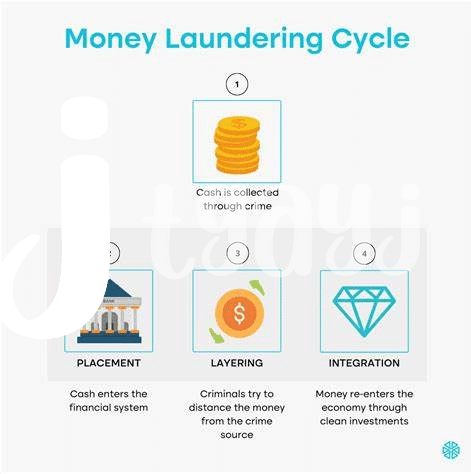

A proper understanding of AML regulations is essential for Bitcoin businesses in Eswatini to operate compliantly. These regulations are in place to safeguard against financial crimes like money laundering and terrorism financing by setting specific guidelines that must be followed. By grasping the intricacies of AML regulations, businesses can ensure they are meeting the required standards and avoid potential legal repercussions. It’s crucial to stay updated on any changes or revisions to these regulations to maintain compliance and uphold the integrity of the business operations.

By staying informed and proactive in adhering to AML regulations, Bitcoin businesses in Eswatini can build trust with customers and regulatory bodies. This trust is vital for long-term sustainability and growth in the ever-evolving cryptocurrency landscape. Understanding and implementing AML measures not only protect the business but also contribute to the overall integrity of the financial ecosystem in Eswatini, promoting transparency and accountability in the digital currency sector.

Conducting Due Diligence Checks 🔍

When it comes to ensuring compliance with anti-money laundering regulations, conducting due diligence checks is a crucial step for Bitcoin businesses in Eswatini. By carefully verifying the identities of customers and assessing the risk associated with their transactions, companies can mitigate the chances of being involved in illicit activities. This process involves thorough investigation and documentation, ensuring that businesses have a clear understanding of who they are dealing with. By taking the time to conduct these checks diligently, Bitcoin businesses can enhance their credibility, protect their reputation, and contribute to a more secure financial ecosystem.

Implementing Transaction Monitoring Systems 💻

Transaction monitoring systems play a pivotal role in safeguarding Bitcoin businesses in Eswatini. By utilizing advanced technology, these systems provide real-time tracking and analysis of financial transactions, enabling swift identification of any suspicious activities or potential risks. Implementing such systems not only ensures compliance with AML regulations but also enhances the overall security measures within the organization. Through constant monitoring and automated alerts, businesses can proactively prevent fraudulent activities and strengthen their regulatory frameworks. By integrating transaction monitoring systems into their operations, Bitcoin businesses can uphold the highest standards of integrity and accountability, fostering trust among customers and regulatory authorities.

Training Staff on Aml Compliance 🎓

Training your staff on Anti-Money Laundering (AML) compliance is a crucial step in maintaining the integrity of your Bitcoin business operations. By providing comprehensive education and clear guidelines, you empower your employees to recognize and address potential risks effectively. Utilizing real-life scenarios and practical exercises during training sessions can enhance their understanding and application of AML principles within the context of your specific business practices. Keeping your team well-informed and up-to-date with the latest AML regulations ensures a proactive approach in safeguarding your business against financial crime. To dive deeper into how Bitcoin businesses can navigate AML compliance challenges effectively, check out this insightful article on bitcoin anti-money laundering (AML) regulations in Denmark.

Remember, a knowledgeable and vigilant team is a valuable asset in the ongoing effort to uphold AML compliance standards and protect your business reputation. Through continuous training and reinforcement, you demonstrate your commitment to maintaining a secure and trustworthy environment for both your customers and stakeholders.

Regularly Updating Compliance Policies 🔄

Regularly updating compliance policies is key to staying abreast of evolving AML regulations and ensuring the effectiveness of your Bitcoin business practices. By routinely reviewing and adjusting your policies, you demonstrate a commitment to compliance and a proactive approach to mitigating risks. These updates can address emerging threats, regulatory changes, and internal operational shifts, helping to fortify your AML framework and maintain a culture of vigilance within your organization. Keeping your compliance policies current not only safeguards your business but also enhances trust with stakeholders and regulatory bodies, showcasing your dedication to upholding the highest standards of integrity and transparency in the cryptocurrency landscape.

Engaging with Regulatory Authorities 🤝

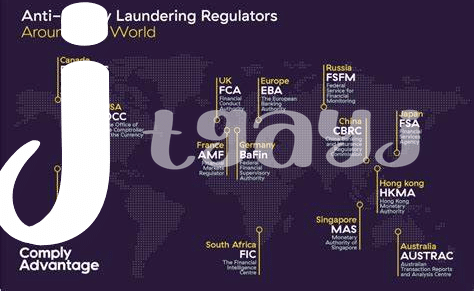

When it comes to engaging with regulatory authorities in Eswatini as a Bitcoin business, communication and cooperation play a vital role. Establishing a positive relationship with these authorities can lead to a smoother compliance process and may even provide insights into any upcoming regulatory changes. Regularly interacting with regulatory bodies not only demonstrates your commitment to compliance but also allows for constructive dialogue that can benefit both sides in ensuring a healthy and transparent financial ecosystem.

For more information on Bitcoin anti-money laundering (AML) regulations in Eritrea, you can refer to the bitcoin anti-money laundering (AML) regulations in El Salvador. Engaging with regulatory authorities can create a collaborative environment where compliance is not just a requirement but a shared goal for a safer and more trustworthy financial landscape.