Regulatory Requirements 📜

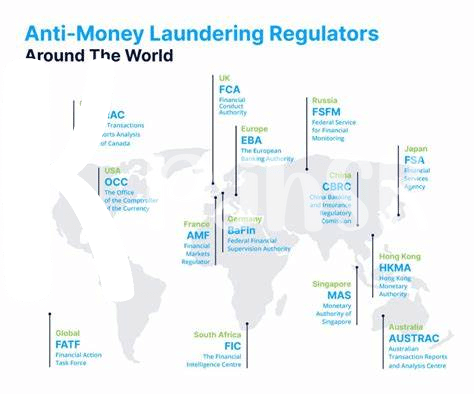

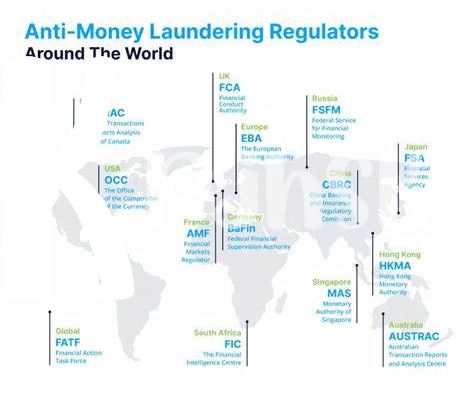

Compliance with regulatory requirements is paramount for Bitcoin exchanges operating under Costa Rican AML laws. These laws serve as guidelines to ensure transparency, accountability, and adherence to legal standards within the cryptocurrency space. Regulatory compliance involves aligning business practices with government-mandated rules, procedures, and protocols to foster a secure and compliant environment for all stakeholders involved.

Understanding and implementing the regulatory framework are crucial steps for Bitcoin exchanges to navigate the complex landscape of AML laws effectively. By staying informed, proactive, and adaptive to regulatory changes, exchanges can uphold integrity, trust, and legality in their operations. Working hand in hand with regulatory bodies allows exchanges to foster a compliant ecosystem that benefits both the platform and its users.

Customer Due Diligence 🕵️♂️

Customer due diligence is a critical aspect of operating a Bitcoin exchange in Costa Rica in compliance with AML laws. By diligently verifying the identities of customers and assessing the risk they pose, exchanges can help prevent money laundering and illicit activities. Establishing robust KYC procedures ensures that only legitimate users engage with the platform, promoting a safer and more secure environment for all participants. Through effective due diligence measures, exchanges can build trust with regulatory authorities and demonstrate their commitment to upholding compliance standards. This not only protects the exchange from potential violations but also safeguards the integrity of the broader cryptocurrency ecosystem. Partnering with customers in maintaining transparency and security is key to fostering a culture of responsibility within the industry.

Transaction Monitoring 🔄

Bitcoin exchanges in Costa Rica must ensure a robust system for monitoring transactions to detect and prevent illicit activities. By implementing advanced technology and analytical tools, exchanges can track the flow of funds and identify any suspicious patterns. This proactive approach not only promotes regulatory compliance but also safeguards the integrity of the platform and protects users from potential risks associated with money laundering and other unlawful behaviors.

Effective transaction monitoring is a key pillar of compliance for Bitcoin exchanges in Costa Rica, providing a crucial layer of security and accountability in the digital asset ecosystem. By vigilantly monitoring transactions in real-time and conducting thorough investigations when anomalies arise, exchanges can strengthen their defenses against financial crime and uphold the trust and confidence of their customers. Continuous refinement of monitoring processes ensures that exchanges stay ahead of evolving regulatory requirements and emerging threats in the ever-changing landscape of cryptocurrency transactions.

Reporting Suspicious Activities 🚨

Reporting suspicious activities is a critical component of compliance for Bitcoin exchanges under Costa Rican AML laws. It involves the careful monitoring and identification of any transactions or behaviors that seem out of the ordinary or potentially linked to illicit activities. Prompt and accurate reporting of such activities to the relevant authorities is essential in combating money laundering and other financial crimes in the cryptocurrency space.

Effective reporting of suspicious activities not only helps in protecting the integrity of the exchange but also contributes to the overall security and reputation of the cryptocurrency industry. By diligently following the guidelines and protocols set forth in Costa Rican AML laws, Bitcoin exchanges can play a pivotal role in ensuring a safe and compliant environment for all users. For further insights into the AML regulations in Cyprus as they relate to Bitcoin, you can check out this comprehensive overview on bitcoin anti-money laundering (AML) regulations in Cyprus.

Training and Awareness 📚

Training and awareness are key pillars in ensuring compliance with Costa Rican AML laws. By investing in comprehensive training programs, Bitcoin exchanges can equip their employees with the knowledge and skills needed to identify and address potential money laundering risks. Regular training sessions not only keep staff up to date with regulatory changes but also foster a culture of compliance throughout the organization. Additionally, raising awareness among all team members about the importance of adhering to AML guidelines can significantly enhance the overall effectiveness of the exchange’s compliance efforts.

Continuous Compliance Evaluation 📊

Continuous Compliance Evaluation involves regularly assessing and updating internal policies and procedures to ensure ongoing adherence to AML regulations. By consistently reviewing and adjusting compliance measures, Bitcoin exchanges in Costa Rica can proactively identify and address any potential gaps or risks in their systems. This iterative process fosters a culture of compliance within the organization, promoting transparency and accountability in the handling of digital assets. Keeping abreast of evolving regulatory frameworks and industry best practices is essential for maintaining effective compliance strategies. For more information on Bitcoin AML regulations in Costa Rica, visit bitcoin anti-money laundering (aml) regulations in cuba.