Understanding Aml Regulations in Djibouti 🌍

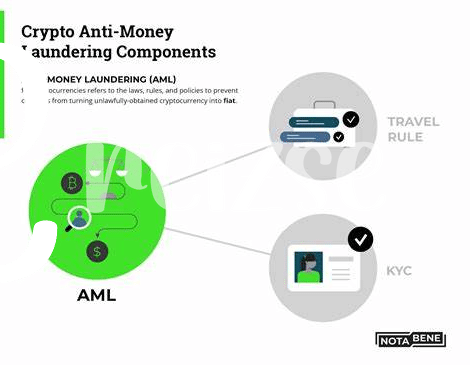

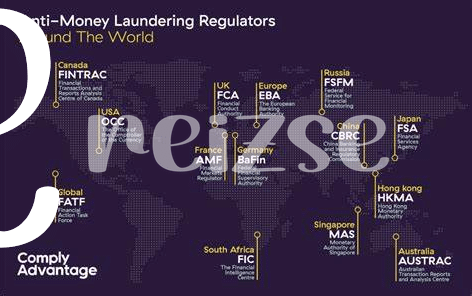

– In Djibouti, the landscape of AML regulations presents a complex framework that requires careful navigation. Understanding the intricacies of these regulations is vital for businesses operating in the Bitcoin space. Compliance with AML regulations not only ensures adherence to legal requirements but also builds trust with regulators and customers. Stay tuned to unravel the nuances of AML regulations in Djibouti and discover key insights for effectively managing compliance challenges in this evolving regulatory environment.

Challenges Faced by Bitcoin Businesses 💡

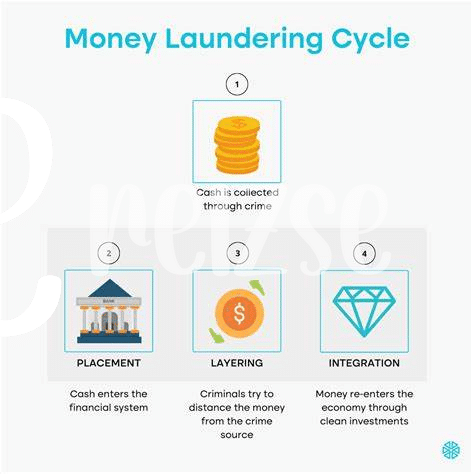

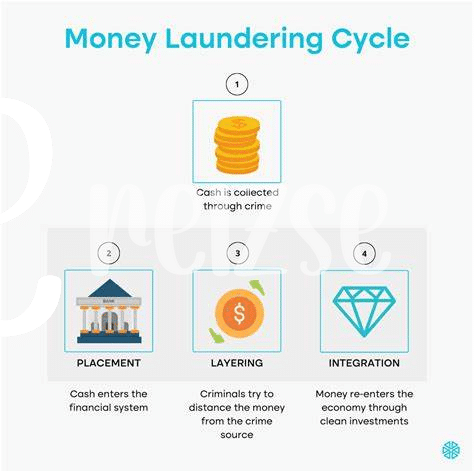

Bitcoin businesses in Djibouti encounter various hurdles when it comes to compliance with AML regulations. The volatile nature of cryptocurrencies, coupled with evolving regulatory frameworks, pose significant challenges. Ensuring transparency, tracking transactions, and verifying identities are key areas that businesses need to navigate carefully. Moreover, meeting reporting requirements and staying ahead of regulatory updates demand constant vigilance and resources. These challenges can impact operational efficiency, customer trust, and overall sustainability. Despite these obstacles, proactive measures such as robust compliance programs, employee training, and technological solutions can help businesses stay compliant and competitive in the dynamic landscape of cryptocurrency regulation.

Impact of Compliance on Financial Transactions 💸

Compliance with AML regulations in Djibouti significantly impacts financial transactions within the Bitcoin landscape. By adhering to these regulations, businesses engaging in Bitcoin activities must implement stringent measures to verify the legitimacy of transactions and counter potential illicit activities. The scrutinized nature of these compliance procedures not only ensures the integrity of financial dealings but also fosters trust among users and authorities. As a result, the impact of compliance on financial transactions serves as a crucial safeguard, strengthening the credibility and sustainability of the Bitcoin ecosystem in Djibouti.

Strategies for Navigating Regulatory Complexities 🧭

Navigating regulatory complexities in Djibouti can be challenging for Bitcoin businesses. To successfully manage compliance, it is crucial to stay updated on evolving AML regulations and proactively implement tailored strategies. This involves fostering strong relationships with regulatory bodies, conducting regular assessments of internal processes, and investing in robust compliance training for staff members. By prioritizing transparency, due diligence, and continuous communication with relevant authorities, Bitcoin businesses can navigate regulatory complexities effectively, mitigate risks, and build trust within the financial ecosystem 🧭. For further insights on AML oversight in different regions, explore the impact of bitcoin anti-money laundering (AML) regulations in Ecuador.

Importance of Proactive Compliance Measures 🛡️

The proactive approach to compliance within the Bitcoin space in Djibouti is essential for maintaining the integrity of financial transactions and fostering trust within the industry. By implementing robust compliance measures, businesses can not only adhere to AML regulations but also safeguard against potential risks and illicit activities. Embracing proactive compliance demonstrates a commitment to ethical practices, which, in turn, can enhance the reputation of Bitcoin businesses in Djibouti.

Furthermore, proactive compliance measures can also lead to operational efficiencies and cost savings in the long run. By investing in compliance early on, businesses can streamline their processes, identify potential issues before they escalate, and ultimately, build a more sustainable and resilient operation within the evolving regulatory landscape.

Future Outlook for Aml Regulations in Djibouti 🔮

The regulatory landscape in Djibouti is evolving rapidly, with a keen focus on strengthening AML regulations to combat financial crime effectively. As the country continues to bolster its AML framework, Bitcoin businesses operating in Djibouti will need to stay vigilant and adaptable to upcoming regulatory changes. With a proactive approach to compliance, businesses can navigate the evolving AML landscape more effectively and ensure continued adherence to regulatory requirements. By closely monitoring regulatory developments and implementing robust compliance measures, Bitcoin businesses in Djibouti can position themselves for sustained success in a dynamic regulatory environment. The future outlook for AML regulations in Djibouti holds both challenges and opportunities for businesses, emphasizing the importance of proactive compliance strategies in addressing regulatory complexities.

Please find more information on Bitcoin anti-money laundering (AML) regulations in the Democratic Republic of the Congo [here](bitcoin-aml-regulations-congo).