Overview of China’s Aml Regulations and Bitcoin 💡

China’s AML regulations in China have brought significant shifts to the landscape of cryptocurrency transactions, particularly affecting Bitcoin. The regulations aim to enhance transparency and combat illicit activities, impacting how Bitcoin is traded and recorded within the country. This has led to a reshaping of compliance protocols for both local and international players in the cryptocurrency space. With China being a key player in the global market, the implications of these regulations extend beyond its borders, influencing how other countries approach AML policies in relation to cryptocurrencies. As China continues to refine its regulatory stance, the future of Bitcoin within the Chinese market remains a subject of interest and speculation.

Impact on Bitcoin Transaction Volumes 📉

The regulatory landscape in China has had a discernible impact on Bitcoin transaction volumes. As policies have evolved, fluctuations in trading activity have been observed, with notable decreases in transaction volumes during periods of regulatory tightening. These measures have influenced market dynamics, affecting both domestic and international cryptocurrency exchanges operating in the region.

Navigating the intersection of regulatory requirements and the decentralized nature of Bitcoin poses unique challenges for market participants. The need to balance compliance with operational efficiency has prompted exchanges to reevaluate their strategies, implement robust AML measures, and enhance transparency to remain viable in the evolving regulatory environment. The evolving relationship between China’s AML regulations and Bitcoin transaction volumes underscores the intricacies of regulatory compliance within the cryptocurrency space.

Compliance Challenges Faced by Cryptocurrency Exchanges 🔒

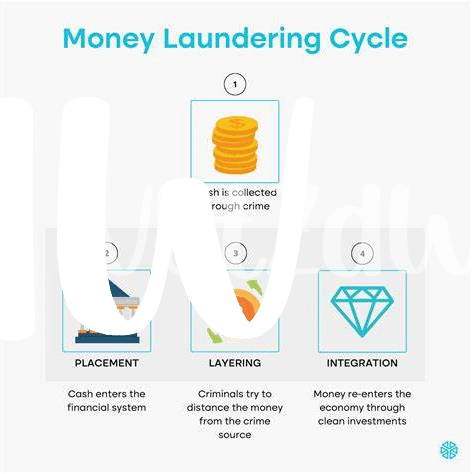

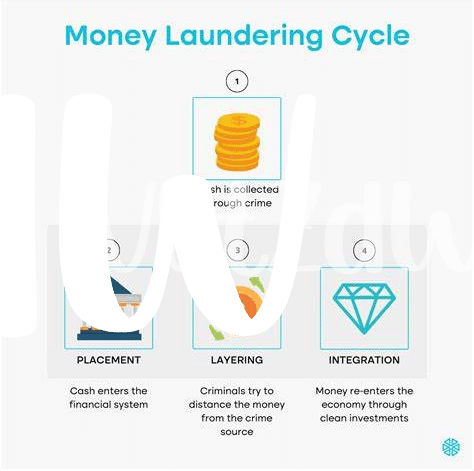

Cryptocurrency exchanges operating in the shadow of China’s AML regulations are confronted with a complex web of compliance challenges. Striking a balance between facilitating user transactions and adhering to stringent regulatory requirements poses a significant hurdle for these platforms. The need to implement robust KYC (know your customer) and AML (anti-money laundering) procedures not only adds layers of complexity to their operations but also necessitates ongoing monitoring and reporting to ensure compliance with evolving regulatory standards. The decentralized nature of cryptocurrencies further complicates matters, as tracking the origin and destination of funds becomes increasingly intricate in the face of regulatory scrutiny.

Strategies Implemented to Navigate Regulatory Landscape 🛠️

Navigating the ever-evolving regulatory landscape can be a daunting task for cryptocurrency exchanges. To maintain compliance with China’s AML regulations while ensuring operational efficiency, these platforms have implemented a variety of strategies. From deploying sophisticated monitoring tools to enhancing customer due diligence processes, exchanges are proactively adapting to regulatory requirements. By collaborating with regulatory authorities and investing in staff training, these platforms aim to strike a balance between compliance and business growth. Through continuous evaluation and adjustment of their AML policies, cryptocurrency exchanges in China are positioning themselves for long-term success in the dynamic regulatory environment.

For further insights on navigating AML regulations in different jurisdictions, including the challenges and best practices, you can refer to a comprehensive resource on Bitcoin anti-money laundering (AML) regulations in Burkina Faso [here](https://wikicrypto.news/navigating-aml-regulations-in-chad-for-bitcoin-businesses).

Global Implications of China’s Aml Policies 🌍

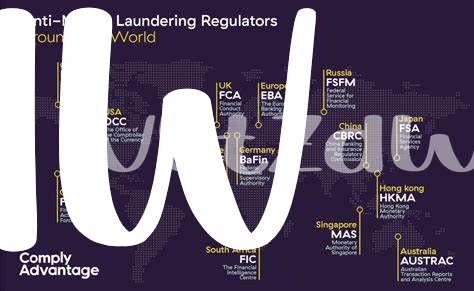

The enforcement of China’s AML regulations has reverberations beyond its borders, resonating globally in the realm of Bitcoin transactions. As one of the world’s largest economies, China’s policies influence not only local markets but also impact the broader cryptocurrency landscape. The stringent guidelines set forth by Chinese authorities serve as a signal to other nations and stakeholders, shaping discussions around compliance and regulation on an international scale. Understanding and adapting to these global implications is crucial for stakeholders in the cryptocurrency ecosystem to navigate the evolving regulatory environment with foresight and agility.

Future Outlook for Bitcoin in the Chinese Market 🔮

The Chinese market continues to play a significant role in shaping the future landscape of Bitcoin. With regulatory developments impacting the cryptocurrency sphere, the Chinese market’s outlook for Bitcoin remains both complex and dynamic. As China refines its stance on digital assets, the cryptocurrency industry closely monitors the evolving regulatory environment. Adapting to these shifts will be crucial for the long-term sustainability and growth of Bitcoin within China. The interplay between regulatory measures and market demand will significantly influence the trajectory of Bitcoin in the Chinese market 🔮. To learn more about Bitcoin anti-money laundering (AML) regulations in Chile, click here: Bitcoin anti-money laundering (AML) regulations in Chad.